On Dec. 8, the Oklahoma Tax Commission issued a final order denying the appeal of a Muscogee Nation citizen who cited the U.S. Supreme Court decision in McGirt v. Oklahoma as grounds to qualify for an “exempt tribal income exclusion” on state income taxes.

“Protestant does not qualify for the Exempt Tribal Income Exclusion claimed on his 2015, 2016, and 2017 returns because protestant has not shown the income he seeks to exclude is derived from a source under the jurisdiction of a tribe of which he is a member,” the OTC order states.

Released publicly today, the order — issued by three tax commissioners in December after adopting fact findings, conclusions of law and recommendations that an administrative law judge issued in November — marks the first post-McGirt income tax protest to complete the Tax Commission adjudication process. The question of whether tribal citizens who live and work on newly affirmed Indian Country reservations are subject to Oklahoma income tax authority is shaping up to be a primary dispute stemming from the July 2020 McGirt decision.

But even though the Oklahoma Tax Commission denied this exemption petition, other pending protests on the same topic could potentially find a different outcome. That’s because the order released today emphasizes that the petitioner holds citizenship within the Muscogee Nation but worked for a connected, federally recognized sovereign government called the Thlopthlocco Tribal Town, located within and historically connected to the Muscogee Nation.

Other pending income tax protests could be more straightforward.

The details of this case, however, underscore the complex nature of the Muscogee Nation’s historic “tribal towns,” about 40 of which relocated from the Southeast to the current Muscogee Reservation when the Indian Removal Act was official policy of the U.S. government.

At that time, the Muscogee were a confederacy of towns that retained autonomy but sent representatives to the House of Warriors and House of Kings. After congressional passage of the Oklahoma Indian Welfare Act of 1936, some towns applied for and received federal recognition. The Thlopthlocco Tribal Town did so in 1939.

The Muscogee Nation reorganized and achieved federal recognition under the OIWA in 1970, subsequently adopting a new constitution in 1979. The Muscogee Nation still features more than a dozen active ceremonial grounds within its reservation boundaries, but the majority do not have “tribal town” status with governmental structures.

Currently, three federally recognized “tribal towns” exist within and in connection to the Muscogee Nation: the Thlopthlocco Tribal Town, the Kialegee Tribal Town and the Alabama Quassarte Tribal Town. (The Sapulpa-based Euchee Tribe has unsuccessfully sought similar status with the federal government.)

‘The context of the relationship’

In the redacted Oklahoma Tax Commission order released Monday, the tax petitioner seeking the tribal exemption is a citizen of the Muscogee Nation but works at the Golden Pony Casino operated by and on trust land of the Thlopthlocco Tribal Town, just south of I-40 east of Okemah.

Although the OTC order referenced that the SCOTUS McGirt decision “has not been expanded to civil matters, including taxation,” the administrative law judge focused their analysis on the Muscogee petitioner not jointly having Thlopthlocco citizenship. (All Thlopthlocco Tribal Town citizens are eligible for Muscogee Nation citizenship, but the converse is not true.)

“The Thlopthlocco Tribal Town and the Muscogee (Creek) Nation are both separate, federally recognized Indian tribes,” the order states, potentially understating the connection of services between the two governments. (The Thlopthlocco Tribal Town website was down Monday.)

The OTC order continues:

The analysis required to resolve this issue, in the context of the relationship between tribal towns and the Muscogee (Creek) Nation (“Nation”), appears not to have been addressed by the Commission previously. That is, whether an enrolled member of the Nation who asserts residence within Indian country under the jurisdiction of the Nation qualifies for the Exempt Tribal Income Exclusion for income earned as an employee of the EMPLOYER, a casino located on a 120 acre tract of Thlopthlocco Tribal Town (“Tribal Town”) trust land and owned by the Tribal Town, a federally recognized Indian tribe.

The order concludes that the “protestant presents no evidence, nor does he assert, that he is a member of the Thlopthlocco Tribal Town.”

Partial reservation status ‘just makes no sense’

On Monday, Cassandra Sweetman of the Oklahoma Tax Commission said the agency had no comment on the newly released order. But Oklahoma Gov. Kevin Stitt released a statement shortly after the publication of this article.

“I believe that all Oklahomans, regardless of their race or heritage, are subject to taxation by the state of Oklahoma,” Stitt said.

Jason Salsman, press secretary for the Muscogee Nation, did not return messages seeking comment prior to the publication of this story. Thlopthlocco Tribal Town King Ryan Morrow also did not return a phone message prior to the publication of this story.

