Through a funding source the city has not been using, $231 million worth of big changes could be on the way to Edmond if members of the City Council — and subsequently voters — give the green light to significant new property taxes.

City leaders have lamented “missing opportunities” to expedite quality-of-life and transportation projects since last summer, when multiple council members and City Manager Scot Rigby first discussed potentially issuing general obligation bonds, a funding source Edmond Public Schools has regularly used, but the city has never adopted.

The City of Edmond has previously funded road and park projects only through sales tax revenue. GO bonds, however, would be able to leverage property taxes to support projects and would pledge the city’s full faith and credit toward repayment.

Edmond’s new 25-member General Obligation Bond Advisory Task Force held its first meeting June 25 and finalized its proposal July 15.

The group’s pitch includes budgeting for $231 million in improvements, primarily focusing on street projects and quality-of-life enhancements at parks and trails. The proposal is expected to come before the Edmond City Council at its Aug. 12 meeting, and it could end up on the November general election ballot.

While city leaders have high hopes for the proposal, funds to pay back the loans for such projects must to come from somewhere, which means officials will have to explain to Edmond residents how much more they can expect to pay and what they will get for their dollar.

How general obligation bonds work

Unlike Edmond’s capital improvement projects for roads and parks, which are funded through revenue bonds backed by sales tax, GO bonds are not restricted to a single revenue stream for repayment. Rather, the bonds are backed by the full faith and credit of the issuing government and its ability to generate revenue through any stream to pay back bondholders.

“When [communities] start, a lot of times they use revenue bonds, which is kind of like the alternative to a GO bond. A revenue bond is earmarked to a specific revenue stream. A lot of times it makes sense as communities are growing because they have really small tax bases,” said Greg Burge, chairman of the University of Oklahoma Department of Economics. “As they grow, sometimes GO bonds make a little bit more sense because any revenue that the city would bring in — just in general, from any source — could be used to pay it off.”

With Edmond’s current “Capital Improvement Projects” sales tax set to expire in 2027, GO bonds provide alternative funding options to get priority road projects started prior to a potential renewal of that sales tax.

