(Update: This story was updated at 4:30 p.m. Wednesday, Sept. 6, to include multiple statements on the impending special session. This story also included an incorrect reference to “Thursday” which has been changed to Wednesday.)

The Oklahoma Legislature will be called to reconvene Sept. 25 for special session, according to a press release from Gov. Mary Fallin.

Lawmakers will be tasked with replacing $215 million in revenue for health care agencies after the Oklahoma Supreme Court ruled the Smoking Cessation Act of 2017 unconstitutional in August. (In a separate ruling, the court upheld revenue generated from removal of a sales tax exemption on motor vehicle purchases.)

Fallin said she is “planning” to call the special session for Sept. 25.

“I am planning on calling a special session beginning September 25 for legislators to adjust the current fiscal year budget. A formal call for a special session will be issued in the next few days, but I wanted to announce my intention to call a special session for planning purposes,” Fallin said in her statement. “I also want Oklahomans to know we are working diligently to address the fiscal matters of our state.”

In mid-August, House Speaker Charles McCall (R-Atoka) said the Legislature will have “a lot of options” for addressing the $215 million hole, which will affect the Oklahoma Health Care Authority, the Oklahoma Department of Human Services and the Oklahoma Department of Mental Health and Substance Abuse Services primarily.

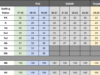

Lawmakers may be able to tap state surpluses — and the Rainy Day Fund — for about $106 million, but that would leave about $109 million remaining to meet the 2017-2018 Fiscal Year budget, which included 4.78 percent cuts for many non-core agencies.

Some lawmakers and state leaders have suggested that a special session could be an opportunity to strike a broader revenue agreement, thus addressing an additional $500 million shortfall anticipated for the 2018 legislative session.

Any broad deal would likely be forced to include either a raise to the state’s gross production tax over the first three years of production or a change in the state’s income tax bracket.

Both measures have been discussed and promoted by Democrats, who would be necessary votes for any tax hike to pass the House with the constitutionally required 76 votes.

Fallin’s press release noted that the $215 million state shortfall could culminate in a total loss of nearly $500 million owing to federal matching funds.

About 4 p.m. Wednesday, McCall sent out a press release touting a plan to reconsider the $1.50 cigarette tax struck down by the courts, and he said he would pass the measure with only 51 votes and send it a statewide ballot if House Democrats do not support it.

Throughout the 2017 session, House Democrats requested that a cigarette tax be tied to change in the gross production tax on oil and gas wells. House Minority Leader Scott Inman (D-Del City) repeatedly said that Oklahoma’s financial woes were not the result of “cigarettes being too cheap.”

From McCall’s release:

“The cigarette tax is the only feasible tax option Oklahomans have said they would support. It would help us replace the funds lost when the Court rejected the cigarette fee,” said Speaker McCall, R-Atoka. “Unlike our Democratic colleagues, House Republicans have no intention or desire to tax the life out of Oklahomans just to grow government – especially at a time when our citizens are living on less. We are not going to raise a billion dollars in taxes to fill a $215 million budget hole.”

McCall said if the cigarette tax fails the Legislature will send it to a vote of the people and use targeted cuts to make up the difference in the budget hole.

“House Democrats have shown time and again they are not going to help pass the cigarette tax despite it being the most feasible among Oklahomans,” said McCall. “They have not supported the cigarette tax during either of the last two legislative sessions, and we have no reason to believe special session will be any different. If they refuse to support the cigarette tax again, any further cuts to state agencies will be on them. The Court struck down the cigarette fee, so the easiest path to replacing the funds is to pass the cigarette tax.

“House Republicans will convene in special session, as we are obligated to do. But we have to make decisions that are in the best interests of the citizens who sent us here, not what is in the best interest of special interests or bureaucrats.”

Earlier Wednesday, Inman had released his own statement:

While our caucus is grateful that Governor Fallin has begun preparations for a special session, we are still concerned that Republican leadership has yet to put forth a plan to fix the budgetary mess they have created.

After almost a month since the Supreme Court ruled the cigarette “fee” unconstitutional, the clock continues to tick on finding a path forward. House Democrats, along with the Governor and Senate leadership have met in good faith to come to an agreement that will allow us to improve our state. While House Republicans seem content with making “adjustments”, the people of Oklahoma deserve better.

Today, we urge Speaker McCall to provide a detailed, bipartisan plan to ensure that the upcoming special session is productive and beneficial and not just window dressing to appease wealthy special interests at the expense of everyday Oklahomans.

If the Speaker or others are interested in such a plan, House Democrats put out our Restoring Oklahoma plan in March, which can be found at www.oklahomahousedems.org/restoring-oklahoma-plan.”

Oklahoma Council of Public Affairs president Jonathan Small also released a statement. His argued against the need for special session at all:

If the executive branch is creative enough to completely drain our state’s constitutionally protected Rainy Day Fund for $240 million, then they are creative enough to allocate a portion of TSET’s $1 billion endowment. Doing so, along with using surplus revenues, would completely meet the cash flow needs of the agencies affected by the loss of cigarette tax money until February when the Legislature reconvenes.

For the long-term fiscal health of Oklahoma, state officials need to focus on state spending. Oklahoma state government is now on track to spend more money next year—more than $17.9 billion—than at any time in state history. The simple truth is we don’t have a revenue problem; we have a spending and a transparency problem.

Hard-working Oklahoma families and small businesses are already chafing from the constant demand of tax consumers. It would be destructive and repugnant for the Governor and the Legislature to come into special session—costing taxpayers around $30,000 per day—just so they can pass whichever tax increases Scott Inman deems best.

Oklahoma Secretary of Finance Preston Doerflinger responded to Small’s release with a fiery statement of his own:

It is reckless and dangerous for special interest groups to peddle misinformation and disregard facts concerning the state budget and the need for special session.

The comparison of borrowing funds for cash flow purposes to raiding the Tobacco Settlement Endowment Trust (TSET) shows a complete lack of understanding regarding the intricacies of the budget as well as the Oklahoma Constitution.

It would appear the playbook that OCPA is working from has outlived its usefulness. Fortunately, they have proven time and time again that their relevancy in the discussion on how our government runs has faded.