Disputes between the state of Oklahoma and sovereign tribal nations over tobacco taxation date back to the 1980s and have spurred critical cases at the highest courts in the land. Now, as other questions linger about civil jurisdiction following the 2020 U.S. Supreme Court ruling in McGirt v. Oklahoma, the state and tribes could be barreling back into the courtroom for new showdowns over compacting authority, tobacco taxation and reservation designations.

Oklahoma Gov. Kevin Stitt says he wants to negotiate new compacts with sovereign tribal nations regarding taxes on tobacco products and motor vehicle registrations, but leading tribes balked at his proposed changes and instead convinced Oklahoma House leaders to push a four-year extension that would kick negotiations beyond Stitt’s new term in office. Leaders of the State Senate, however, were frustrated by the attempted end-run, instead agreeing to extend all tobacco and motor vehicle compacts one additional year through Dec. 31, 2024.

Last week, Stitt vetoed a pair of bills that would do just that, leaving legislative leaders to decide later this month whether they will override Stitt’s vetoes, as they did 19 times at the end of the year’s regular session. Regardless, the latest state-tribal compact dispute may end up in court one way or another.

“I believe that, if these compacts expire, the chance of litigation goes up dramatically,” Senate Floor Leader Greg McCortney said May 24 while presenting one of the compact extension bills.

Two days later, lawmakers formally sent Stitt SB 26X and HB 1005X during their budget-related special session, even though neither appears to meet the three appropriation-specific reasons listed in the special session call.

Stitt started his June by vetoing both measures, claiming “clear violation of Oklahoma’s fundamental and statutory law” and “circumvention of the executive’s authority to negotiate compacts.”

In his SB 26X veto message, Stitt mentioned the McGirt SCOTUS decision that functionally affirmed the existence of eight reservations in eastern Oklahoma as Indian Country, a crucial distinction in federal law:

Enrolled Senate Bill 26X purports to extend existing and expired tobacco tax compacts. Both because this bill amounts to a circumvention of the executive’s authority to negotiate compacts and is not in the state’s best interests, I must veto it.

As enacted, Senate Bill 26X would rubberstamp pre-McGirt compacts containing the very language five of the state’s 38 federally recognized tribes have relied upon to challenge, in Stroble v. Oklahoma Tax Commission, the state’s right to collect income tax within its territory.

Tribal leaders fired back, with Choctaw Nation Chief Gary Batton saying Stitt has “personal hostility” toward sovereign tribal nations, with which he has clashed since attempting to renegotiate casino gaming compacts in 2019.

“Significant majorities in both chambers of the Legislature voted to extend tobacco and vehicle compacts for one year because they provide important, ongoing benefits for the people of Oklahoma,” Batton said in a statement. “By vetoing these bills, Gov. Stitt has once again put his personal hostility to tribal sovereignty ahead of what is good for the state and what is good for the tribes.”

Chickasaw Nation Gov. Bill Anoatubby said lawmakers overriding the vetoes would help “avoid extended litigation” between the state and tribes.

“We applaud the Oklahoma Legislature for voting to extend these proven compact agreements which have brought numerous benefits to Oklahoma and tribal nations for decades,” Anoatubby said in a statement. “These thoughtfully negotiated agreements are designed to effectively balance the rights and responsibilities of tribal and state governments, which enables both governments to avoid extended litigation and serve our citizens more efficiently. We encourage the Legislature to continue taking the lead on this important issue by overriding this veto.”

McCortney: ‘I believe these compacts have worked very well’

While veto messages and critical press releases frame a political picture of feuding heads of state, the background and functional details of state-tribal compacts on tobacco taxes are much more complicated.

To that end, the hour-long presentation of SB 26X in the Oklahoma State Senate featured extensive questions and passionate debate among those proposing and opposing the compact extensions.

“I believe these compacts have worked very well for many years,” said McCortney (R-Ada). “I guess that I would say [if] they end, there could still be negotiations ongoing to try to enter into a new one. But I believe that if they expire, the chances of a lawsuit would probably go up quite significantly.”

