(Update: Energy company EDF Renewables announced shortly before noon Friday, Nov. 9, that it plans “to reverse” the controversial wind farm financing arrangement at the center of the story below. For more information about EDF’s decision, find that story here.)

Pending lawsuits over a northern Oklahoma wind farm’s property tax liability could have more than $1 million worth of implications for state education funding, according to Brady Barnes, superintendent of Newkirk Public Schools.

But while the suits await action in court, leaders of Kay and Grant counties, the Oklahoma State Department of Education and a subsidiary of Électricité de France are attempting to strike some sort of agreement that would prevent what Barnes says could be a $550,000 impact on his district come January.

“It’s going to crush us. We’re going to lose $342,000 of operational money, plus we’re going to have to take [$200,000] out of our general fund to make a sinking fund (bond) payment,” Barnes said. “And it’s hurting our kids right now, today. There’s technology, transportation needs, there’s school supplies that we could be buying that we’ve had to put on hold right now because of this issue.”

Those two chunks of money underscore the complexity of Oklahoma’s school funding system.

In short, Barnes said Newkirk Public Schools is set to lose “a little more than $200,000” in county property tax millage owing to an ongoing dispute over the Rock Falls Wind Farm in Grant and Kay counties. Barnes said Newkirk schools are also set to lose $342,000 in state aid as part of Oklahoma’s annual mid-term adjustment scheduled for January. The OSDE adjusts district budgets at the half-way mark of each fiscal year to account for variations in “average daily membership” (ADM) and other changes in property tax values.

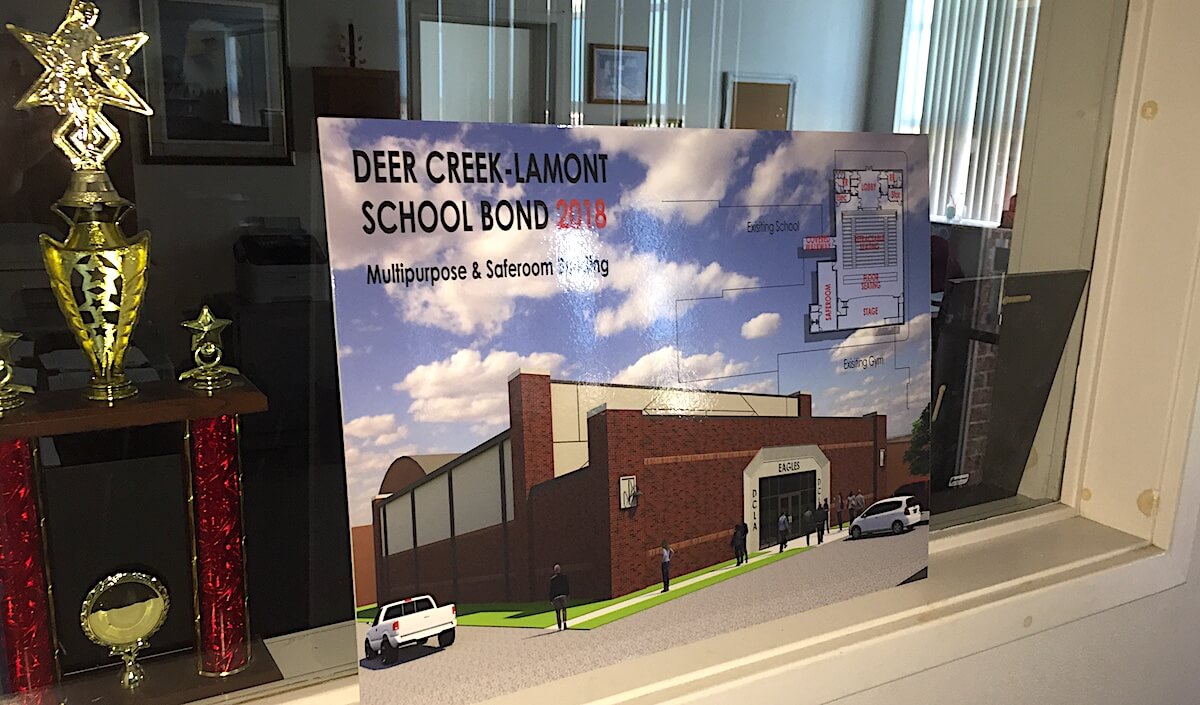

But Newkirk Public Schools and Deer Creek-Lamont Public Schools are also both set to lose hundreds of thousands of dollars in state aid because, as far as OSDE is concerned, county valuations say their districts should receive substantial property tax funding hikes because the 60-turbine Rock Falls project went online in December 2017.

