(Editor’s note: The following story, maintained in its original form, reported inaccurate information regarding commissioners’ recommendation about the Oklahoma film enhancement rebate. An update to this story can be found here.)

After substantial confusion about what it is charged to do under state law, the Incentive Evaluation Commission voted Tuesday to approve recommendations to hasten the termination of tax rebates related to film and wind investment in Oklahoma.

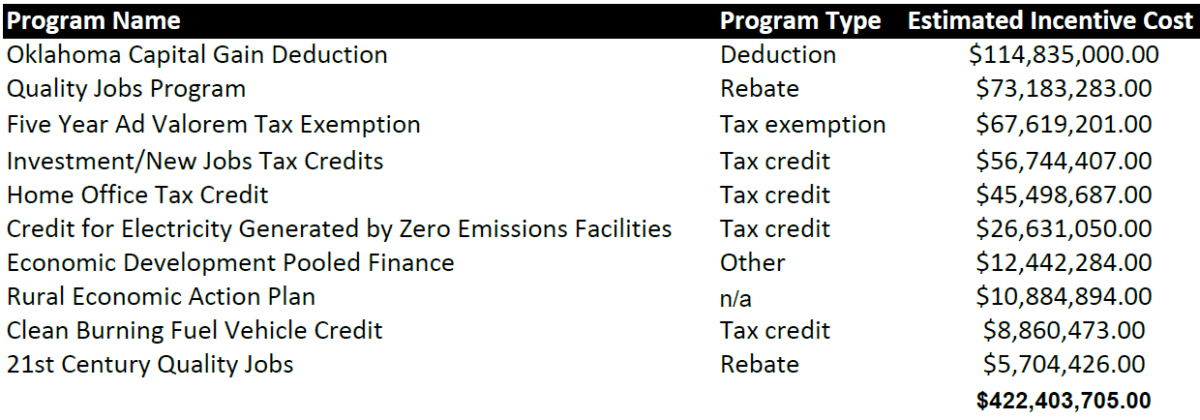

“Looks clear as mud,” one of the commissioners quipped during discussion of how to approve or disapprove recommendation reports about 11 Oklahoma tax incentives and credits. The commission hired PFM Group to provide recommendations on a handful of state economic-incentive programs annually.

After an hour of wrangling with the rules and process by which the commission would make its initial annual recommendations, commissioners voted to accept 10 of the 11 incentives being reviewed, and it tabled the 11th until a Nov. 29 meeting.

Two of the 10 accepted recommendations are likely to create controversy as well as a lobbying battle for the 2017 legislative session and, possibly, beyond. PFM Group recommended ending the state’s film enhancement rebate or allowing it to sunset as currently set in 2024.

“I think the evaluation is pretty clear that our belief is that the rebate is (…) not going to create a permanent industry,” said PFM representative Randy Bauer. “More effective ways to do that (may exist) on the appropriation side of the ledger.”

The rebate has long been the source of controversy and discussion at the State Capitol.

RELATED

Tax credit draft reports: ‘Repeal’ film rebate, ‘reconfigure’ others by William W. Savage III

Regarding the state’s tax credit for electricity generated by zero-emission facilities, commissioners approved PFM’s recommendation that the state “reconfigure the program to cap program credits or accelerate the closing of the program window (currently January 1, 2021) to January 1, 2018.”

That recommendation also advises the Legislature to maintain the ability for non-wind facilities to claim the credit through Jan. 1, 2021.

Commission Chairman Lyle Roggow abstained from voting on the zero-emission credit. His brother has previously lobbied for wind-power efforts in Oklahoma.

‘Learning as we all go’

The commission cast its votes quickly once the proverbial ball got rolling, but commissioners bogged down early when discussing what exactly it was voting on, what its report would include and when and how public comment would be taken into consideration.

The commission’s initial vote — regarding tuition reimbursement for aerospace employers — did not even specify whether the motion was to approve or disapprove of PFM’s recommendation.