Sen. Shane Jett (R-Shawnee) questioned McCortney about how tobacco taxes are collected and how the compacts estimate sales to tribal citizens.

“The state of Oklahoma wires back $17 million to just two tribes — $6 million to the Chickasaw Nation (…) and $9 million to the Choctaw,” Jett said, appearing to be off about $2 million mathematically. “If they didn’t do the compact, wouldn’t the state of Oklahoma just keep that $17 million?”

McCortney replied: “No, that $17 million would have never existed if it were not for the compact.”

Underscoring the complex nature of how excise taxes are collected on tobacco, neither Jett’s question nor McCortney’s answer was fully accurate.

A landmark Supreme Court case in 1991

Federal law exempts tribal citizens from paying state excise or sales taxes on tobacco products purchased on Indian Country land as defined by 18 U.S.C. 1151. Federal law also allows states to tax non-tribal citizens who buy tobacco from tribal businesses in Indian Country. There are 38 federally recognized tribes headquartered in Oklahoma, and a 1991 landmark U.S. Supreme Court case — Oklahoma Tax Commission v. Citizen Band Potawatomi Indian Tribe of Oklahoma — affirmed states’ rights to tax non-tribal citizens who purchase tobacco on tribal land.

After the SCOTUS ruling, tribal nations and the state of Oklahoma began signing tobacco tax compacts in 1992 as an effort to establish rules for tax collection and administration. Under the compacts, all businesses pay taxes when they buy tobacco products from wholesalers, who remit the taxes to the state. Tribes then receive a rebate from the state at a percentage rate specified by their compact. Many of the initial compacts from the early 1990s established that tribes owed the state an equivalent of 25 percent of all applicable excise taxes on tobacco sold by their nation or businesses with majority ownership among tribal citizens.

Subsequent decades have seen notable changes and legal drama. When Gov. Brad Henry’s office negotiated a slate of new 10-year compacts in 2003, they retained the 25 percent payment portion and added stipulations exempting some tribes from paying the tax in various circumstances, including an exemption in the Choctaw and Chickasaw compacts for sales made within 20 miles of the Texas border until Texas increased its tobacco taxes.

A 2005 disagreement over the cost of cigarette tax stamps stands among the most contentious state-tribal tobacco compact disputes. After State Question 713‘s tobacco tax increase was approved by Oklahoma voters in 2004, the state’s tobacco compacts with tribes functionally created six different compact tax rates ranging from 6 cents to 86 cents per pack.

The 6-cent stamps were reserved for border stores in competition with low-tax states. However, the different tax rates proved difficult to enforce, and 6-cent tax stamps were found on cigarette packs in tribal stores miles away from state borders. Some tribes chose not to sign a compact.

The Muskogee (Creek) Nation was among those that did not sign a tribal compact with the state, and the nation filed a federal lawsuit over the issue as the state tried to force the tribe into signing a compact. Talk grew of the state setting roadblocks outside the tribe’s smoke shops in Tulsa to confiscate cigarettes without the appropriate tax stamp, but state leaders chose other action instead.

In 2009, agents from the Oklahoma Tax Commission seized about $40,000 worth of cigarettes from the Muscogee (Creek) Nation, and in 2010 the Oklahoma Tax Commission seized 77 cases of cigarettes that were on their way to smoke shops on the Muscogee (Creek) Nation. The commission said the retailers were selling the cigarettes without state tax stamps, and the product was valued at $103,000, according to a search warrant.

In 2009, the state created a different statutory process for estimating and collecting tobacco taxes from noncompacting tribes.

Like Stitt, former Gov. Mary Fallin’s administration saw tobacco compact negotiations with tribes extend more than a year. In late 2012, she sent tribes letters notifying them that she would not renew the Henry administration’s tobacco compacts. One-year extensions were reached by Fallin and many tribes in 2013 as talks continued.

When dozens of new agreements were signed in 2013 and 2014, many included stair-stepped increases in the percentage of taxation retained by the state, with the percent increasing steadily from a 30 percent share to the 50 percent share currently in effect.