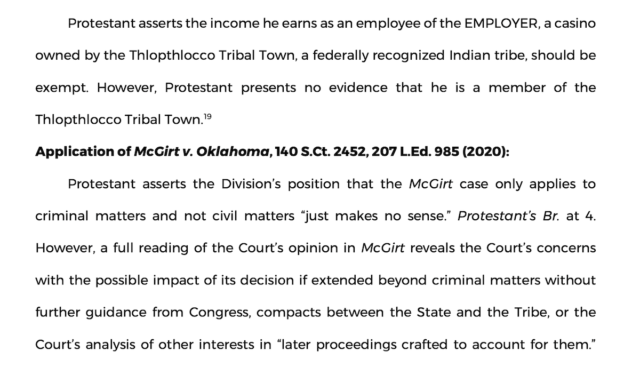

In the Tax Commission’s order, about three pages are dedicated to the “application” of the McGirt v. Oklahoma decision, which the OTC’s Income Tax Accounts Division has stated does not to affect civil matters such as taxation jurisdiction.

“Protestant asserts the division’s position that the McGirt case only applies to criminal matters and not civil matters ‘just makes no sense,'” the order states. “However, a full reading of the court’s opinion in McGirt reveals the court’s concerns with the possible impact of its decision if extended beyond criminal matters without further guidance from Congress, compacts between the state and the tribe, or the court’s analysis of other interests in ‘later proceedings crafted to account for them.'”

The order notes that the Oklahoma Tax Commission is one of several agencies that has made a “collateral drafting choice” that incorporates the federal 18 U.S.C. 1151 definition of “Indian Country” into its own definitions.

The Oklahoma Tax Commission definition of Indian Country “means and includes formal and informal reservations, dependent Indian communities, and Indian allotments, the Indian titles to which have not been extinguished, whether restricted or held in trust by the United States.”

Following the McGirt decision’s affirmation of the Muscogee Nation as an Indian Country reservation under 18 U.S.C. 1151(a), some tribal citizens have applied for a state income tax exemption offered by Section 710:50-15-2 of the Oklahoma Administrative Code, which reads:

The income of an enrolled member of a federally recognized Indian tribe shall be exempt from Oklahoma individual income tax when (…) the member is living within “Indian Country” under the jurisdiction of the tribe to which the member belongs; and, the income is earned from sources within “Indian Country” under the jurisdiction of the tribe to which the member belongs (…).

Ryan Leonard, an attorney contracted by the state of Oklahoma to handle McGirt-related issues, has previously emphasized that civil jurisdiction issues such as taxation authority were never litigated in the McGirt v. Oklahoma case. The majority opinion, for instance, begins with the statement, “Held: For [Major Crimes Act] purposes, land reserved for the Creek Nation since the 19th century remains ‘Indian Country.'”

But the question could be headed for further litigation. Tax attorneys representing tribal citizens and Cherokee Nation Principal Chief Chuck Hoskin Jr. disagree with Leonard’s stance.

“There’s nothing new about the law out there on the ability of a state to tax a member of a federally recognized tribe on a reservation. What’s new, of course, is the scope of the reservation (because) of the McGirt case,” Hoskin said during an Oct. 27 panel discussion hosted by the Oklahoma Policy Institute. “So, we can look to existing law, and we can see that taxation doesn’t attach to individual Native Americans who live on reservations.”

Meanwhile, SCOTUS denies more certs

Monday proved to be a busy day regarding decisions related to the Indian Country reservations in eastern Oklahoma.

In an order released Monday morning, the U.S. Supreme Court declined to hear more than 30 McGirt-related cases brought by the state, many concerning convictions that were overturned and handed to federal and tribal jurisdiction on the basis of McGirt.

Last week, the court said it would hear arguments in Oklahoma v. Castro-Huerta, in which the state had asked that the McGirt decision be overturned entirely. However, the court’s order specified that it would not consider overturning McGirt and would only hear arguments concerning the other question presented by the case: “Whether a state has authority to prosecute non-Indians who commit crimes against Indians in Indian country.” Arguments in the Castro-Huerta case are scheduled for April.

Other cases not granted a hearing today similarly asked for McGirt to be overturned.

Earlier this month, the court declined to hear a trio of cases questioning whether McGirt applies retroactively to cases in which a final verdict has been reached. As a result, the Oklahoma Court of Criminal Appeals ruling that the decision is not retroactive in such cases remains in place.

Although other McGirt-related cases remain on the court’s schedule, today’s order clears the docket of the bulk of the state’s recent attempts to roll back McGirt via the Supreme Court.

Read the Tax Commission order

Loading...

Loading...

(Update: This article was updated at 4:20 p.m. Monday, Jan. 24, to include a quote from Gov. Kevin Stitt.)