Oklahoma’s state budget picture got simultaneously more clear and less certain today as the Board of Equalization certified a Fiscal Year 2020 revenue failure, listened to bleak financial estimates for FY 2021 and FY 2022 and voted to send the Legislature a letter urging creative approaches to cutting state services.

“The Legislature writes the budget, and I get to sign it,” Stitt told media after the meeting. “They have some tough decisions to make. I’m just presenting the facts. These are historic times. Nobody likes it.”

Leaders of the Oklahoma Legislature have not liked a lot of things recently, and they have questioned Stitt’s “facts” along the way. Lawmakers panned Stitt’s claim earlier in April that they had broken a deal by not backfilling $250,000 of his Digital Transformation Revolving Fund. By calling the Board of Equalization meeting and certifying the FY 2020 revenue failure, Stitt moved on from that battle today.

“As far as I’m concerned, the 2020 budget is done and finished,” the governor said. (Soon after his remarks, legislative leaders filed a motion to dismiss their lawsuit against the Board of Equalization.)

Fiscal Year 2021’s budget, however, is a different story.

After Oklahoma Tax Commission director Jay Doyle and Office of Management and Enterprise Services state budget director Shelly Paulk sped through dire fiscal estimates for July 2020 through June 2021, legislative budget leaders — glued to spreadsheets within a fifth-floor conference room — expressed uncertainty on the numbers presented to media.

“What makes it difficult at this point is that we don’t have all the facts. A lot of the numbers that they released today, we’ve asked for the research behind those numbers. We have not received that yet,” said Senate Appropriations and Budget Chairman Roger Thompson (R-Okemah). “We are still looking for the research. We are still looking for what the [federal government] is going to allow us to do with the COVID (relief) money. So until we get all the facts, it’s kind of hard to begin to craft a solution.”

Thompson praised Attorney General Mike Hunter, a member of the Board of Equalization, who asked Doyle during the meeting whether his projections will be modified when it’s clear what amount of $1.5 billion in federal stimulus dollars can be used to cover agency budget issues.

As Hunter asked his question, Secretary of Budget Mike Mazzei whispered to Doyle: “We don’t get that for revenue.”

Doyle relayed the answer to Hunter and the other five Board of Equalization members who had called into the day’s meeting.

“My understanding is that is directly to be used to impact the effects of COVID-19 on the state and isn’t going to applied to the general revenue,” Doyle said.

Hunter disagreed.

“I think you might be mistaken about how restricted those funds are going to be,” the attorney general said. “My understanding is we still haven’t gotten direction from [the U.S. Treasury Department], so I am optimistic there will be more flexibility.”

Mazzei whispered to Doyle that flexibility had been requested, and Doyle relayed the information to Hunter.

“Yes, I believe we are still waiting on some further guidance,” Doyle said.

In his office after the meeting, Thompson said Hunter “asked a very good question.”

“I think it is premature to say we can’t use any of that money except for COVID-related expenses,” Thompson said.

House Appropriations and Budget Chairman Kevin Wallace (R-Wellston) said state agency expenditures related to COVID-19 are currently being paid out of FY 2020 budgets.

“There will be an offset,” Wallace said.

The legislative budget chairmen took additional umbrage at the executive branch’s budget projections, which estimate a loss of $1.3 billion in revenue for appropriation between FY 2020 and FY 2022.

“I think he made statements today based on the current situation, and I think everybody realizes we are in a fluid situation,” Thompson said.

Wallace agreed.

“We can play for 2022, but right now we need to focus about what we have in hand moving through 2021,” Wallace said. “Because the numbers and statistics we are facing today will not be the same tomorrow, and that can be either positive or negative.”

Stitt said legislative leaders should plan for problematic scenarios, although lawmakers and legislative staff said they did not receive the Board of Equalization’s letter of guidance Monday. The letter was sent on the afternoon of Tuesday, April 21.

“We are going to get through this,” Stitt said. “State government is going to have to tighten up just like Oklahoma families.”

The next morning of April 21, Doyle told NonDoc he had relayed background information to Thompson and Wallace by email and phone call prior to the Board of Equalization meeting. He said deeper details were sent the following morning.

Thompson confirmed Doyle’s statements and said the information he and Wallace were given the day of the meeting included “an economic forecast.”

“I wanted the notes behind the numbers they are looking at,” Thompson said, adding that he received that information in 31 pages of documents provided by Doyle the morning of April 21.

Maintaining #oklaed funding could double other cuts

Exactly which and how state agencies will be asked to “tighten up” remains unclear, though some discussions have been public.

“The Legislature writes the budget, but I just want Oklahomans to know that our budget won’t recover overnight, and we will need to get creative over how we protect our core services in the longterm,” Stitt said.

