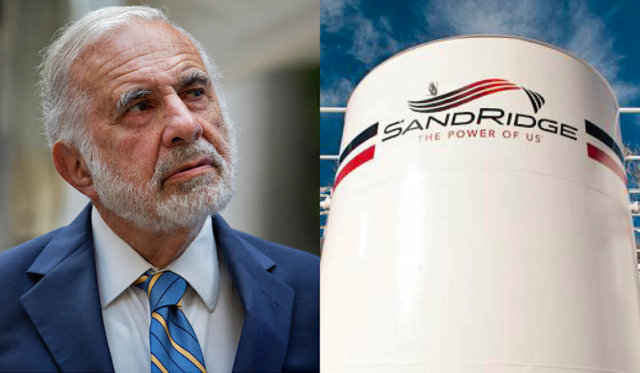

Carl Icahn, the renowned businessman who is often called a “corporate raider,” sent a scathing letter to the board of directors of Oklahoma City-based SandRidge Energy this morning. The letter comes days after Icahn, SandRidge’s largest shareholder, led efforts to prevent a risky acquisition by the company, and it rebukes the board for going “to such lengths to completely eviscerate shareholder rights.”

Icahn purchased 13 percent of SandRidge in November and immediately joined other shareholders in criticizing an attempted acquisition of Bonanza Energy, claiming the price was too high. That deal fell through last week, and Icahn referenced it in his letter Tuesday morning.

Your attempt to entrench yourselves by adopting an unorthodox poison pill intended to prevent large shareholders from talking with one another to oppose the Bonanza acquisition would make a totalitarian dictator blush. Over the years we have unfortunately seen many boards attempt to take advantage of owners, but we cannot recall another situation where a board has gone to such lengths to completely eviscerate shareholder rights. Your apparent disregard for any semblance of accountability to the owners of SandRidge reminds me of the medieval belief in the divine right of kings.

Icahn demanded that SandRidge replace two of its five directors with new members selected by him and other shareholders.

We understand that you intend to meet next week with some of SandRidge’s largest shareholders to discuss their views on the future of the company. We obviously support this and encourage a fulsome and ongoing dialogue between the board and the company’s owners and, while we are extremely troubled by your lack of urgency, we nevertheless look forward to meeting with you on January 17th as part of this process. But that should by no means be the exclusive forum for discussing issues vital to the company’s continued existence. If the pill is not terminated immediately then SandRidge should dispel lingering shareholder concerns by making a public announcement, by no later than Thursday, January 11th, stating unequivocally that discussions among shareholders concerning the above proposed changes – and any other corporate governance changes suggested by other shareholders – will not trigger the pill. As you might be aware, the Delaware courts have not ruled on the validity of “Acting in Concert” provisions but we are convinced they are illegal and would be happy to debate the matter before a Delaware judge if you insist.

SandRidge Energy is the second Oklahoma-based energy company that Icahn has bought into and demanded changes from. He famously helped oust Aubrey McClendon from Chesapeake Energy before offloading all of his Chesapeake stock by the end of 2016.

SandRidge was formed by Tom Ward, a former partner to McClendon at Chesapeake. Ward left the company amid controversy about his personal ownership stakes in wells, and SandRidge’s stock collapsed soon after, resulting in a 2016 bankruptcy.

Read Icahn’s full letter to SandRidge here.