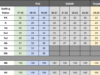

While a spreadsheet presented to legislators Wednesday lists a 0.06 percent increase in the Oklahoma Department of Transportation’s appropriation from last year, that number doesn’t tell the full story.

ODOT receives appropriations from two pots of state money: a portion of Oklahoma income tax off the top that’s capped at $575 million in a Roads Fund; and money from Oklahoma’s motor vehicle fuel tax, which last fiscal year totaled $154 million and this year will total $155 million under SB 860, the general appropriations bill.

The motor vehicle fuel tax generates another $53.5 million, but that amount has been designated to the state’s Special Cash Fund. It marks the second year a sizable chunk of that money has been directed away in that manner, and the agency had another $100 million swept out of its Roads Fund.

Still, some estimates from earlier in the session indicated transportation funding in Oklahoma might fare worse.

“This actually turned out better than I thought,” said ODOT executive director Mike Patterson on Wednesday after a budget had been released. “I thought we would have ended up with less.”

Chairman of the House Appropriations and Budget Subcommittee on Transportation, Dustin Roberts (R-Durant), said Tuesday he felt like nailing down transportation funding levels would help clear the way for an agreement on the overall state budget.

Meanwhile, Rep. Casey Murdock (R-Felt) said Tuesday that the Senate had been proposing cuts between $125 million and $150 million to the Roads Fund, while only $100 million was ultimately swept from there to fund other state services.

Murdock said such reductions could have a negative impact on ODOT’s eight-year plan.

“I don’t really think the Senate plan [would] fly on the House side,” said Murdock, a member of the House A&B Subcommittee on Transportation.

Ongoing shortfalls bedevil transportation officials

As they sought ways to raise money while facing an $878 million budget hole, legislative leaders had weighed various transportation-related ideas:

- an increase to the motor fuel tax;

- a restoration in the amount of money allocated to ODOT through the motor fuel tax;

- and even another bond issue for the agency. (A $200 million bond issue was used to help fund ODOT last year after the agency took on $367 million in appropriated cuts, which is something Roberts said he opposed then and continues to oppose now.)

“That is completely off the table,” Roberts said, citing concerns about the debt service ODOT inherited as part of last year’s bond issue. “My theory is that we should have never done that.”

That debt service for next year — $7.5 million — was included in ODOT’s appropriation released Tuesday, Patterson said.

“The debt service will be higher next year,” he said, estimating the number at $17 million.

Transportation Secretary Gary Ridley said the past year was a tough one for ODOT. He stressed the importance of changing course this year. He added that projects in the eight-year plan could be delayed at the very least if there be any cuts to state revenue.

“Any or all could be at risk,” Ridley said. “There’s no good side to this at all.”

Bobby Stem, executive director for the Association of Oklahoma General Contractors, said ODOT has taken more than its share of the losses due to the state’s budget crisis. He pointed to the decreased percentage of locked-in revenues from the motor fuel tax as one example.

He said ODOT now only receives six cents from the 17-cent-per-gallon tax. Patterson said that is not ideal.

“It’s kind of an unusual situation that a certified fund is supposed to come to the department, but the last few years, it hasn’t,” Patterson said.

Combine that with reductions in general appropriations, and Stem said this year is shaping up to have a potentially negative impact on existing projects.

“The eight-year plan has already had projects pushed off,” Stem said.

Despite it never gaining bipartisan support required to pass the House, a motor fuel tax increase had support from lawmakers like Murdock, under certain conditions. He said he supported the motor fuel tax if it were guaranteed to go toward road and bridge projects.

“That money should be dedicated to roads,” Murdock said.

ODOT director: ‘We need to be hiring people’

Although an increase to the motor fuel tax this session won’t happen, Oklahoma ranks near the bottom among states in terms of how much it taxes at the pump. The state’s 17-cent-per-gallon tax for unleaded gas ranks 49th nationally. Patterson said Oklahoma would rank dead last if Alaska follows through with approving a motor fuel tax increase as expected.

Patterson said he wasn’t sure which of the 1,600 projects in the eight-year plan might be affected by reduced revenues, but only negatives would have come from another budget cut.

On the surface, that scenario appears avoided. Patterson said there were several critical projects on the eight-year plan, and it appears inevitable the agency will face some tough decisions at one point or another.

The agency employed 4,300 people in 1965, when Ridley first began working at the agency. Now, he said it employs only 2,277, despite a significantly increased workload.

“We’re not furloughing anybody, [and] we’re not RIFing anyone,” Patterson said. “We need to be hiring people.”