Asked about Doyle’s estimate that COVID-19 economic slowdown and a devastating collapse of the oil and gas industry could return Oklahoma’s appropriation levels to FY 2016 and FY 2017 levels — before the Legislature’s historic tax increase funded an average $7,300 pay raise for state teachers — Stitt said lawmakers have to get into “the details and weeds.”

“That’s up to the Legislature to go through and say, ‘Should they get an across-the-board cut? Should you hold one agency harmless and one gets less than another?'” Stitt said. “If you hold [all education] flat, that’s 50 percent of the revenue, then those cuts get exaggerated for the other 50 percent. So those are the complicated questions the Legislature is going to have to deal with.”

On that, Wallace agreed.

“If you hold them flat, you double everybody else’s cut,” Wallace said.

Oil crash shocks state leaders

While they may not be fully on the same page about building future state budgets, Stitt, Thompson and Wallace shared a memorable experience Monday: watching the futures market on oil prices fall to negative numbers.

“I took a screenshot when it got down to a nickel. I don’t think I’ll ever see that again,” Thompson said. “And then it went down into negative.”

Wallace summarized negative oil prices simply.

“That’s when they are paying you not to deliver,” he said.

Stitt said he received updates on the historic crash throughout Monday morning.

“I actually was on a call with Vice President (Mike) Pence. He was doing a governors’ call on COVID-related items whenever my assistant chief of staff told me it dropped to $11 (per barrel),” Stitt said. “Then we came in here and we were working on this budget and getting prepared for this meeting when they told me it dropped below $4.”

The governor said he was in his office when the price fell into negative numbers and he “about hit the roof.”

Mazzei, however, offered some cautious perspective.

“Partly what is happening is that the April contract ends at a certain time on the futures. We are dealing with a one-month contract that is the price. The June contract, there is already some expectations once we get past this unusual shutdown scenario, that the June contract might open up at $30,” Mazzei said. “Tankers are in the harbor, nobody wants to take any oil. Nobody wants to move anything on a ‘May contract’ so that it’s just collapsed in its price. But hopefully by the time we are lifting safer at home orders and getting back to work, we will see the price recover to maybe $30 quickly. I don’t know if that’s realistic, but we are dealing with futures contracts here, not specifically the price of a commodity.”

Doyle provided the Board of Equalization with dire estimates for oil and gas employment over the next year: a loss of between 8,000 and 10,000 industry jobs during the second quarter of FY 2021 and a total state unemployment rate between 12 and 14 percent.

“Drilling activity is not expected to resume in a meaningful way until late 2021 or early 2022,” Doyle said.

Stitt said he believes petroleum demand will ultimately pick back up and “normalize” when COVID-related shutdowns end. He said economic factors are being considered within discussions of how and when to re-open Oklahoma’s economy.

“We’re thinking about the economic impact, we are thinking about the people who have lost their jobs, but we also are looking at the data,” Stitt said. “In May, June and July, I’m going to continue to monitor hospitalizations, and if anything picks back up and gets toward a peak, then we are going to kind of take a step back again. But if not, we are going to roll this out in phases. I should be giving more guidance in the next couple of days.”

Board of Equalization letter signed by Stitt

Legislative members said they received the Board of Equalization’s letter after 1 p.m. Tuesday, April 21. The letter, released by the governor’s office after an open records request, references the board but is signed only by Stitt. The letter appears here in full:

At the Board of Equalization meeting today, the executive director of the Oklahoma Tax Commission presented revised estimates for revenues available from major tax sources to be apportioned for Fiscal Year 2021. Their best estimate, based on the impact of the COVID-19 economic downturn and resultant decrease in income and sales taxes, together with the significant drop in oil prices and the ensuing drop in gross production taxes, is that the State’s revenues for the period ending June 30, 2021, will decrease approximately $1,733,729,000 from impacts to major source collections, which will impact the General Revenue Fund negatively by approximately $1,366,288,860.

In light of the extraordinary circumstances of the current COVID-19 global pandemic, we the board believe it is important to point out that the Feb. 18, 2020, certified general revenue numbers are no longer reliable for consideration of the state’s fiscal plan for Fiscal Year 2021. We respectfully advise that the Legislature take into account the above information from the Oklahoma Tax Commission to properly adjust expectations of estimated revenue for planning purposes in crafting a budget for Fiscal Year 2021.

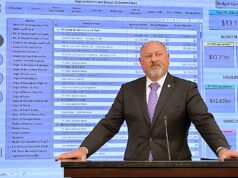

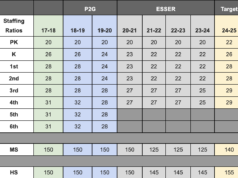

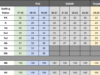

April 20 Board of Equalization graphics

Loading...

Loading...

(Update: This story was updated at 10:10 a.m. Tuesday, April 21, to include additional detail about information provided to Thompson by Doyle. It was updated again at 3:05 p.m. to include the Board of Equalization letter.)