‘I don’t think anyone knows the percent’

During his questioning of McCortney on May 24, Jett said the current compacts estimate that 50 percent of tobacco sales at tribal casinos and smoke shops are made to tribal citizens. Jett, a Cherokee Nation citizen, questioned how that could be even remotely reflective of reality when only 10 to 15 percent of Oklahomans — not including Texans who buy smokes at casinos — are tribal citizens.

“I would agree that a higher percentage of tribal members would probably buy at their own smoke shop, but just by pure distribution of probabilities, most of their customers are going to be non-native Oklahomans,” Jett said.

Underscoring the function of the compacts, McCortney said, “I do not think anyone knows the percent” of tribes’ tobacco customers who are tribal citizens.

“The (tobacco) wholesalers pay the tax — 100 percent of the tax, and then 50 percent of the tax is rebated back,” McCortney said. “If these compacts did not exist (…) zero percent of the product sold to tribal members would be taxed if it were not for the compact. Therefore none of that money would ever hit the coffers of the Oklahoma Tax Commission.”

But McCortney’s remark failed to consider the 2009 alternative to tobacco tax compacting that the Oklahoma Legislature created in state statute. Perhaps even more complicated than compacts, the law allows for tribes to remit excise taxes to the state based on mathematical calculations involving tribal membership, state smoking rates and cigarette consumption rates:

The probable demand for Native American tax free stamps for each noncompacting tribe or nation shall be determined by the Tax Commission by ascertaining the total membership in Oklahoma of the tribe or nation from the Bureau of Indian Affairs or other reliable source of public information regarding such membership, and multiplying that number by the percentage of smokers in Oklahoma or in the United States, whichever is greater, based on the most recent data available from the State Department of Health and/or other reliable source of public information.

The product of that calculation shall be multiplied by the average yearly consumption of cigarettes by smokers in Oklahoma or the United States, whichever is greater, based on the most recent data available from the State Department of Health and/or other reliable source of public information. The resulting number shall be deemed to constitute the probable demand for Native American tax free stamps of such noncompacting tribe or nation for a calendar year.

It’s unclear whether any tribes are currently complying with that state tobacco taxation requirement instead of compacts.

Meanwhile, on the enforcement front, a 2014 Oklahoma Supreme Court decision upheld a $47.4 million judgment against the Sac and Fox Nation for selling contraband cigarettes.

Echols: ‘Find a way to stabilize tribal relations’

With tobacco compacts signed by the Choctaw Nation, Chickasaw Nation and 14 other tribes set to expire by the end of this year, the question of whether to renew or amend the agreements has hung awkwardly in the air between Stitt and those nations’ leaders who endorsed Joy Hofmeister over Stitt last year and spent millions of dollars in pursuit of his defeat.

Rumors of Stitt wanting to renegotiate the tobacco and motor vehicle compacts percolated this legislative session, but the topic only reached public discussion when the Oklahoma Legislature revealed its first major slate of budget bills May 16. To the surprise of many — including some tribal nations with tobacco compacts — the House had filed bills to extend the state-tribal tobacco and motor vehicle compacts until Jan. 1, 2028, when Stitt would be out of office.

In the House’s Joint Committee on Appropriations and Budget meeting, Majority Floor Leader Jon Echols (R-OKC) presented the tobacco compact bill first. Although it only had been posted publicly less than two hours earlier, Echols breezed into a motion to pass the measure without even saying it dealt with tobacco taxes or tribal compacts.

“Everybody was fully aware of what the bill did,” Echols said later when asked why he chose not to describe the compact bill when presenting. “We do need to find a way to stabilize tribal relations between the state government and our tribal partners, but Speaker (Charles) McCall will have to answer on that one. It’s his bill.”

Senate leaders were less pleased by the House’s attempt to fast-track a four-year extension of the tobacco and motor vehicle compacts, and they chose not to hear the versions posted May 16.