The French connection

Spanning a remote swath of northern Oklahoma, the Rock Falls Wind Farm is owned by EDF Renewables — a subsidiary of the international energy conglomerate EDF, 83.7 percent of which is owned by the French government.

Construction on the Rock Falls project began in January 2017. Three months later, the Oklahoma Legislature ended an economic development program that granted renewable energy companies tax credits. Projects could still qualify if they were placed in operation by July 1, but Rock Falls was not completed until December 2017.

“EDF Renewables initiated development and made a considerable financial investment in construction of the Rock Falls wind project on the basis of the financial benefit this tax credit provided,” EDF Renewables Senior Director of Development Matthew McCluskey said Wednesday in a statement to NonDoc. “The tax credit was instrumental for the feasibility of the Rock Falls wind project, the contractual commitments EDF Renewables entered into and the significant investment EDF Renewables has made in Oklahoma.”

Lobbyists for renewable energy companies like EDF made that case to lawmakers. But with state revenue streams lagging, the tax credits had become a source of fiscal controversy owing to their 85-percent refundability beyond a company’s state income tax burden. Some conservative politicians described the tax credits as “blank checks” costing Oklahoma upwards of $50 million per year.

PREVIOUSLY

Wind farm fight may ‘drastically affect’ Oklahoma policy by William W. Savage III

The Legislature’s discontinuation of the refundable tax credit left EDF with two choices: scrap the Rock Falls project or find another avenue to make the numbers more feasible on their end.

“EDF Renewables looked for and identified with Blackwell Economic Development Authority a structure that could replace some, about a third, of the lost value from the repealed credit,” McCluskey said. “This, and other, tax abatement structures are often used in infrastructure projects in Oklahoma.”

After Rock Falls went live under BEDA’s temporary ownership, those parties applied for property tax exemption under laws used by other municipal economic development entities. Both counties rejected the application, so the BEDA and the company sued.

Wednesday, McCluskey said EDF Renewables is “evaluating the situation to understand and avoid any unanticipated consequences of the bond transaction on school districts in Kay and Grant counties and have also requested a meeting with State Superintendent Joy Hofmeister to initiate the conversation on how we can work together.”

McCluskey said EDF has decided it “will make the first installment of 2018 property taxes when due in December.” That money, however, could be returned to the company if it prevails in the lawsuits.

“EDF Renewables is committed to the local communities in which our projects are located, and committed to working with local stakeholders to understand and address their concerns,” McCluskey said. “The complex nature of the structure and the stakeholders involved mean that resolutions satisfactory to all parties will not be easy or immediate. It is our intent to work together with such stakeholders to develop better understandings and find a mutually beneficial resolution to continue to make wind energy generation beneficial to Kay and Grant counties, and all of Oklahoma.”

‘Every dollar matters’

Rep. John Pfeiffer (R-Orlando) represents Kay and Grant counties. Pfeiffer said he supports wind energy development, but he voted in March 2017 to end the zero-emission tax credit for new projects because “after an industry is established it needs less help.”

Now, Pfeiffer believes state and local stakeholders need to study the complications encountered by the Rock Falls and BEDA incentive arrangement, and he said he expects the Legislature to examine the mid-term adjustment issue when it convenes in 2019 if no solution can be found prior.

“We need to look at the procedures and parameters we have in place to find out what changes need to be made as we enter into this new era of local incentivization,” Pfeiffer said. “As we continue to find new ways to incentivize business in the state of Oklahoma, we have to be mindful of what all we need to protect at the local level.”

Pfeiffer, Barnes and Brent Bushey of the Oklahoma Public School Resource Center all said local property tax exemptions affect the entire state because, in the case of Rock Falls Wind Farm, more local dollars for Newkirk and Deer Creek-Lamont would free up other state dollars for the rest of Oklahoma’s school districts.

