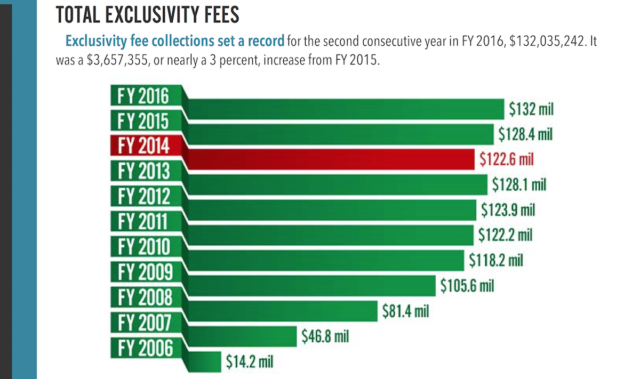

A report released today shows Oklahoma collected more than $132 million from tribal gaming facilities this past fiscal year, a new record.

The Oklahoma Office of Management and Enterprise Services noted that tribal gaming revenue totaled about $2.2 billion over the period:

A variety of factors has caused collections to increase by nearly $9.4 million since FY 2014, including FY 2015 being the first full year during which new staff at the Office of Management and Enterprise Services Gaming Compliance Unit was in place and operating under improved policies and procedures.

The state collects “exclusivity fees,” which amount to 4 percent of a tribe’s initial $10 million in revenue, 5 percent of the second $10 million and 6 percent on anything above $20 million.

Loading...

Loading...

‘If the sun rises in the east …’

The OMES report notes that the $132 million in exclusivity fees went three places in FY16: $116 million to the Education Reform Revolving Fund (aka the 1017 Fund); $16 million to the General Revenue Fund; and $250,000 to the Oklahoma Department of Mental Health and Substance Abuse Services.

In November 2015, NonDoc reported on Oklahoma’s growing gaming industry, which federal regulators noted spans the strongest two regions in the country.

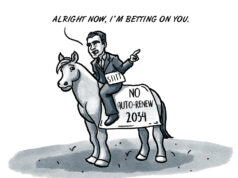

Additionally, experts noted that the state of Oklahoma may seek to increase its exclusivity fee percentages when the Oklahoma Model Tribal Gaming Compact comes up for renewal in 2020.

“If the sun rises in the east (in 2020), there will be action taken (on the compact),” said Rep. Jerry McPeak (D-Warner) at the time. “Since they have screwed up their own finances and since the tribes have been so successful — and it appears the tribes have been much better caretakers of their success — I’m sure they would like to capture more of that success for their own use.”

McPeak was referencing a then-impending 2016 budget deficit and revenue failure, and once again it looks like the Oklahoma Legislature will be trying to fill a major financial gap in 2017.

OMES issued a release Tuesday noting state revenues are again missing their estimates:

With personal income tax and other revenue making a correction and sales tax continuing to decline, total General Revenue Fund (GRF) receipts were 12.4 percent below the September estimate.

(…)

GRF collections in September totaled $452.6 million, which is $64.2 million, or 12.4 percent, below the official estimate upon which the Fiscal Year 2017 appropriated state budget was based and $91.5 million, or 16.8 percent, below prior year collections. Total GRF collections through the first three months of FY 2017 are $1.2 billion, which is $16.8 million, or 1.4 percent, above the estimate and $130.2 million, or 9.5 percent, below prior year collections.