The Incentive Evaluation Commission met Wednesday and approved a proposed schedule for the review of Oklahoma state tax incentives.

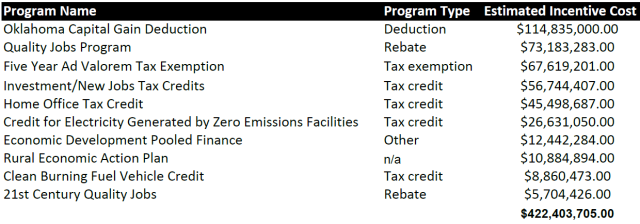

An analysis of data provided by the Office of Management and Enterprise Services shows that the top 10 tax incentives under review have totaled $422.4 million, which is 88.2 percent of the total amounts listed in the IEC’s schedule.

The following programs constitute the top 10 as ranked by estimated cost. (Note: In OMES’s list, there are 14 of 53 programs that exhibit “Unknown,” “None” or “N/A” values in the field for estimated incentive cost; those were excluded.)

- Oklahoma Capital Gain Deduction — $114,835,000

- Quality Jobs Program — $73,183,283

- Five Year Ad Valorem Tax Exemption — $67,619,201

- Investment/New Jobs Tax Credits — $56,744,407

- Home Office Tax Credit — $45,498,687

- Credit for Electricity Generated by Zero Emissions Facilities — $26,631,050

- Economic Development Pooled Finance — $12,442,284

- Rural Economic Action Plan — $10,884,894

- Clean Burning Fuel Vehicle Credit — $8,860,473

- 21st Century Quality Jobs — $5,704,426

TOTAL: $422.4 million

For a more detailed list of the top-10 tax incentives to be reviewed, see this table:

Loading...

Loading...

Background on reviewing tax incentives

A law that took effect in 2015 requires independent evaluation of Oklahoma’s economic incentives to take place every four years.

To do this, the law creates the Incentive Evaluation Commission (IEC), which sets criteria for evaluating incentives and their efficacy but hires an outside contractor to perform the actual evaluations.

That contractor then recommends either retaining, reforming or repealing each incentive, and the IEC in turn votes to approve or disapprove the contractor’s evaluations. Any change to or termination of an incentive program would be made by the Legislature.

Extra! Extra! Man is ‘old and crotchety’

Before Wednesday’s IEC meeting, House Democratic media director Mike Ray followed up an OMES email with his own that claimed a potential conflict of interest lies within the IEC.

Ray’s email stated:

ALL,

Just wondering: Does anyone think it’s odd that the chairman of this commission is the brother of a lobbyist for the wind industry, which gets a pretty hefty tax break from the State of Oklahoma?

It was the kind of thing that, warranted or not, would require some phone calls.

Anatomy of an alleged conflict

The chairman of the IEC is Lyle Roggow. A former chairman of the Oklahoma Health Care Authority, Roggow holds his IEC position by virtue of language in the aforementioned law. It stipulates that one of the IEC’s eight members must be the “president of the Oklahoma Professional Economic Development Council or his or her designee who is also a member of the Oklahoma Professional Economic Development Council.” As past president and current chairman of the OEDC’s Legislative Affairs Committee, Roggow passes muster.

Lyle’s brother, Curt Roggow, who bills himself as a “Government Relations Consultant” on his website, had represented the Oklahoma chapter of The Wind Coalition, which is “leading efforts to defend tax and siting policies that treat wind development equitably,” according to the group’s About Us page. In 2014, he wrote an editorial published in The Oklahoman saying “we must support the wind energy industry.”

Lyle said Wednesday, however, that Curt had left The Wind Coalition following the 2015 legislative session and had since landed a consulting role with Southern Power. (You can view his lobbyist page with the Oklahoma Ethics Commission here.)

As a subsidiary of Atlanta-based Southern Company, Southern Power owns two wind facilities, both of which are located in Oklahoma (Grant County and Kay County, to be exact).

Regarding the IEC, two tax incentives within the aforementioned top 10 relate either partially or specifically to wind power: the Five Year Ad Valorem Tax Exemption and the Credit for Electricity Generated by Zero Emissions Facilities, respectively.

Another incentive, the Credit for Manufacturers of Advanced Small Wind Turbines, is estimated to represent $178,690 in annual costs. In total, wind-related incentives account for $94.4 million in estimated annual costs (or about 20 percent of total incentive costs).

IEC chairman: ‘I don’t see any concern’

So, is there a conflict of interest with regard to one Roggow brother overseeing a commission that evaluates tax incentives for an industry in which the other brother has a vested interest?

“I don’t see any concern,” Lyle said Wednesday over the phone. He went on to explain that, through his role with OPEDC, he often deals with industries that might stand to benefit from the IEC’s actions. Beyond that, the bulk of recommendations regarding changes to existing tax incentives (wind or otherwise) originates from third-party analysis.

“I think the numbers are going to come out and individuals are going to make decisions based off of numbers and not whether I’m involved in economic development or on this commission,” he said.

Public Financial Management is the Philadelphia-based contractor hired by the IEC to provide analysis and recommendations.

“It’s a consultant who is coming back with the recommendation. It’s not the commission who’s making the recommendation, it’s the consultant,” Roggow said. “We’re just managing a process.”

Last, Roggow said that, should an issue arise that potentially compromises the integrity of his position, he would simply remove himself from the process.

“If there is or I feel like I have something that conflicts, I’ll definitely abstain from the voting of it,” he said.

‘Firewall’ in place

To further counter the concerns Ray raised in his email, John Estus, director of public affairs with OMES, highlighted the fact that, not only does the IEC lack control of the eventual recommendations for each incentive, the law specifically addresses the potential for conflicting interests.

“The state law that created this commission established a firewall between the contractor and industry representatives,” said Estus via phone Wednesday. “Industry representatives cannot directly contact the contractor. The contractor would have to reach out to them.”

While the law creates a “speak only when spoken to” relationship between industry shills like Curt Roggow and an IEC consultant from Public Financial Management, the language doesn’t specifically bar commission members and industry representatives from discussing ongoing incentive evaluations.

As such, the efficacy of such a clause elicited skepticism from Ray.

“‘Hey,'” Ray said mockingly, as if speaking as the Roggow brothers, “‘we’re not gonna discuss this at Thanksgiving dinner and Christmas. Oh yeah, we’re not gonna be talking about this July Fourth when the family gets together, no … .'”

Still not convinced?

There are definitely those within the political observation deck who staunchly stand by the old maxim that if it looks like a duck, walks like a duck and quacks like a duck, then it must be a duck.

Ray must have thought he was at the duck pond when he sent Wednesday’s insinuation.

“This stuff just gets to me,” said Ray, who worked as a journalist prior to his 18-year off-and-on career as a Democratic message crafter. “By God, sometimes I just get fed up with this crap.

“I’m getting old and crotchety, I freely admit.”