“Every dollar matters. If we’re losing a ‘chargeable,’ that’s putting those districts on state aid,” Bushey said. “That’s more mouths to feed, so that’s going to affect everybody who is relying on state aid.”

Pfeiffer said that is not the only issue.

“One of the biggest problems we’ve had throughout the state program and now into the local program is the ad valorem adjustments and how the state funding formula changes before they have the cash in hand, leaving local school districts in the lurch at either the start of the year or in the middle of the year,” Pfeiffer said. “It’s a problem that we still have not found an adequate solution for that is a huge issue for districts across the state.”

Barnes: $1 million > $42,108.94

Barnes said he is convening a Dec. 5 meeting at the Cooperative Council for Oklahoma School Administration’s Oklahoma City office in an attempt to gather all parties affected by the Rock Falls Wind Farm issue. He attended an Oct. 24 meeting organized by EDF representatives but came away “disappointed.”

The next day, Barnes summarized the Oct. 24 meeting and his frustrations in an email to Pfeiffer, Deer Creek-Lamont Superintendent Barbara Regier, OSDE Deputy Superintendent of Finance & Federal Programs Matt Holder, Blackwell Public Schools Superintendent Richard Riggs, an IRS employee and others.

In the email, Barnes said EDF offered Newkirk, Deer Creek-Lamont and Blackwell districts annual payments of $42,108.94 each in an effort to end the controversy.

“I do not believe that the patrons of Newkirk and Braman would have agreed to all the wind farms if they knew they would not be paying their taxes to help fund their local schools,” Barnes wrote. “I informed them that the $42,108.94 they were offering us would be in lieu of around $1 million that they would be liable for in taxes.”

In September, Blackwell Economic Development Authority director John Robertson told NonDoc that Blackwell leaders invested in the wind farm primarily to help Blackwell Public Schools, which would not otherwise receive property tax dollars from Rock Falls because the project sits in the two neighboring school districts.

“Blackwell is the lowest-funded school system in the county, and we are going to work on making some of that equity. They have gutters in the classroom, for god’s sake. Rather than fix the roof, let’s get it over in the bucket where we want it. That’s terrible,” Robertson said in September.

But Barnes’ district has its own roofing issues, which residents voted to fix by passing a bond that requires yearly “sinking fund” payments to cover.

“Our middle school had been added onto four or five times throughout the years, and it had 18 leaks in it before we put a new roof on it last year. That was a significant capital improvement to our district,” Barnes said.

Newkirk Public Schools — which absorbed Braman Public School District in 2012 — also has a new gymnasium and a new early childhood education center under construction.

“These other wind farms are helping pay for all that,” Barnes noted. “[Rock Falls] is the third wind farm that has been built in our district. The first two are under the ad valorem reimbursement, so the state is paying that (property tax bill) for the first five years.”

After those two wind farms were built, however, the Oklahoma Legislature also terminated its ad valorem reimbursement incentive for new wind projects such as Rock Falls.

“I think it was breaking the state,” Barnes said of the ad valorem reimbursement program that benefited his district on past wind projects.

Multiple calls to Riggs, the Blackwell superintendent, were not returned for this story.

State Department of Education uncertain if it can help

Holder, the OSDE deputy superintendent of finance, called the situation “uncommon” and noted that the agency’s “hands are essentially tied” because property valuation is a county issue.

“As far as we’re concerned on it, the information comes from the county assessor to the Tax Commission and then to us. So we have to use whatever numbers they send us,” Holder said in an Oct. 30 interview. “It appears the assessor has put the wind farm on the rolls, and in turn it is going to show up as a ‘chargeable’ in [Newkirk’s] mid-term adjustment.”

A former superintendent of Weatherford Public Schools, Holder said the OSDE is “pretty much driven by whatever the assessor puts on the rolls” when deciding mid-term adjustments related to property taxes.

But eight days later, OSDE sent a follow-up statement from general counsel Brad Clark.

“We are aware of the lawsuits and are gathering information to determine what action, if any, the agency might consider that is in the best interest of area students,” Clark said.

Barnes said he hopes his Dec. 5 meeting can help answer that question prior to the mid-term adjustment taking effect.

“How do we not punish our kids right now? It’s in excess of $550,000 in operational money that it is going to cost us for this whole fiasco,” Barnes said. “It works in everybody’s best interest if they just pay their taxes.”