“We were a little caught off guard with that JCAB bill. I had known the issue was out there. The speaker and I had briefly talked about the issue, but I didn’t know they were going to put them in JCAB,” Senate President Pro Tempore Greg Treat (R-OKC) told media. “We had been in talks about whether we can narrow that window a little bit to where it’s not a five-year extension but something shorter so that we can get our arms around what the real ramifications are. Obviously, it could have an adverse budget impact if we don’t get compacts renewed at some point. I’m open to extending them for some period shorter — probably a year.”

Ultimately, that’s what House and Senate leaders agreed to with SB 26X and HB 1005X, but not before Stitt sent May 18 letters and new compact proposals to Anoatubby and Batton, the Chickasaw governor and the Choctaw chief. In each letter, Stitt referenced visits with Anoatubby (late February) and Batton (March 1) at the Governor’s Mansion, which he said involved conversations over the tobacco compacts.

“The understanding reached in those conversations was that substantive dialogue about the tobacco compact, which is set to expire December 31, 2023, would occur in June 2023,” Stitt wrote each leader. “Although we were looking forward to good faith conversations at that time, and still welcome those discussions, we recently learned that some have engaged the Legislature in lieu of the discussions planned for June.”

Attached to his letter, Stitt included signed versions of a proposed one-year amended compact that would retain the current 50 percent state-tribe taxation split. But Stitt’s proposed amendment addressed a broader issue that concerns his administration, even though he omitted reference to it in his letters.

Throughout the history of Oklahoma’s tobacco compacts, the agreements have been specified for tobacco sales from tribe-owned establishments within “the Nation’s Indian Country” as specified in 18 U.S.C. 1151. That federal statute encompasses three types of land:

- All land within the limits of any Indian reservation under the jurisdiction of the United States government;

- All dependent Indian communities within the borders of the United States whether within the original or subsequently acquired territory thereof;

- All Indian allotments, the Indian titles to which have not been extinguished.

In 1980, the U.S. 10th Circuit Court of Appeals ruled in Cheyenne-Arapaho v. the State of Oklahoma that land held in trust by the federal government for the benefit of a tribe meets the Indian Country legal definition.

But with the U.S. Supreme Court’s 2020 McGirt v. Oklahoma affirming that Indian Country reservations in eastern Oklahoma still exist, the Stitt administration views the language in the current state-tribal tobacco compacts as problematic:

The provisions of this Compact shall establish and govern the rate of taxation and payment of taxes to the Nation and the State on the retail sales of cigarettes and other tobacco products in the Nation’s Indian Country as defined by federal law, including 18 U.S.C. § 1151, hereinafter referred to as “Compact Jurisdiction,” when said retail sales are made by the Nation. (Emphasis added.)

Instead, when Stitt sent compact extension offers to Anoatubby and Batton on May 18, he proposed a modified “compact jurisdiction” definition limited to historic allotment land and tribal land held in trust by the federal government:

The provisions of this Compact shall establish and govern the rate of taxation and payment of taxes to the Nation and the State on the retail sales of cigarettes and other tobacco products in the Nation’s Indian Country as defined herein, i.e., as lands owned by the Nation and/or its members which are held in trust by the United States, or which are owned by members of the Nation and are subject to restricted title.

Stitt’s team has pointed to a pair of amici briefs filed by the Five Tribes in support of a Muscogee Nation citizen whose case claiming exemption from state income taxation is before the Oklahoma Supreme Court. The Chickasaw, Choctaw and Cherokee nations filed one amicus brief supporting Alicia Stroble, arguing that “the definition of Indian Country applied to state tax laws before McGirt was decided.”

