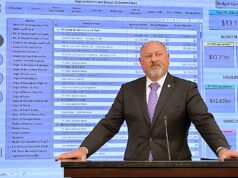

When Kevin Stitt discusses Gateway Mortgage on the campaign trail, he emphasizes entrepreneurship, hard work and a few large numbers: 1,200 employees; 3,000 loans per month; $18 billion worth of home loans serviced.

Asked Aug. 10 to explain his mortgage company’s experience when America’s housing bubble burst in 2008, Stitt defended Gateway against third-party attack ads run by a business organization supporting Mick Cornett in the GOP gubernatorial runoff.

“We had to tighten our belt. We had to get more efficient, and loans went down. There wasn’t as much demand,” Stitt said at a brief press conference. “I can’t do it by myself, I’m just one person. But I’m a great leader, and I put the people in the right positions, and we set the vision, and we came out of the crisis — the mortgage crisis — that hit Lehman Brothers and all the companies that went out of business back in 2008, 2009, and I’m super proud of where we are at today.”

But today, Stitt finds himself receiving new criticism from the campaign of chief opponent Drew Edmondson, a former state attorney general who hardened his political name by bringing litigation against numerous private companies.

At a status hearing this afternoon, a New York bankruptcy court heard an update from attorneys for Lehman Brothers, a famously defunct financial institution that is suing Gateway Mortgage and more than 40 other loan originators for losses associated with the nation’s sub-prime lending crisis.

Reached by phone, a court clerk for Judge Shelley C. Chapman confirmed that a subsequent hearing was set for Monday, Oct. 29.

In a December 2016 court filing (embedded below), Lehman Brothers claims indemnity — or protection against loss — on the home loans originated by Gateway Mortgage and other lenders. In the mid 2000s, Gateway was but one of many American companies that originated millions of subprime mortgages, meaning home loans that often featured adjustable interest rates for people with below-prime credit. Subprime mortgages were typically made available to homebuyers who may not have qualified for traditional loans with set interest rates.

Lehman Brothers was the fourth-largest investment bank in the world before its 2008 bankruptcy. Other major investment firms, like Bear Sterns, also went under.

Loading...

Loading...

Clingman: ‘These legal troubles are not behind Kevin Stitt’

The campaign of Democrat Drew Edmondson wasted little time criticizing Stitt on Tuesday, quickly tying the dry machinations of a New York bankruptcy court hearing to Stitt’s fitness to be governor.

“It will likely take years to sort through Gateway’s role in the mortgage collapse,” Michael Clingman, Edmondson’s campaign manager, stated in a press release. “We know from public records that dozens of Oklahomans lost their homes, including at least 24 people in Tulsa, who found themselves on the wrong side of Kevin Stitt’s predatory lending business. These legal troubles are not behind Kevin Stitt. They are playing out in the federal courts as we speak.”

Donelle Harder, communications director for Stitt’s campaign, responded later Tuesday by saying “Drew Edmondson is down in the polls and desperate.”

“After Lehman Brothers went bankrupt they sued hundreds of businesses around the country to the tune of $4 billion. Their claim involving Gateway involves only five small loans which equals to 0.01 percent of this case,” Harder said in a statement. “Gateway Mortgage is a success story with more than 1,200 employees, many in Oklahoma, and a nationwide-award-winning reputation with a delinquency rate that is 50 percent below the national average. Desperate Drew better do better than this.”

Edmondson becomes the third opponent of Stitt to take aim at the Norman High School graduate’s mortgage company. In the Republican primary, Tulsa attorney Gary Richardson launched a website calling Stitt “shady,” and former Oklahoma City Mayor Mick Cornett similarly criticized Stitt in the GOP runoff election.

The “Shady Kevin” website — which no longer exists — specifically drew its name from a 2009 Business Insider article that lists Gateway Mortgage Group as one of “the 15 shadiest mortgage lenders being backed by the government.” The article claims that, at the time, Gateway Mortgage had “98 percent more defaults” than its peer companies.

But so far in Oklahoma’s gubernatorial race, Kevin Stitt’s congeniality, political outsider status and renowned salesmanship have helped him brush off attacks against his company’s reputation. In a political climate where Oklahoma education issues poll as the electorate’s primary concern, Gateway Mortgage’s regulatory hand-slaps and lending practices appear — at most — tangentially connected to the candidate’s electoral profile.

To that end, Stitt has confronted discussions of his company directly, talking confidently about being “super proud” of his employees and the empire he has built.

On May 2, Stitt appeared as a guest on conservative radio host Pat Campbell’s show to rebut Richardson’s “Shady Kevin” website. He answered numerous questions from Campbell, spoke confidently about being a leader in the private sector and called the criticisms of Gateway Mortgage “typical politics” from “people who have never signed a paycheck.”

In August during the GOP runoff, Stitt held an impromptu press gathering at H&H Gun Range to address the ads attacking him. Stitt noted how Gateway Mortgage Group has grown and adapted in the decade since the financial crisis that caused millions of Americans to have homes foreclosed upon.

“We offered all different types of mortgages: Fanny Mae, Freddie Mac, FHA, VA loans,” Stitt said of his company, which he launched in 2000. “So the business has changed a lot over 18 years. You know, regulations change, but now we’re a servicer. We were much smaller back then. Now we actually service. We don’t sell any of our loans off. We actually service. We are one of the largest servicers in the country, so you’re a customer for life with Gateway at this point. We create securities and service loans all over the country. Over $18 billion in home loans.”

Stitt’s comments at the gun-range press conference came two days after Gateway Mortgage announced it would be expanding its business operations even further by purchasing Farmers Exchange Bank, which has locations in Cherokee, Helena, Wakita, Nash and Tonkawa. In its announcement, Gateway Mortgage said the merger is expected to make the bank one of Oklahoma’s five largest. Gateway Mortgage is owned in its entirety by the Stitt Family Trusts.

Stitt and Edmondson also face Libertarian gubernatorial candidate Chris Powell on the November ballot. Oklahomans have until Oct. 12 to register to vote in the state’s Nov. 6 general election.

Shortly after Edmondson’s press release was received, NonDoc requested a phone interview with Edmondson. This story will be updated with further comments, if they become available.

(Update: This story was updated at 5:23 p.m. Tuesday, Oct. 2, to include comment from Donelle Harder.)