(Editor’s note: This story was authored by Mollie Bryant of Oklahoma Watch and appears here in accordance with the non-profit journalism organization’s republishing terms.)

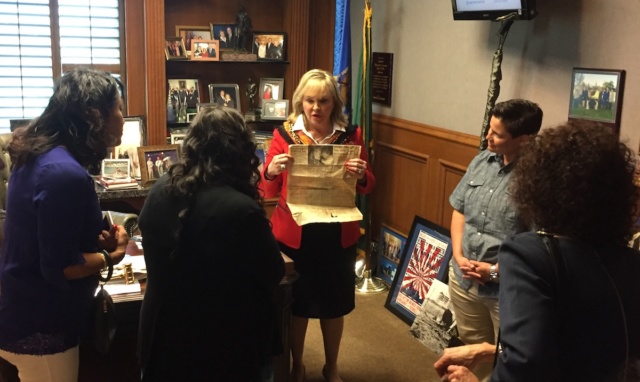

Gov. Mary Fallin vetoed a high-interest loan bill Friday that would have allowed companies to make loans with a 204 percent annual interest rate.

In her veto message, Fallin wrote that the bill, which reflects a national push for new installment loans by the payday lending industry, would create a high-interest product without restricting access to other payday loan products.

“In fact, I believe that some of the loans created by this bill would be MORE EXPENSIVE than the current loan options,” she wrote.

Oklahoma’s legislation had one of the highest potential annual interest rates among 10 similar payday lending bills this year in seven states, an Oklahoma Watch review found.

House Bill 1913 would have created “small” loans with a monthly interest rate of 17 percent, which equates to 204 percent in annual interest. A 12-month loan of $1,500 would leave borrowers owing about $2,100 in total interest if all payments were made on time.

Asked for comment about the bill, the office of one of its sponsors, Rep. Chris Kannady (R-Oklahoma City) referred all questions to a senior vice president at a large payday lending company, Advance America. The company is part of Mexico-based Grupo Elektra, which is the largest payday lending firm in the United States and is owned by Mexican billionaire Ricardo Salinas.

Jamie Fulmer, of Advance America, said he didn’t know who wrote Oklahoma’s bill.

“Our company provided input based on our perspective as a marketplace provider,” he said. “I’m sure a lot of folks provided input, as is the case with every piece of legislation.”

HB 1913 would not require lenders to check a borrower’s ability to pay and would give the lender direct access to customers’ bank accounts.

Fallin vetoed legislation four years ago that would have created a short-term loan with an annual interest rate of 141 percent, but it’s unclear what she will do on the current bill, called the Oklahoma Small Loan Act. Her spokesman said she does not comment on pending legislation.

Supporters of the bill said it would increase borrowing options for people who have poor credit records and can’t obtain lower-interest loans. Opponents said the loans would be predatory because the interest rates are high and could bury vulnerable borrowers in debt.

A spokeswoman for the bill’s other sponsor, Sen. James Leewright (R-Bristow) said he also was unavailable to answer questions. In a written statement, Leewright said the bill offers higher-risk borrowers “a much better product” and improves their options.

The bill proposed a type of loan that is different than traditional payday loans. Payday lending involves loans of up to $500 that borrowers are expected to pay back in a lump sum within 12 to 45 days. The new small loans could be up to $1,500 and borrowers would pay them back monthly for up to 12 months.

Payday loans have higher rates that are currently capped at 456 percent in annual interest. The proposed new small loans were capped at an interest rate of 17 percent a month, or 204 percent annually.

Policy experts said the payday lending industry crafted the new legislation.

Ezekiel Gorrocino, a policy associate for the Center for Responsible Lending, a North Carolina-based nonprofit that fights predatory lending practices, described the legislation as a “prepackaged” bill that payday lending companies have pushed over the past few years across the country.

Gorrocino said the industry advocated for the same legislation in about a dozen states this year, but most of the bills didn’t survive. Similar legislation appeared in Arizona, Indiana, Iowa, Kentucky, Maine and Nebraska.

Of the 10 payday lending bills the center identified this year, HB 1913 appeared to have one of the higher potential interest rates, mainly because the bill did not expressly prohibit compounded interest. That occurs when a borrower misses a monthly payment, and the interest owed is folded into the loan’s principal. The bill also said the act “shall not be subject to or controlled by any other statute governing the imposition of interest, fees or loan charges.”