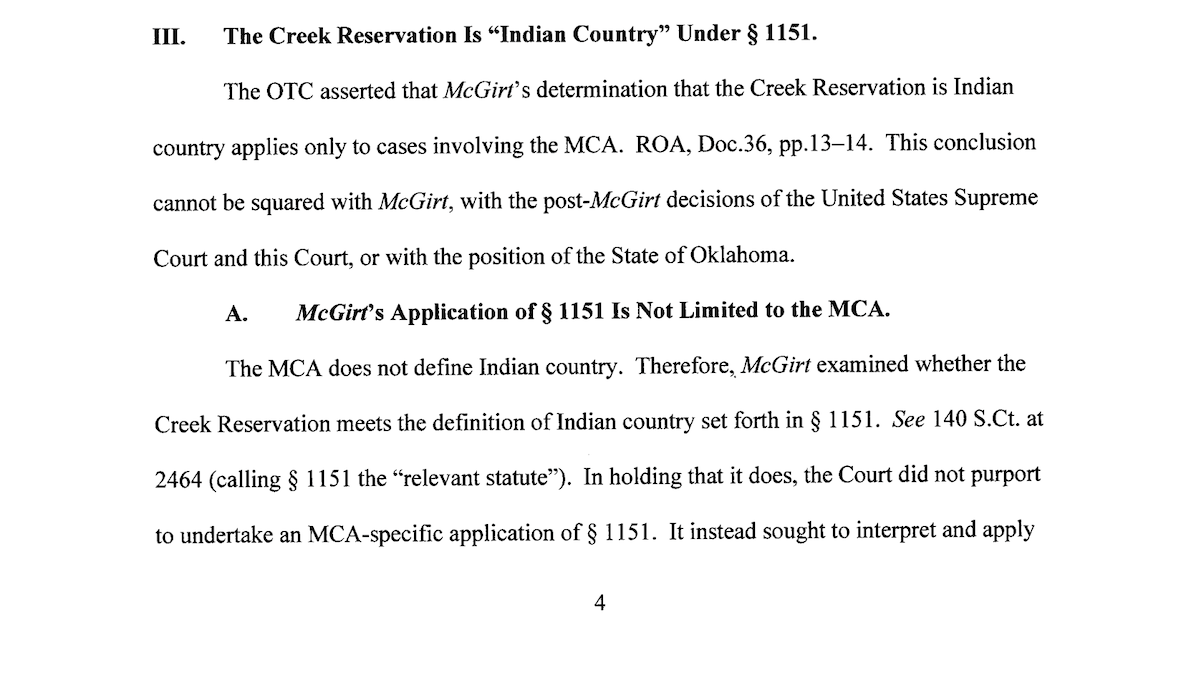

The Muscogee Nation and the Seminole Nation filed a separate amicus brief, which featured a subhead titled, “McGirt’s application of §1151 is not limited to the MCA.” The tribes’ attorneys wrote:

The [Major Crimes Act] does not define Indian country. Therefore, McGirt examined whether the Creek Reservation meets the definition of Indian country set forth in §1151. In holding that it does, the court did not purport to undertake an MCA-specific application of §1151. It instead sought to interpret and apply “§1151(a)’s plain terms,” which make clear that, so long as they remain in existence, federal Indian reservations are Indian country.

In his veto message on SB 26X’s proposed tobacco compact extension, Stitt pointed to the amici briefs as clear indication of how tribes’ view the civil-law jurisdiction issues involving their affirmed reservations.

“Although I believe the tribes’ arguments in Stroble are without merit, to legislate as though at least those few tribes are not prepared to lodge the same argument in the tobacco tax context (and likely elsewhere) is at best unwise,” Stitt wrote.

Kate Vesper, Stitt’s press secretary, said the SCOTUS ruling in McGirt v. Oklahoma expressly limited its impact for “purposes” of criminal jurisdiction.

“A few tribes have shown they will point to language contained in pre-McGirt tobacco tax compacts to significantly expand geographical boundaries within which they will claim tax advantages or full exemptions,” Vesper said. “Although those tribes’ arguments are fundamentally and legally wrong, the state would be unwise to not update compact language to ensure the state’s century-plus old tax structure isn’t disrupted.”

Ultimately, SB 26X and HB 1005X passed both chambers with the supermajority support that would be needed to override Stitt’s vetoes if lawmakers return to special session June 12 as planned.

Sen. Mary Boren (D-Norman) debated in favor of SB 26X. An attorney, she said extending the compacts by one year would afford Stitt and tribal leaders more time to reach an agreement and avoid litigation.

“I think the issue is do we want these negotiations to be in board rooms where our executive CEO of the state of Oklahoma can negotiate the compact, or do we want these negotiations to go into courtrooms?” Boren said.