“I agree with the secretary that we do need to state what the recommendation is so that it’s in the minutes,” said Carlos Johnson thereafter.

RELATED

Top-10 tax incentives revealed, commissioner criticized by Josh McBee

Later, Johnson reminded staff that commissioners should be able to discuss any motion after he had been interrupted.

“All a second means is it’s open for discussion. Robert’s Rules of Order!” Johnson exclaimed, his trademark bushy eyebrows bouncing in animation as he smiled. “Your effective chairman with a bulldozer was moving on.”

Roggow laughed, and the group pressed forward after ironing out more details. Afterward, he called the brand new commission a “process” that will inherently improve in future years.

“We’re learning as we all go through this. This is all new,” Roggow said. “No one has ever gone through what we just went through. If it was easy, the Legislature would have already done this.”

The commission will meet Nov. 29 to address one remaining incentive report and craft its own comments on the items that will be sent to the Legislature and the governor’s office in addition to the approved PFM reports.

Below are votes cast Tuesday related to the incentives up for consideration.

Aerospace engineering incentives

The commission ultimately voted unanimously to approve three items related to PFM’s recommendations about state aerospace-engineering incentives. [PFM recommendations]

Zero emission incentive

The recommendations were accepted 4-0 with Roggow abstaining. [PFM recommendations]

Aircraft sales excise tax exemption

The commission voted unanimously to approve the PFM recommendations to reconfigure this exemption. [PFM recommendations]

Five-year ad valorem tax manufacturing exemption

The commission voted unanimously to approve PFM’s recommendation to retain but consider revising eligibility requirements. [PFM recommendations]

Historic-rehabilitation tax credit

The commission voted unanimously to approve PFM’s recommendation to retain the credit but adopt an annual cap. [PFM recommendations]

Oklahoma Capital Investment Board

The commission voted 3-2 to approve the PFM recommendation to retain the Oklahoma Capital Investment Board with its existing sunset. Roggow and Johnson, the chairman and vice chairman, respectively, voted against the PFM recommendations. [PFM recommendations]

“My comment is that this is the sort of program that is nearly impossible to evaluate or predict,” commissioner Cynthia Rogers, an OU economics professor, said.

Bauer agreed.

“We approached it from a burden-of-proof perspective,” he said, adding that a higher burden of proof would be needed to eliminate the sunset and thus create OCIB permanently. He said that burden of proof could not be met.

Oklahoma film enhancement rebate

Approved 4-1 with Johnson casting the sole vote against accepting the recommendation to end or allow the rebate to sunset. [PFM recommendations]

Recommendation is to repeal or sunset the existing program.

PFM: “I think the evaluation is pretty clear that our belief is that the rebate is … not going to create a permanent industry.” “More effective ways to do that on the appropriation side of the ledger.”

Quality events program

The commission unanimously approved the PFM Group’s recommendation to reconfigure the program by streamlining application processes. [PFM recommendations]

Industrial access road program

The commission tabled its consideration of the PFM Group’s recommendation to repeal the Oklahoma Department of Transportation’s industrial access road program, which helps fund new public roadways that lead to new industrial business developments across the state. [PFM recommendations]

Ex-officio commissioner Deby Snodgrass, executive director of the Oklahoma Commerce Department, made a motion to remove industrial road program from consideration, saying the commission is “not qualified” to determine what constitutes an incentive.

“It’s not in statute, nor is it ever a line-item in the budget,” Snodgrass said of the ODOT program. “This purview of the program is the domain of the agency and not the domain of this body.”

Another ex-officio commissioner suggested tabling consideration of the industrial road program until the next meeting. Ultimately, they did.

“I think at some point this body needs to determine if it’s going to review administrative rules,” Snodgrass said, noting that the Legislature does not deal with agency rules once they are in existence. “It’s an internal rule for the agency.”

The commission last met 12 days earlier to review the recommendations from the PFM Group, an organization they hired to gather information and create analytical reports about the costs and benefits of state tax incentives and credits in Oklahoma.

Commissioners also heard and considered public comment at that meeting.