For supporters of Edmond’s upcoming GO bond proposal, walking into the senior center Thursday evening at Mitch Park may have felt like playing an away game in front of a raucous road crowd.

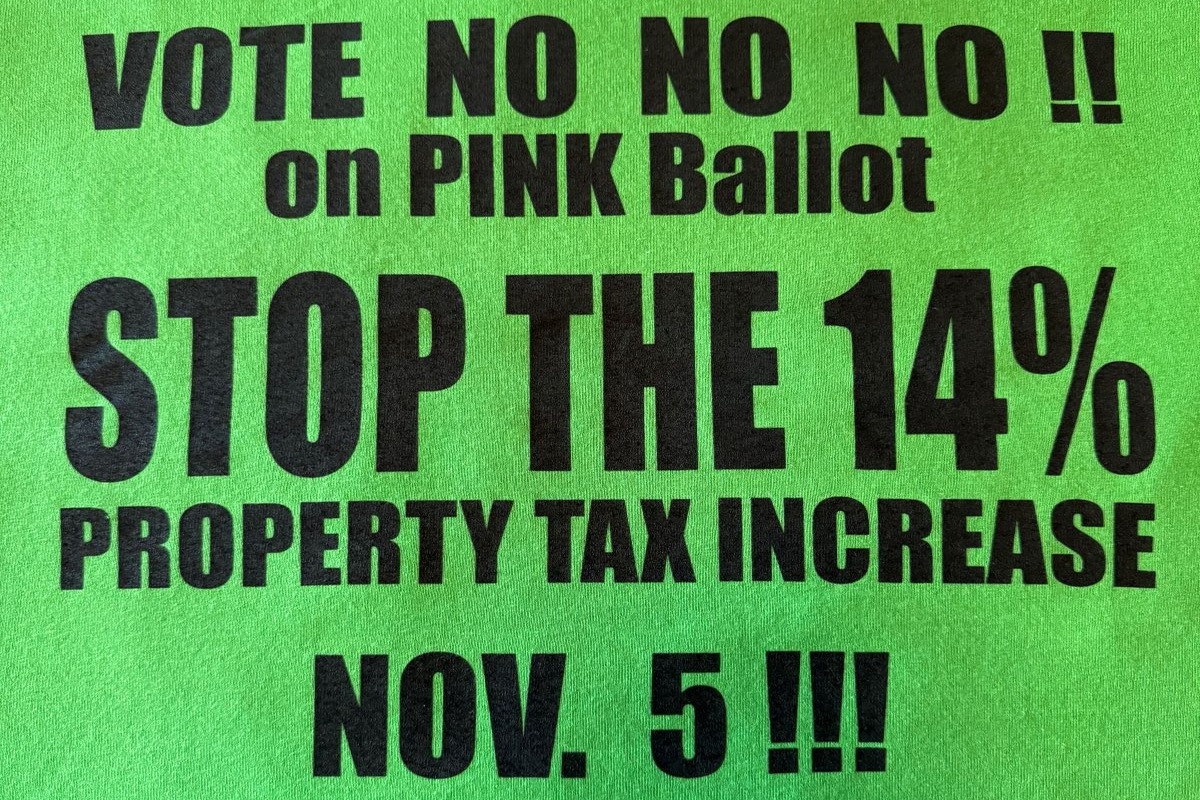

The meeting, hosted by the Edmond Neighborhood Alliance and facilitated by Ward 2 Councilman Barry Moore, drew about 40 onlookers. Before the event had even begun in earnest, one group of attendees distributed “vote no” printouts, and another produced green T-shirts opposing the general obligation bond package. (The hue of the shirts hinted at the cash opponents say they want to save by avoiding increased property taxes).

Most feedback from attendees over the course of the two-hour event skewed in opposition of the proposal, which will be on Edmond ballots Tuesday, Nov. 5. For many in the audience, the roughly 14.3 percent property tax increase marked their major concern, as did trust in the city to efficiently carry out the projects, which include street improvements and quality-of-life enhancements at parks and trails.

ENA officers Mark Nash and Ronnie Williams presented first, highlighting the cons of the GO bond for Edmond residents. Later in the meeting, former Edmond Councilman Josh Moore and ENA board member Todd Olberding, who both served on the task force that crafted the proposal, presented as supporters.

“My guess is that’s probably the toughest room that a presentation may be in, but it’s a good thing to hear different opinions and different circumstances,” Moore said after the meeting.

Opponents: Bond risks tighter budgets, less EPS support

As the GO bond proposal was crafted earlier this year, members of the 25-person task force displayed data listing the median home value in Edmond around $304,700. The proposed 15-mill levy would increase the annual property tax on a home of that value by about $487 for a decade. The increase would vary for those with higher or lower home values, which you can test on the Oklahoma County assessor’s property tax calculator.

