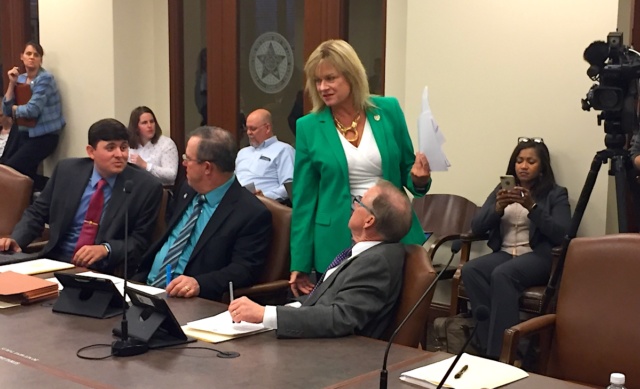

The first major piece of Gov. Mary Fallin’s new revenue efforts passed today in the House Appropriations and Budget Committee.

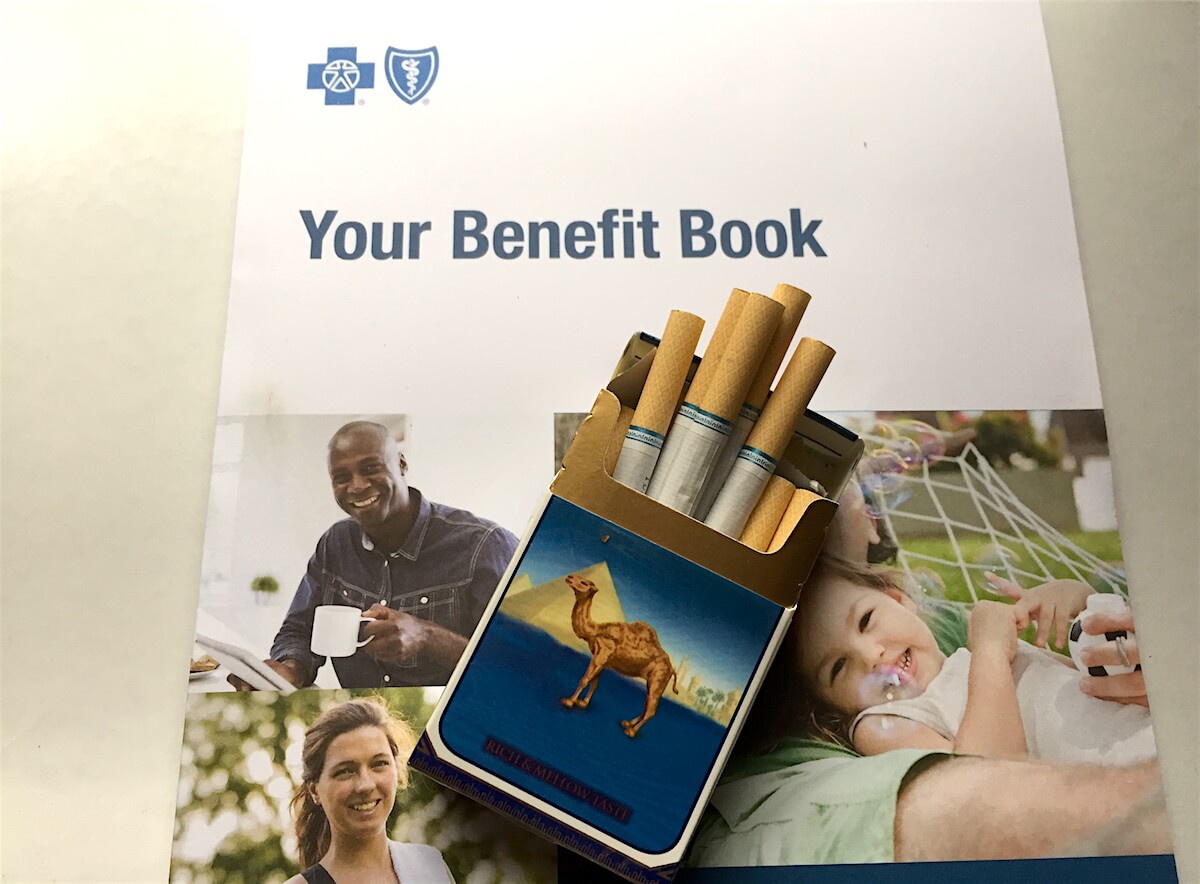

HB 1841, by Rep. Leslie Osborn (R-Tuttle), would implement a new $1.50 tax on packs of cigarettes. Estimates show the proposal could draw in $160 million annually, which would be divided among a slew of new revolving funds targeted for specific health agencies. (The bill’s committee substitute, adopted Monday, is embedded below.)

Osborn’s legislation passed by a vote of 17-10 despite criticism from House Minority Leader Scott Inman (D-Del City), who argued that Osborn was telling other groups — such as judges and educators — that the success of the cigarette tax would improve the budget outlook for non-health care agencies.

“What you just said is, ‘If it passes, [health care agencies] are going to get what they need,'” Inman said to Osborn during questioning on the bill. “If it doesn’t pass, they’re going to get what they need because you’re going to take it from somewhere else.”

Osborn said the measure’s revenue is specifically designated — to the fullest extent of the Legislature’s single-year ability — toward funding health care entities that have been cut severely in recent years. The Tuttle Republican pushed back sternly.

“Leader Inman, I’m not interested in playing games,” said Osborn, chairwoman of the committee. “I’m not interested in being partisan. I’m interested in doing what is right for the state of Oklahoma.”

