“So there you have it, folks.”

Oklahoma Secretary of Finance Preston Doerflinger opened his remarks at a Thursday press conference by letting the enormity of the state’s budget dilemma sink in: $900 million less projected revenue for next fiscal year and an impending “revenue failure” declaration for this year’s appropriations coming Monday.

“The fact that we find ourselves in this position is providing us with a tremendous opportunity,” Doerflinger pitched to a crowd of reporters. “I’ve been talking for years about the structural problems the state faces. Now, we find ourselves in a very challenging situation. Panicking about the situation is not productive. We need to use this as an opportunity to do the things we otherwise might not have the will to do.”

In the longer term (next year’s budget), exactly what those things will be remains unclear, and Doerflinger, House Speaker Jeff Hickman (R-Fairview) and Senate Appropriations Chairman Clark Jolley (R-Edmond) only provided faint outlines of how legislative leaders and Gov. Mary Fallin will fill next year’s budget hole.

“Our job is not to let the oil bust knock us out,” Hickman said.

But in the shorter term, the revenue failure for this fiscal year will mean between 2 and 4 percent cuts across the board to state agencies, Doerflinger said. That includes education.

“The state revenue failure will have a significant and painful impact on our schools during a time in which every dollar is precious,” State Superintendent of Public Instruction Joy Hofmeister said in a statement earlier this week. “It is difficult to foresee a scenario in which Oklahoma’s schoolchildren will not feel the negative impact of this crisis.”

The assembled power players in Oklahoma’s budget process mostly agreed Thursday, citing common sense and the magnitude of next year’s projected shortfall.

But when questions and conversation turned to the topic of education, the three men pushed back against a recent Associated Press story from Sean Murphy that highlighted public concern over previous income tax cuts and the new cut that will take effect Jan. 1.

The two legislators argued that the $900 million budget deficit has no connection to the income tax-rate lowering that will occur Jan. 1. But after a question from The Oklahoman’s Rick Green, Doerflinger corrected them and pointed out that about $47 million in additional income tax revenue would have been collected from Jan. 1 through June 30, 2016.

“It is a small piece of the overall picture we’re talking about,” Doerflinger said. “The citizens of this state have elected majorities in both the senate and the house and every statewide office because they want low taxes. The electorate has elected a Republican majority that runs on low taxes.”

Follow NonDoc:

Hickman and Jolley, meanwhile, attempted to thread a narrow political needle — speaking of a need to provide teacher raises and prevent cuts to core services while also railing on the state’s existing budget process that takes billions of dollars “off the top” for things like education and county roads, thus leaving legislators with fewer dollars to appropriate.

“If we’re spending more money than we ever have, why is that not getting into teachers’ salaries?” Jolley asked.

Hickman recited numbers saying state agencies like the Oklahoma Educational Television Authority, the Department of Environmental Quality, the Insurance Department and the Oklahoma Department of Emergency Management have absorbed up to 20 and even 30 percent cuts since the recession began in 2008.

Then, Hickman pointed to common education figures showing a 5.83 percent increase in funding since 2007. He hammered home that schools have more total dollars than they’ve ever had before, but he conceded that health insurance, energy costs and student enrollment have all climbed substantially over the past eight years.

“When you have those costs growing, that’s what’s eating up all that money to put into salaries,” Hickman said after the press conference. “I think we’ve got to figure out a way to strike a balance to get more money into pockets and figure out what we do with those health insurance costs.”

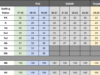

The best fix, of course, would be a return of even average oil tax revenue in the state. Numbers handed out Thursday showed this fiscal year’s projected gross production tax revenues for oil will be 98.2 percent lower than the fiscal year estimate from June. More than $100 million was estimated, while only about $1.8 million is projected for collection.

Corresponding projections for most other revenue streams are also down, thanks largely to the oil bust, Hickman and the others said.

Opportunities for higher oil revenues

Asked whether the impending Congressional allowance of oil exports would yield immediate benefits in Oklahoma, Hickman expressed cautious optimism.

“As we get more of our supply on the market, then the price should go back up,” Hickman said, pointing to a 70 percent drop in oil prices in the past year. The price even dropped Thursday, finishing at $34.95 for a barrel of crude.

Jolley noted a different sort of oil-price paradox during the press conference.

“We’re one war in the Middle East away from high gas prices and high oil prices,” he said.

The Board of Equalization will meet Monday to confirm estimates and projections.

(Correction: A quote from Hickman regarding employee benefits was deleted because the number did not involve teachers as stated.)