The Thinker’s attention was recently called to Monday’s press release from the OCPA. In it, former U.S. Sen. Tom Coburn fired a warning shot in advance of the Oklahoma House vote on HB 1011XX, a Republican-led bill that would cap non-charitable itemized deductions for Oklahoma taxpayers at $17,000 and thus add $84 million to a kitty needed for teacher pay raises.

The good Dr. No was quite passionate in the release, stating, “… politicians have increased income taxes in a back-door manner on multiple occasions by eliminating broadly used deductions …”, and that they need to “… make Oklahoma government work better without raising taxes on the most vulnerable, on working Oklahoma families, and on small businesses …”.

His plea failed because HB 1011XX passed the House and the Senate.

Who’s really being affected?

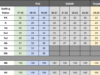

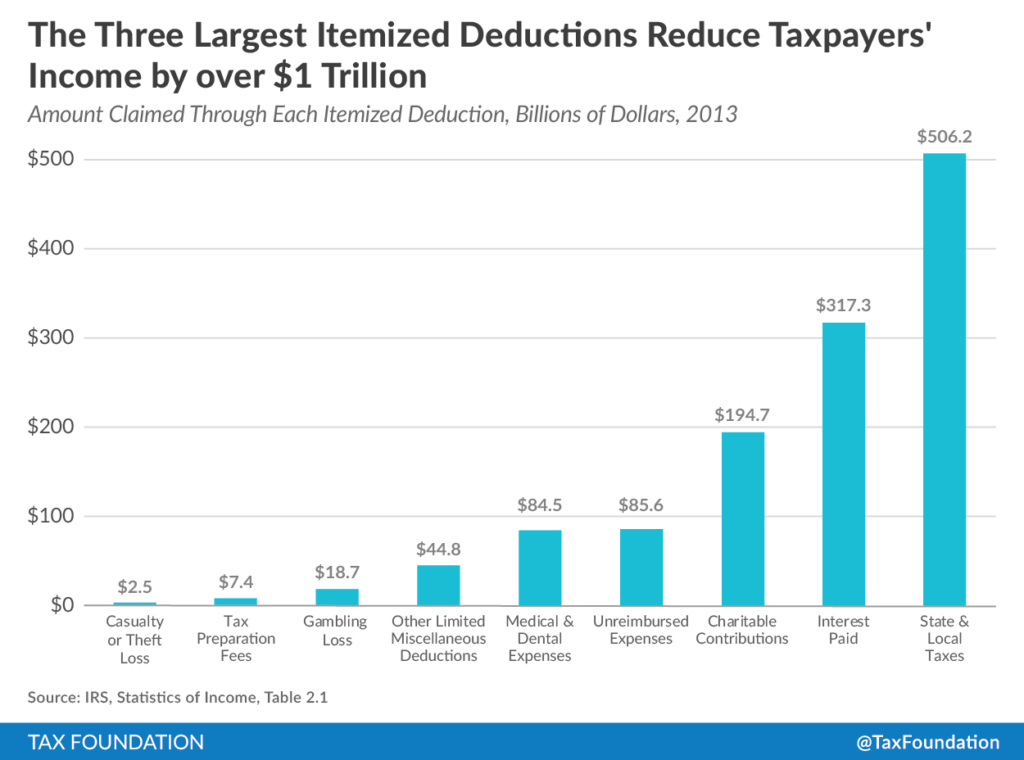

So, let’s think about who’s being affected here. Look at this chart from the Tax Foundation:

If Oklahomans’ itemized deductions follow this same pattern, you can see clearly that the top three — state and local taxes, interest paid and charitable contributions — dwarf the other six categories.

Oklahomans can no longer deduct state income taxes (which was one of those “back-door” changes, as Coburn calls them, made previously), so local property taxes, which primarily impact homeowners, constitute the largest component of state and local taxes. The charitable contributions and medical and dental expenses categories are specifically excluded from the $17,000 cap under HB 1011XX, so that makes interest paid as the 800-pound gorilla ruining Dr. No’s holiday.

Between the interest paid and local property taxes, it seems clear that this burden will fall most heavily on Oklahomans who own real property. A house in Tulsa County with a market value of $300,000 will cost its homeowner no more than $3,840 in taxes; the mortgage interest each year, at my credit union’s 30-year fixed rate of 4.5 percent, will decline from a maximum of under $13,500. Together, that’s $17,340 in itemized deductions.

This is just our lake cabin

It seems clear that the “most vulnerable” and “working families” affected by HB 1011XX for whom Dr. No has such passionate concern are to be found among Oklahomans living in houses worth more than $300,000 — or maybe among those who also have a vacation home.

I guess if you don’t have a house worth more than $300,000, you simply aren’t “working” enough, nor can you be “vulnerable” when you have nothing much to lose.

Post-script: My thanks to Dr. No for causing me to review my 2017 Oklahoma return, in which I found a $150 error in my favor. Also, thanks to his daughter, Sarah Coburn, whose magical voice gave us great pleasure Saturday evening with the Tulsa Symphony.