(Update: HB 1404 about aggregates advanced out of House Appropriations and Budget Committee around 5 p.m. Wednesday, Feb. 27, by a 19-10 vote.)

With rosey financial forecasts letting lawmakers bask in the benefits of last year’s historic revenue package, creating new taxes in conservative Oklahoma might seem off the table.

That’s not exactly the case.

HB 1404 by Rep. J.J. Humphrey (R-Lane) would authorize counties to pass a $0.10-per-ton severance tax on the production of rock, gravel, granite, sand and limestone. Called aggregates, the materials are used primarily in construction capacities.

“Most of these products are going out of state, some even out of country, with absolutely no taxing,” Humphrey said Feb. 19. “What I don’t understand is why would we tax gas and oil, a non-renewable resource, but we would not tax mining. And we have sand that is going to Silicon Valley, we’ve got gravel that is going to Texas.”

If Humphrey’s proposal sounds familiar, that’s because a similar version passed the House in 2015 under the name of another lawmaker: now-House Speaker Charles McCall (R-Atoka).

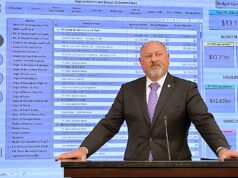

“It’s an important issue in my House district and to other areas across the state,” McCall said Tuesday in his office. “Our state, last time I checked, produced close to 80 million tons a year (of aggregate materials). In some of those counties, that is the natural resource that they produce, and there really is no financial benefit off of that material. I’m not discounting the impact of the jobs and investment of equipment, but there is no revenue thrown off of that which would be similar to the gross production tax on oil and gas.”

By a 5-2 vote, Humphrey advanced HB 1404 out of an appropriations subcommittee Feb. 18, but this afternoon it appears on a 43-bill agenda for the full House Appropriations and Budget Committee. Humphrey has filed a committee substitute that allows counties to contract with the Oklahoma Tax Commission for assessment and enforcement of such tax.

The bill directs counties to split resultant tax revenue evenly with any overlapping municipality, and it also specifies the monies can only be used for road and bridge projects.

Devry Youngblood, executive director of the Oklahoma Aggregate Association, said his member companies support restoring revenue to the County Improvements for Roads & Bridges revolving fund that was displaced during lean budgetary years.

“We think that’s a far better way to do it,” Youngblood said of addressing county infrastructure needs. “This really creates the potential of a patchwork all across the state. It creates a lot of problems for our industry.”

As such, the State Chamber of Oklahoma has listed HB 1404 on its annual “Job Killers” bill list.

Dolese Bros. Co. director of communications and community relations Kermit Frank Jr. said Tuesday that the aggregate industry provides important jobs to rural communities.

“There’s probably 300 or 400 employees who are working in Johnston County that are working in quarries because they need rock in Texas,” Frank said. “Where are those 300 or 400 jobs going to come from if they go away? It’s not like there’s a lot of things happening in Johnston County that are going to drive the payroll of folks.”

‘I’ve lost business over dimes before’

Frank, Youngblood and other aggregate industry representatives attended the Capitol on Tuesday to oppose the tax proposal.

“An aggregate tax essentially is a tax on all construction,” Frank said. “Ten cents — or whatever the tax may be — is going to be passed onto our customers, and our customers are concrete operations (and) asphalt operations. Concrete and asphalt are the bases for building roads, bridges, houses, buildings, everything.”

McCall disagreed with the notion that an aggregate production tax would negatively affect Oklahoma businesses.

“Number one, it just creates more demand for their own products. The money has to be used for roads and bridges, so [counties and municipalities are] going to buy material from them,” McCall said. “My observation is that this is not going to be a job killer, it’s going to be a job enhancer because the amount is so insignificant.”

Frank said an average industry truck can haul about 25 tons of aggregate. At $0.10 per ton, a truckload might yield about $2.50 in taxes. In “round numbers,” Frank also said one cubic yard of concrete requires about one ton of rock and about 0.7 tons of sand. Thus, each cubic yard of concrete requires aggregates that would total about $0.17 of tax.

“There’s 75 yards (of concrete) in a house, about 1,000 yards in a good-size commercial building,” he said. “There are hundreds of thousands of yards in the main-line paving of a turnpike.”

Frank disagreed with the idea that $0.10-per-ton would be an insignificant tax.

“I’ve been in rock sales for my whole career, and I know people beat me up over a dime,” Frank said. “I would argue that I’ve lost business over dimes before, so dimes are important to me.”

