(Update: This story was updated at 4:45 p.m. to include details of the Senate’s passage of HB 2360.)

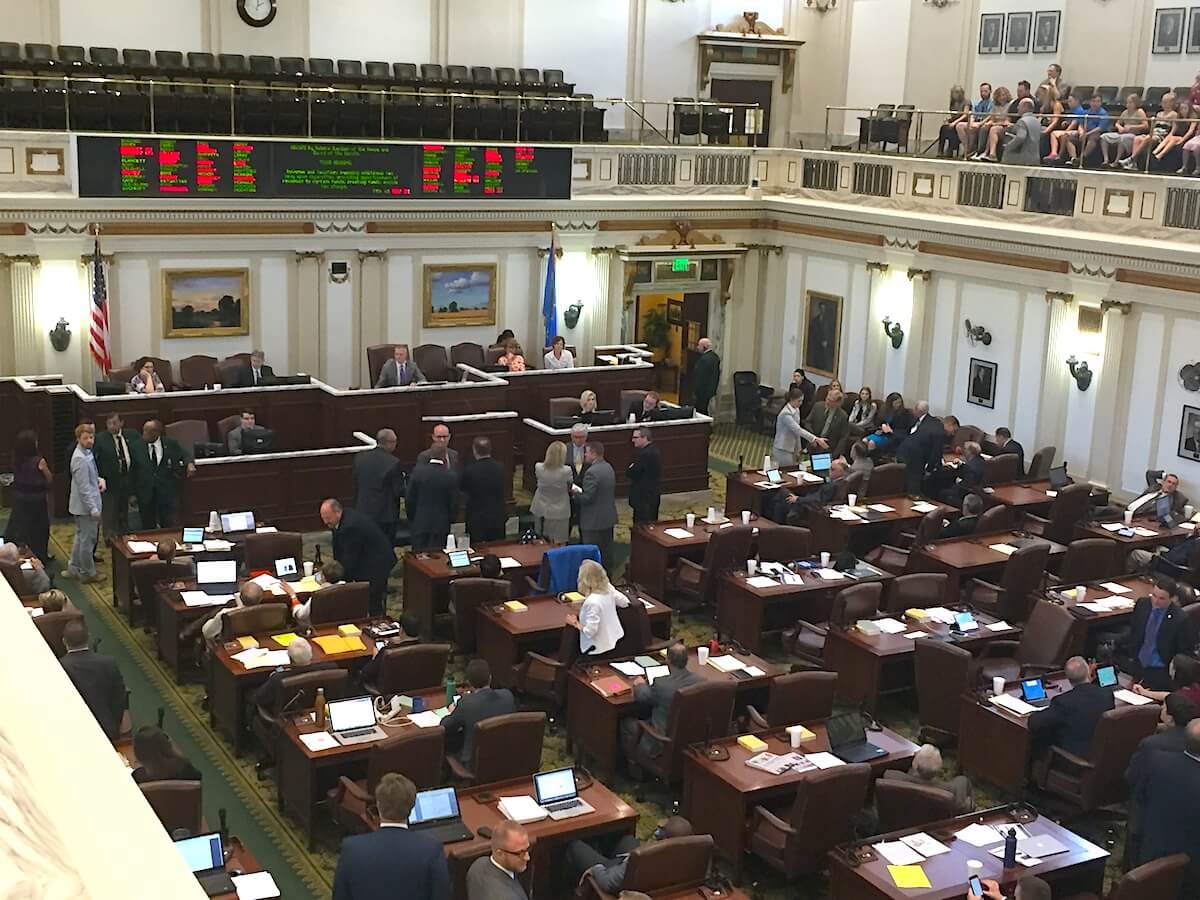

A $1.50 hike to Oklahoma’s cigarette tax failed to receive a three-fourths majority in the House of Representatives this afternoon, but its passage 63-34 makes it eligible for a statewide ballot question if the Senate were to pass it in the same form.

However, the Senate sent a different revenue package — including the cigarette tax — back to the House later in the day.

Despite broad disagreement over HB 2372, the House vote occurred without debate for or against it. It needed 76 yes votes to pass the chamber without ballot approval from the public.

The House vote was held open for more than 20 minutes, although many lobbyists, lawmakers and other Capitol insiders expected it to fall short of 76 votes all morning Monday. Word spread that a separate version of the cigarette tax — possibly at a lower rate of $0.67 per pack — might be heard as a result, though details and timeframe remain unclear.

While the House vote was open, Senate President Pro Tempore Mike Schulz (R-Altus) held a press briefing to announce that his chamber would be amending a House bill to send a different revenue package back to the lower chamber.

Schulz said the measure — which was ultimately heard on the Senate floor this afternoon — would include the cigarette tax, a $0.06 fuel tax increase, the elimination of certain oil and gas tax credits and the elimination of a sales tax exemption on manufacturing for the wind industry.

Schulz said that package would raise about $510 million in recurring revenue, but he declined to take questions from media. He had declined to take questions Friday during his weekly media availability as well.

House Speaker Charles McCall (R-Atoka) held a press conference after Schulz and did take questions. He said the fuel tax proposed by Schulz “guarantees failure” in the House because House Minority Leader Scott Inman (D-Del City) has refused to consider it without a change to the state’s income tax.

“The Senate already knows that a fuel tax is a poison pill,” said McCall, who clarified that he would support raising the gas tax if Democratic votes were not needed.

He said he was pleased that 75 percent of his GOP House caucus voted in support of the cigarette tax, and he said it could be recalled to pass with a three-fourths majority.

“There were many more Republican votes this year, and there were more Democrat votes on the bill than last year,” McCall said. “I’m hopeful that we will be able to convince Democrat leadership and members of the House to be more supportive and have that be brought back up.”

About 4:30 p.m. Monday, the Senate passed its plan in the form of an amended HB 2360. The amended bill (embedded below) includes all the items Schulz identified. Regarding the specific oil and gas rebates he mentioned, the bill would end gross production tax exemptions on reactivated wells and other industry scenarios.

Loading...

Loading...

Back in the House

Some lawmakers took to Twitter during the open House vote to call for it to be closed.

Enough with the theater. The vote doesn’t have 76 votes and we are wasting precious time to get folks back to the table on revenue.

— Rep Jason Dunnington (@jdunnington) May 15, 2017

Gov. Mary Fallin appeared on the floor during the vote, standing among Republicans and taking the occasional photo. She walked to the Democrats’ side of the House floor, shaking hands with lawmakers there, too.

The vote marks the second consecutive year that a proposed $1.50 cigarette tax failed to receive the required three-fourths majority required for new revenue measures.

Democrats including Inman have largely insisted that any cigarette tax be paired with new revenue from modification of the state’s gross production tax incentive. Schulz did not mention GPT in his press briefing, and McCall said a consensus did not exist in the House on the issue.

The Legislature must pass any new revenue measures five days before the end of session, which is scheduled for May 26. The state is facing a $878 million budget shortfall, and health care groups have strongly supported the cigarette tax as a way to avoid further cuts to Medicaid provider rates and various state agencies.

The $1.50 tax has been estimated to raise $215 million.

Loading...

Loading...

(Editor’s note: The Make OK Better campaign has been advertising on NonDoc.)