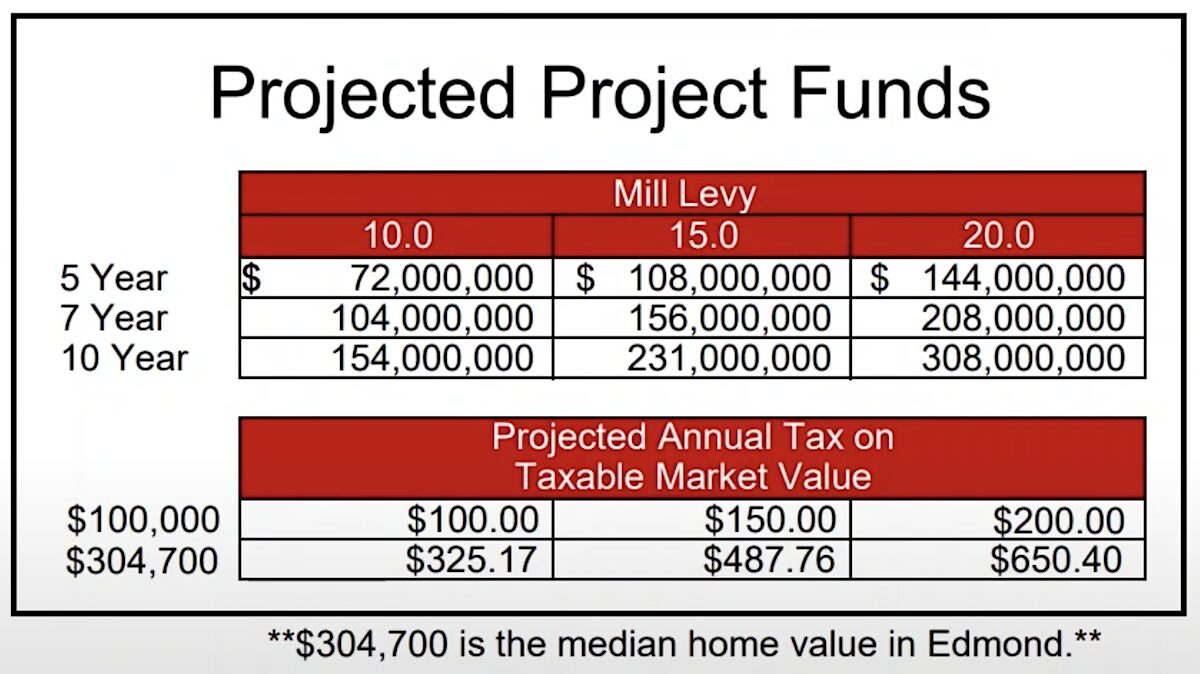

Now, the proposed 10-year GO bond package would issue a 15-mill property tax levy over a decade to fund the desired projects. Under Oklahoma law, cities and towns cannot levy property taxes to fund operational expenses. However, they can charge property taxes to repay GO bonds on specific capital projects or specific legal judgments.

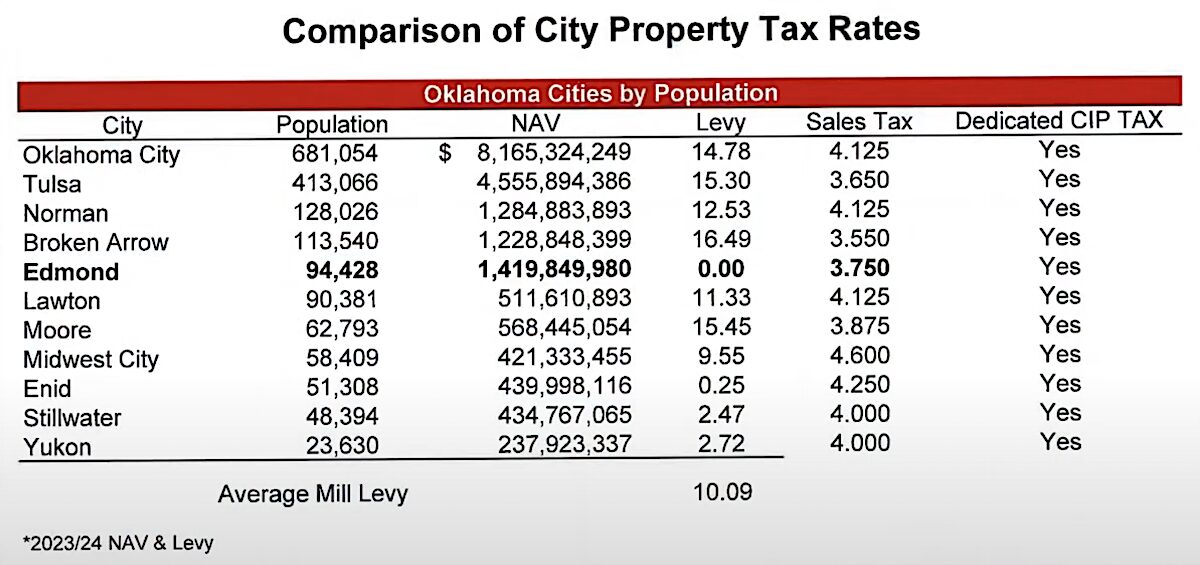

Edmond is notable as one of the largest cities in the state without current GO bonds. Burge said that while all debt cities take on carries some risk, GO bonds are fairly fiscally responsible.

“Communities like Edmond are a very good example of this, as being considered pretty low risk by financial investors,” Burge said. “Stable property tax revenue streams, stable sales tax revenue streams, those sorts of things would tend to help that city get a high credit rating (…). In economically thriving, sort of stable growth areas like Oklahoma, a big city like Edmond would probably be viewed pretty favorably by the credit markets.”

Rather than splitting up payment for necessary projects year over year as Edmond has done through its Captial Improvement Projects funding, Burge said it can make more sense for a city to take on debt and fund multiple high-priority projects at once with GO bonds.

“They may think, rather than split this up into 10 little pieces and try to pay for one a year over the next decade, let’s just do it all,” Burge said. “Let’s just do it the right way. Let’s just get a better price point that’ll also, in some scenarios, kind of synergize the projects themselves (…). It makes the most sense if you can convince me that an average citizen’s medium-to-long-term quality of life and service will be better off if you follow this path than the alternative, which is the piecemeal path.”