The 22-project proposal is split into three sections for parks, roads and public safety. If all three votes pass, the levy would last 10 years. If only one or two pass, the tax period would be shorter. The levy would be 15 mills regardless of how long it lasts.

Williams argued that a property tax increase, which would also impact properties like rental homes and apartment complexes, could exacerbate affordable housing and rental issues in Edmond.

“We could be creating our own inflationary ecosystem just because of what we’re doing on the tax side,” Williams said.

Retired U.S. Army Col. Leonard Scott raised concerns about how increased taxes would tighten the budgets of senior citizens living on fixed incomes.

Todd McKinnis, chairman of the task force that created the package, said the concern was legitimate. He argued the actual rent impact would be low, however.

For example, McKinnis said he owns rent houses in Edmond that lease between $1,100 and $1,300 a month. They are valued around $150,000, he said, which would mean an annual property tax increase of about $240 if the 15-mill increase passed to pay back the general obligation bonds.

“I have the option as a landlord to eat that $20 a month or pass that on to my tenant at a rate of $20 more in rent,” McKinnis said. “If I did that, and I didn’t have any other consideration, then, yeah, someone’s going to pay $20 more a month in rent.”

McKinnis argued the increase could be lower when factoring in portions of the property tax as a business expense for landlords. Funding one-time improvement projects with property tax revenue, McKinnis said, would be less detrimental to residents’ finances than the sales tax increase that would be necessary to achieve the same funding.

Williams and Nash also highlighted potential competition between the city’s Nov. 5 bond proposal and future Edmond Public Schools bond questions. While the city has rarely used bonds to fund its projects, EPS relies heavily on bond proposals to support transportation, new facilities and the maintenance of old ones.

Marcus Jones, the Edmond Public Schools Board of Education president, served on the task force that created the GO bond proposal.

“I think any time you would introduce a new tax on citizens, a tax that’s already there, which would be the (school) bond in this case, (it) would potentially be a concern,” Jones said. “Let’s say the GO bond passes. Once the GO bond passes, the next time the school runs a bond, you can easily say you can reduce your taxes by not passing the school bond.”

Still, Jones said he recognizes the potential positives of the GO bond package for Edmond residents.

“There are definitely benefits. I voted for it to go to the people. Obviously, it’s up to the people to decide if they want that tax or not,” Jones said. “It hits all parts of the town, and there’s something in it for everyone in Edmond.”

Supporters: ‘A chance to get ahead’

During his presentation, Williams expressed skepticism about the city’s ability to undertake the 22 proposed projects simultaneously. He cited ongoing efforts to construct a new joint YMCA/library and the downtown municipal government complex, which came in over its original estimated cost and prompted later cost-reduction measures.

“We, as a city, do not have a track record of completing projects very efficiently, and I’m not trying to point fingers,” Williams said. “Part of this is just because we’ve grown so fast.”

Former Edmond Mayor Dan O’Neil, though, encouraged voters to “at least look at” the street-project aspect of the proposal. He said it addresses problems that are common complaints from Edmond residents, making the ballot question at least worthy of consideration despite the associated tax.

“This is a chance to get ahead of some of this stuff,” O’Neil said. “You can’t complain about something for a hundred years, get an opportunity to fix it, and then tell them, ‘Hell no.'”

Former mayoral candidate and current chairman of the Oklahoma Statewide Charter School Board Brian Shellem argued the current bond package would only address Edmond’s problems by creating future financial issues.

“I’m not going to pick up smoking because it curbs my appetite. Eliminating one problem by creating another doesn’t help,” Shellem said. “It’s as if our council hasn’t taken economics — you can’t have everything at once.”

Rather than adding GO bond obligations onto the ledgers of property owners, Shellem emphasized the need for city leaders to be more careful when funding priority projects with existing CIP dollars. During Moore’s presentation, Shellem asked if other revenue streams like development impact fees could be considered.

“A tax, everyone pays for. A fee is going to be paid by the person that benefits from it,” Shellem said.

Moore, a developer, acknowledged the city has discussed an impact fee program, but he said it would not be enough to fund the proposed projects alone.

Moore said there has been little negative feedback about most of the 22 projects slated for funding, a positive for supporters of the proposal.

“I think most of us agree that the projects are needed,” Moore said. “People come to Edmond for good schools, low crime and great quality of life. Every project in this list links together for all of those things, and that’s why they’re being asked for.”

The GO bond proposal will be on ballots during the Nov. 5 general election. Voters will be able to vote on each of the three project categories — parks, roads and public safety.