The bills identified in other states would also establish new high-interest loans – a “flexible loan” in Iowa, a “fair credit loan” in Kentucky, a “small loan” in Maine and a “Consumer Access Line of Credit Loan” in Arizona. The loans typically are in the $500 to $2,500 range and have terms of no more than two years. Various fees could add hundreds of dollars to borrowers’ costs.

Some lawmakers expressed concerns during Senate debate that HB 1913 had been pushed by out-of-state lending interests who sent lobbyists to the Capitol.

“The bill was written by the payday loan industry and promoted by the payday loan industry,” Oklahoma Policy Institute executive director David Blatt said. “They sent a small army of lobbyists to push the bill. They wined and dined the Legislature to push support.”

Oklahoma Watch also identified bills introduced last year in Oklahoma, Alabama, Kentucky and Nebraska, most of which contained language almost identical to HB 1913. Of the four bills, Oklahoma’s contained the highest annual interest rate.

“They look the same because they are,” Gorrocino said, adding, “They may change details here or there, but they are the exact same debt trap.”

Last year’s bill would have created a new type of product called flex loans. Those would have carried an interest rate of 20 percent per month, or 240 percent annual interest.

The bill’s sponsor, Sen. David Holt (R-Oklahoma City) pulled the bill. He wrote on Twitter at the time that there wasn’t enough support in the Senate for it to pass or “a public consensus to expand options in this industry.”

Holt said that members of the payday lending industry had approached him about writing the bill to avoid pending federal regulations.

Payday loan-industry lobbying

Payday and installment loan companies and their political action committees, associations and employees have spent at least $68,600 in campaign donations since last year, Oklahoma Ethics Commission records show. Five lobbyists with ties to the industry spent more – almost $100,000 in campaign contributions to Oklahoma politicians.

Advance America and its PAC donated $22,800 to lawmakers and two other PACs – Majority Fund and Oklahomans for a Strong Future.

Asked about the donations, Fulmer said, “We don’t talk about the specifics of any campaign contributions, but I think, in general, in our democracy, individuals, consumer advocacy groups and corporations all make campaign contributions. It’s all part of the democratic process.”

Lending companies and related associations retained at least seven lobbyists to approach legislators and state consumer credit and banking agencies this session.

Those lobbyists have spent about $96,960 in campaign contributions since last year. The most was spent by lobbyist Jami Longacre, who gave $54,750 in campaign donations. Longacre represents Multistate Associates Inc. and affiliated payday loan company Check Into Cash.

During debate on April 27, several senators expressed concern that the federal Consumer Financial Protection Bureau is seeking to eliminate payday loans altogether. Sen. Dan Newberry (R-Tulsa) suggested the bureau wants to shut down about 3,500 payday loan locations across the state, putting thousands of people out of work. HB 1913 would bring another option to the marketplace, he said.

“Let’s not demagogue what this is on some high morality ground,” he said.

Newberry sponsored the 2013 bill that Fallin vetoed and since last year has received $13,500 in campaign donations from PACs and individuals with ties to payday lenders, records show.

Concerns over possible federal regulation are behind efforts in a number of states to pass this legislation, said Gorrocino, of the Center for Responsible Lending.

Last year, the federal consumer bureau issued a preliminary ruling that lenders must ensure their customers have the ability to repay a loan without defaulting or taking out additional loans.

“The fact that lenders are saying this principle of responsible lending – making sure they can pay it back – will put them out of business is evidence they rely on trapping consumers in unaffordable debt in order to survive,” Gorrocino said.

When asked if he saw any issues with the interest rate, Fulmer, of Advance America, said the new type of loans would increase options for borrowers and empower consumers.

“So, really you have to understand when you evaluate the cost, it’s easy to say something’s too expensive, but when you put it in the context of the real world and the consequences of not getting credit, it’s a different discussion, and it’s a more realistic discussion,” Fulmer said.

Jonathan Small, president of the Oklahoma Council of Public Affairs, said the loans would help consumers and called criticism of the interest rate a scare tactic.

“Even opponents of the bill know people come upon emergencies where they don’t have access to ready cash,” he said. “They’d just prefer government do it, as opposed to people having a private option.”

Sen. Joe Newhouse (R-Broken Arrow) who opposed the bill, said there are already sources for short-term loans with lower interest rates.

“There might be some vulnerable people who find themselves really trapped in this cycle of continuous debt, so they’re offering them yet another tier of additional financing when they already can’t afford what they’re trying to finance in the first place, at a higher interest rate,” he said. “This is just not, I don’t think, good practice and discipline.”