Echols: ‘Aggregates are the same’ as oil and gas

When Mccall advanced a similar proposal (HB 1876) out of committee 18-4 in 2014, he was a first-term legislator fresh off an eight-year tenure as mayor of Atoka. After winning re-election, McCall passed a similar HB 1775 out of the House by a 60-35 vote in 2015. Weeks later, it failed 4-5 on a Senate committee vote.

Now, McCall holds the House’s top leadership post, and he emphasized Tuesday that Humphrey’s HB 1404 is a “top priority” for him as HD 22’s representative. But he said the bill is not a House GOP Caucus priority championed in his capacity as speaker.

Still, key members of his leadership team are also supportive.

“If it’s a county option, I’m definitely in favor,” said House Majority Floor Leader Jon Echols (R-OKC). “There may have been an argument about how high the gross production tax (on oil and gas) should have been, but everyone agreed there should have been a gross production tax. When you take oil out of the ground, it’s gone. That is an asset that used to be there, and now it’s gone. Aggregates are the same way.”

House Minority Floor Leader David Perryman (D-Chickasha) also said he appreciated the county-by-county option for an aggregate tax.

“I would probably be supportive of that,” Perryman said.

Follow @NonDocMedia on:

In Senate ‘the challenge is getting it heard’

If HB 1404 passes its House committee today and the full House in March, it might face opposition — or at least amendment — in the Senate.

Sen. Frank Simpson (R-Ardmore) co-authored McCall’s proposals in 2014 and 2015. The 2014 version would have allowed counties to establish up to a 5 percent tax rate on the gross value of the aggregate production.

Monday, he said his aggregate tax vehicle for 2019 (SB 440) would not be heard by this week’s committee deadline.

“I would support it,” Simpson said of Humphrey’s HB 1404. “The challenge is getting it heard.”

Sen. Greg McCortney (R-Ada) said he will be interested to see any language that Humphrey and McCall can pass out of the House.

“I’m open to it, depending how he’s got it formulated and how much it would affect in-state vs. out-of-state (use),” McCortney said.

Other senators expressed similar preference for treating aggregates shipped out of Oklahoma differently than aggregates used within the state or by its political subdivisions.

“You’ve got quarries over in Rogers County, and if you charged a tax on that and the county was using it or the state was using it, all you’re doing is driving up the cost on a resource that you already have,” Sen. Marty Quinn (R-Claremore) said. “But if it’s going across state lines, I think it’s reasonable for you to want to do something with that.”

Sen. Paul Scott (R-Duncan) agreed.

“People mine the sand from the Red River, they mine the sand out of the South Canadian River in my district,” Scott said. “If it’s going to go out of state, I think we should probably tax it. But if not, if it’s going to be here in Oklahoma, I don’t want to make the cost of our state highways go up.”

McCall referenced quarries in his south-central Oklahoma district.

“In Johnston County, it hits the rail and it goes south. It leaves the state,” he said. “It’s a mineral, and a lot of it is being sought out of our state because of its quality.”

But Youngblood said the bill as written leaves unanswered questions about how a tax would be imposed on aggregate leaving Oklahoma.

“Nationally at least, we know that 90 percent of aggregate is used within 50 miles of its origin,” he said. “We’re disappointed we weren’t consulted. These are things we would be happy to sit down and work on to figure out what the problem is and what the scope of the problem is.”

Humphrey said he recognizes that aggregate companies are asking his colleagues to vote against creating the taxation opportunity.

“I’ve got one member who has come to me and said, ‘Man, I’ve got Dolese in my district, and I can’t vote for this.’ And I said, ‘Well, the question is were you elected to represent Dolese, or were you elected to represent the people?’ I said, ‘I have Dolese, I have Lattimore (Materials), and I have Martin Marietta all in my district. So don’t talk to me about how you’re going to make people mad,” Humphrey said.

He noted that the majority of the 2019 Legislature was not elected when McCall ran his 2014 bill. On the other hand, Humphrey said he hopes last year’s fight over oil and gas gross production taxes will have lawmakers asking why Oklahoma currently imposes no tax on aggregate production.

“I’m bumfuzzled on that, so I hope we can get people to look at it. I hope people begin to call their representatives so we can get this out and then call their senators because this is a common-sense deal,” Humphrey said. “I think it’s a bill for the people. Not for corporations, but for the people of Oklahoma.”