The two veteran legislators continued to butt heads, with Inman referring to how roughly one in five Oklahomans currently lack health insurance and how nine rural hospitals have closed or filed for bankruptcy recently, including Atoka County Medical Center in the district of House Speaker Charles McCall (R-Atoka).

“That was a fact, not a partisan statement,” Inman said. “So I don’t appreciate the partisan-based lobs that are coming my way. Would this cigarette tax, if it were on the books last year, would it have kept the hospital in the Speaker’s hometown open? I posit that it wouldn’t have.”

Osborn repeatedly told Inman she is willing to consider other proposals he may offer, and she joked that, “I might have to give up my Republican card and join your side of the table,” owing to her on-the-record statements about the need for multiple revenue-raising measures to pass the Legislature.

“I appreciate you, madam chair, for putting up with me,” Inman eventually said.

Osborn replied: “Always a delight.”

“I bet,” Inman said.

‘Legislators smoke cigars’

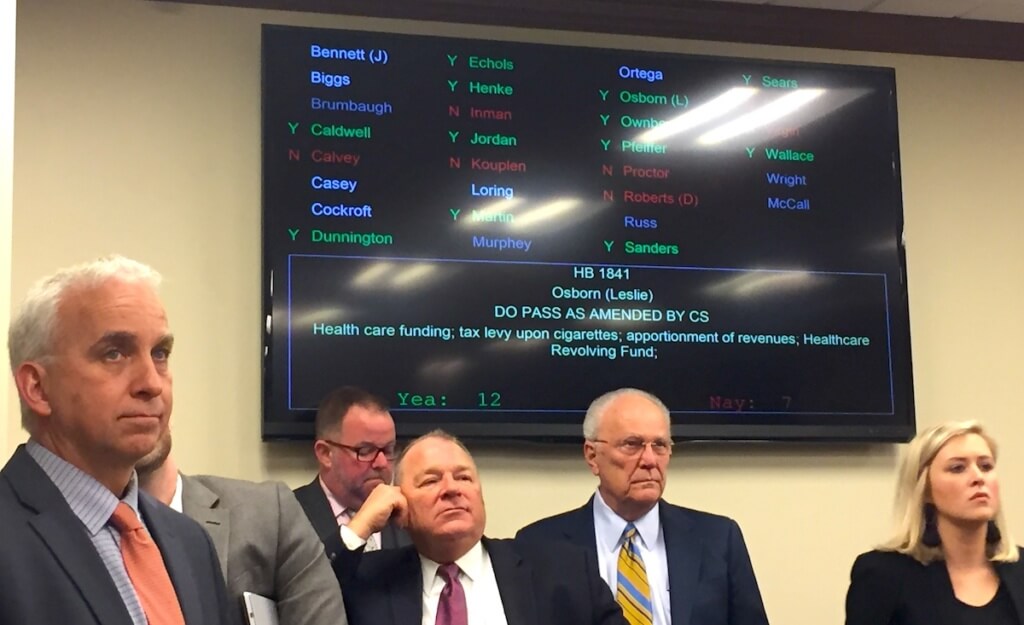

Ultimately, the bill passed with a mix of Republican and Democratic votes after a long day of lobbying for and against the bill by competing interests.

Democrats mostly voted against HB 1841, though Rep. Jason Dunnington (D-OKC) and Rep. Ben Loring (D-Miami) voted in favor.

Rep. Kevin Calvey (R-OKC), Rep. John Bennett (R-Sallisaw) and Rep. Charles Ortega (R-Altus) all voted against it.

FROM THE 2016 SESSION

Medicaid, Medi-can’t: Tobacco tax stalled in House by William W. Savage III

The bill only includes a tax on cigarettes and excludes other forms of tobacco like cigars or dip.

Numerous lobbyists for and against the proposal could only speculate to NonDoc as to why other types of tobacco have been left out of this and other tax proposals over recent years.

“Legislators smoke cigars,” one lobbyist said on the condition of anonymity. “(Former Senate President Pro Tempore) Glenn Coffee smoked the shit out of cigars.”

After Monday’s meeting, Osborn said her bill was based around what had been deemed palatable last session.

“It just would open up so many more special interest groups to come out against it,” Osborn said about any bill to tax other tobacco or vapor products. “This is politically viable.”

HB 1841 appears to have broad support, though its inherent opposition — tobacco companies — wield great power and employ numerous lobbyists. Many stakeholders said prior to Monday’s vote that they expected the bill to clear the House A&B Committee but struggle in the full House of Representatives.

Still, a coalition of mental health advocates, hospitals, agency liaisons and disease-advocacy organizations supports the bill. The language has also been endorsed by the Oklahoma State Chamber.

Supermajority needed for current bill

The cigarette tax stands as a key pillar of the budget-balancing blueprint Fallin laid out to start session last week.

As a new tax, HB 1841 will require three-fourths majorities to pass out of the House and the Senate, something that lawmakers promoting the effort last year failed to muster.

Should such a supermajority again prove impossible, lawmakers could potentially rewrite the bill to put the tax on a statewide ballot. Doing so would only take a standard majority of legislative votes.

In 2004, voters approved SQ 713, which removed sales tax from tobacco products and implemented a larger tax that currently applies to tobacco products. That question also tweaked language related to fuel and income tax levels.

Loading...

Loading...

(Correction: An earlier version of this story implied that Atoka County Medical Center has closed when, in reality, it has only filed for bankruptcy protection. NonDoc regrets the error.)