Community members within the Cache Public Schools district will see an unexpected property tax increase of about 15 percent this year owing to a clerical error that misstated the community’s assessed valuation by about $51 million.

Comanche County Assessor Grant Edwards notified the district that a mistake was made in the figures that were gathered, certified by the Comanche County Excise Board and reported by his staff for 2021.

The March 2021 mistake was not reported to the school district until June 2022, about four months after voters had approved two new bond packages totaling $36.4 million for Cache Public Schools. The district has also been paying off existing bonds totaling $7.2 million from 2020 and 2021 packages that voters approved.

Districts use anticipated property tax revenues to secure financing through bond issues for building and transportation projects. The over-valuation of property within district boundaries means the district would not collect enough taxes to pay off the bonds without raising the rate paid by property owners.

Superintendent Chad Hance discussed the situation in a statement posted today on the district’s Facebook page.

“We have invested the last two weeks in better understanding this unusual situation and determining how this will affect our school district and local taxpayers,” Hance said. “Unfortunately, it will have a decidedly negative impact — one that the school board and district officials are unable to correct or control.”

Shortly after the publication of this article, Edwards provided a statement (embedded below) explaining how the error was made.

“It’s unfathomable that one simple clerical error could cause a situation like this and be overlooked for so long, but that’s the reality of the situation and I am so sorry to everyone,” Edwards said. “My team and I have met and implemented several new due diligence steps to prevent anything like this from happening again.”

Located about 17 miles west of Lawton, Cache is a town of about 3,000 people whose sprawling school district along Cache Road is a draw for Comanche County residents.

RELATED

‘Instability’: Hundreds of Oklahoma property tax protests leave schools in limbo by Megan Prather

Each year, county assessors determine the value of property within the boundaries of each school district, which is used to calculate the funding for county schools. The county excise board certifies the net assessed valuations and sets the budget for county schools, the county health department, career- teach centers and other county services.

Shannon Baker Hutchison has three children that attend Cache Public Schools and called the mistake “outrageous” on Facebook.

“This will crush some people, especially with the current inflation,” she said.

The Cache Area Chamber shared the district information to their Facebook page, urging individuals to keep their money in the community.

“Unfortunately, this will also negatively impact local business,” the post reads. “It’s more important than ever for you to support local and keep your money in the community when you can.”

‘Larger class sizes will be necessary this school year’

In the statement explaining the situation to community members, Hance said that, as a result of the error, the district collected $700,000 less than was needed for its sinking fund, which is used to pay off bond debt. This will result in the 15 percent increase in property taxes on upcoming notices that residents will receive from the county assessor’s office in December.

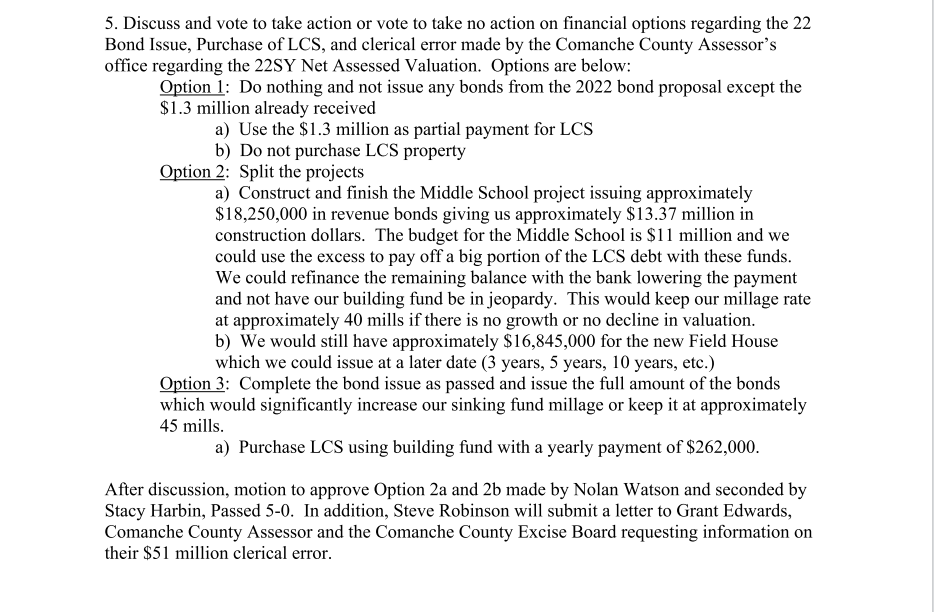

However, residents will also endure a 5 percent higher property tax increase next year as well, owing to the issuance of a general obligation bonds from the February 2022 bond election. During that election, nearly 64 percent of ballots were cast in favor of an approximate $35.3 million bond proposition to acquire an activity center and renovate the district’s middle school. Community members also approved a $1 million transportation bond issue with nearly 70 percent of the vote.

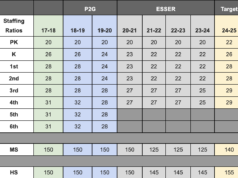

Hance said Cache Schools’ general fund, which is used to pay for most district expenses, will have a $2 million reduction that will not have a direct financial impact on local residents, but will require the district to make what he calls “difficult decisions.”

“We will continue to do everything possible to protect the learning environment for students, but it is likely that larger class sizes will be necessary this school year,” Hance said in the statement.

The district’s building fund will be reduced by $300,000, which Hance said will result in the need to curb new district projects and improvements.

“Although this mistake happened at the county office, I want to express my sincere apologies to Cache taxpayers for the impact it will have on them and their families,” Hance said. “This is a community that supports public education and gives generously to its schools to ensure students have what they need to be successful. I value and want to protect the trust and relationships that our district has built with local residents. I am sorry this situation occurred.”

Sen. John Michael Montgomery (R-Lawton) told NonDoc Tuesday afternoon that he’s aware of the issue.

“I’m aware of the problem and I am certainly willing to engage and try to find solutions for taxpayers,” Montgomery said.

Read full statement from Comanche County Assessor

Loading...

Loading...

(Update: This article was updated at 5:43 p.m. on Tuesday, July 12, to include statements from Comanche County Assessor Grant Edwards and Sen. John Michael Montgomery.)