Burge said cities will sometimes use development impact fees concurrently with GO bonds to help retire the bond debt. Edmond is considering implementing its own development impact fees, which are one-time payments typically collected from developers at the time building permits are issued.

Tackling traffic, prioritizing parks

Former Ward 2 Councilman and local builder Josh Moore, who was part of the 25-member volunteer task force on GO bonds, said he feels the group has provided voters a list of projects that are high priority and worth supporting, even for those who lament higher taxes.

“The list is something we need right now, whether it’s a busy intersection near your home or a busy intersection near your school or shopping district or Mitch Park, you name it,” Moore said. “I think when people see all of those items on the list, each item, it’s hard to debate that each one isn’t needed and needed now, or at least needed within the next seven to eight years.”

If the Edmond City Council sends the proposal to voters, the projects included in a GO bond package would be listed individually on the ballot.

“What I love about a GO bond is that you do have to list the projects specifically on the ballot, and there’s great transparency to that,” Moore said. “It’s great to be able to educate the community on what you’re voting for.”

The bond task force’s final proposal includes $123.4 million budgeted for specific street projects, alongside $61 million for parks and $9 million for fire station improvements. The remaining $37.6 million of the total proposal exists as “unlisted funds,” which would be assigned to broad categories like roads and parks but could be applied to different individual projects within those categories if necessary.

The specifically listed projects in the Edmond GO bond proposal include:

- Widening Covell Road from Interstate 35 to Air Depot Boulevard;

- Covell Road and Western Avenue intersection improvements;

- Bike lane and pedestrian infrastructure improvements to Thatcher Street;

- Second Street and South Boulevard intersection improvements;

- Capacity improvements to 15th Street between South Boulevard and Broadway;

- Capacity improvements to Edmond Road and Kelley Avenue;

- Capacity improvements to 15th Street and Bryant Avenue;

- Capacity improvements to Edmond Road and Santa Fe Avenue;

- Widening Danforth Road from Holly Hill Road to Thomas Drive;

- Covell Road and Santa Fe Avenue intersection improvements;

- Widening Coltrane Road north of Second Street;

- Completion of the Creek Bend trails;

- Improving ballfields, infrastructure and amenities at Mitch Park;

- Establishing a new park at Post Road and Second Street;

- Establishing a veterans memorial;

- Relocation/reconstruction of Fire Station No. 3;

- Renovation of Service-Blake Soccer Complex;

- Neighborhood parks playground replacement;

- Phase 5 of Edmond’s Intelligent Transportation Systems implementation and

- City street overlay/reconstruction.

Attorney Todd McKinnis, the chairman of the bond advisory task force, said he believes Edmond is at a stage in its development where GO bonds have become necessary to move the multitude of projects forward.

“It’s one of those things that there’s only two good times to plant a tree, 60 years ago or today,” McKinnis said. “The city, for whatever reason, didn’t have a GO bond revenue model in place. They’ve done, I think, a pretty good job of managing their infrastructure with what revenue they have. However, I think the tipping point has kind of arrived, where if we’re going to set us up for success for the next 60 years, it’s time to plant the trees.”

What could Edmond GO bonds cost residents?

If the Edmond City Council and voters approve the projects, the accompanying property tax increase will vary depending on the value of residents’ homes. In property tax terms, one mill is equal to $1 in taxes per $1,000 of taxable value on a home.

The task force’s July 15 presentation used data listing the median home price in Edmond as $304,700. An additional 15-mill levy on a home with that value would come out to $487.76 more in taxes a year or about $41 a month, according to the task force presentation.

“Regardless of if Edmond was getting the money before or not before compared to Norman or Tulsa, you are asking people to invest more of their taxpayer dollars,” McKinnis said. “Now, the good news is, I think you’re asking them to invest their dollars with significant accountability, that these projects will be done with those dollars.”

McKinnis said the best argument for votes in favor of raising property taxes to fund Edmond GO bonds is that voters will have specific projects to keep tabs on where their money is being spent.

“In order for Edmond to address all the things that people think are important, and traffic appears to be the top of the list, we have to have an initial method of funding that,” McKinnis said. “Over half of the total bond issue is road committed. They’re not just committed generally, where the government is just a hog and takes in more dollars and you never know where it goes. They’re specifically identified to elements around town, that most, if not all, citizens would agree need attention.”