Recent changes to the U.S. income tax will result in a modest tax decrease for the average Oklahoman. The average Oklahoman may very well have plans for how to spend this remainder, but, since the average household had previously budgeted these funds to pay federal income tax, the average household wouldn’t suffer financially if Oklahoma income tax captured those funds instead. In the end, of course, the average Oklahoma household would benefit if the State of Oklahoma has the funds to provide for the state’s needs.

An example of the old tax formula

Here are the numbers: The current median-household income in Oklahoma is a little less than $50,000. This means half of Oklahoma households make less than $50,000 and half make more. On average, Oklahoma households consist of 2.5 people.

To figure the median household’s 2017 federal income tax, we first subtract the exemptions for those 2.5 people (about $10,000) and then take the standard deduction of $12,000 for married couples who file jointly, leaving a taxable income of $28,000. Incomes at that level pay a tax of 10 percent on the first $19,050 of income and 15 percent of the excess over $19,050, or a total tax of about $3,247.

An example of the new tax formula

To figure the new (2018) federal income tax, we subtract the new standard deduction of $24,000 to get a taxable income of $26,000 (there are no exemptions under the new law). Incomes at this level pay 10 percent of the first $19,050 as before, but now the rate for the excess over $19,050 is only 12 percent, for a total tax of $2,744.

Thus, the median household is going to pay about $500 less. People whose federal tax is withheld from their paychecks every month will take home a little less than $42 more per paycheck. This is not zero, of course, but it’s only about 50 cents per day per person for that 2.5-person household.

How to transfer federal savings to state coffers

There are about 1.3 million households in Oklahoma. Suppose they all were in this median income circumstance (which they aren’t; half do better, half do worse). Then, the cumulative savings in federal income tax for Oklahoma households is a whopping $650 million, more than our Legislature has been searching for during most of 2017. As far as the finances of Oklahoma households are concerned, collecting that $650 million in state income taxes would be a wash.

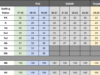

Here’s how collecting the new savings in federally taxed income could be done: Oklahoma’s average (as opposed to median) household income is about $65,000, which means that total household income in the state is about $84.5 billion. Households making the median or more earn well over half of that. That’s about $42 billion. An additional income tax of 1.5 percent on that $42 billion comes out to $630 million, almost equaling the tax savings created under the new federal plan.

Embrace this opportunity to raise Oklahoma income tax

Right now, Oklahoma’s top income tax rate of 5.25 percent applies to any income over $15,000 (for married, filing jointly). If Oklahoma had a new top rate of 6.75 percent on any income over $50,000, we would capture in state income tax the savings in federal income tax. The tax burden on Oklahomans would not change, and the state budget hole would be filled.

Let’s embrace this opportunity.