The spread of the COVID-19 virus has led to a surge in furloughs and layoffs all across the country as restaurants, theaters and other venues have been ordered to close in many states. As consumers hunker down in their homes following the advice of public-health officials, many people are wondering how to file for unemployment benefits in Oklahoma.

Today, the Tulsa World reported that the state’s unemployment-insurance claims have skyrocketed, with 5,986 claims coming in between March 16 and March 18. Only 1,836 claims were submitted the entire previous week.

On Thursday, Gov. Kevin Stitt amended his emergency declaration executive order to waive the usual week-long waiting period required before applicants can receive benefits. Stitt said the waiver will last as long as the declared state of emergency related to COVID-19 is in effect.

How to file for unemployment benefits in Oklahoma

In order to apply for benefits, visit the “claimants” section of the Oklahoma Employment Security Commission’s website. Full details about the application process, eligibility, and other information are available here.

The commission’s physical offices are currently closed to the public to help prevent the spread of the corona virus. If you are unable to file online, you can call (405) 525-1500 or (800) 555-1554. For the hearing-impaired, call (866) 284-6695. The Commission’s website cautions that there are long wait times owing to the number of inquiries coming in.

You should have the following information handy when you apply:

- your Social Security number

- your alien registration number and expiration date, if you aren’t a citizen

- your Oklahoma driver’s license or ID card number, if you have one

- the name, physical address and phone number of your last employer

- your supervisor’s name

- the name of the company that appears on your pay stub or W2 (which could be a payroll or staffing company)

- your employment history for the past 18 months, including the names of any employers as they appear on pay stubs or W2 forms

- your dates of employment for all jobs you’ve held in the past 18 months

- your wages and how you were paid (hourly, weekly, monthly) for each job you’ve held for the past 18 months.

Click here for a complete list of information you’ll need to provide, including special forms required from former members of the military and government employees.

Who is eligible and what you receive

Oklahomans are eligible to file for unemployment if they have lost their jobs or had their hours reduced through no fault of their own, or if they quit because of unsafe or harmful working conditions.

RELATED

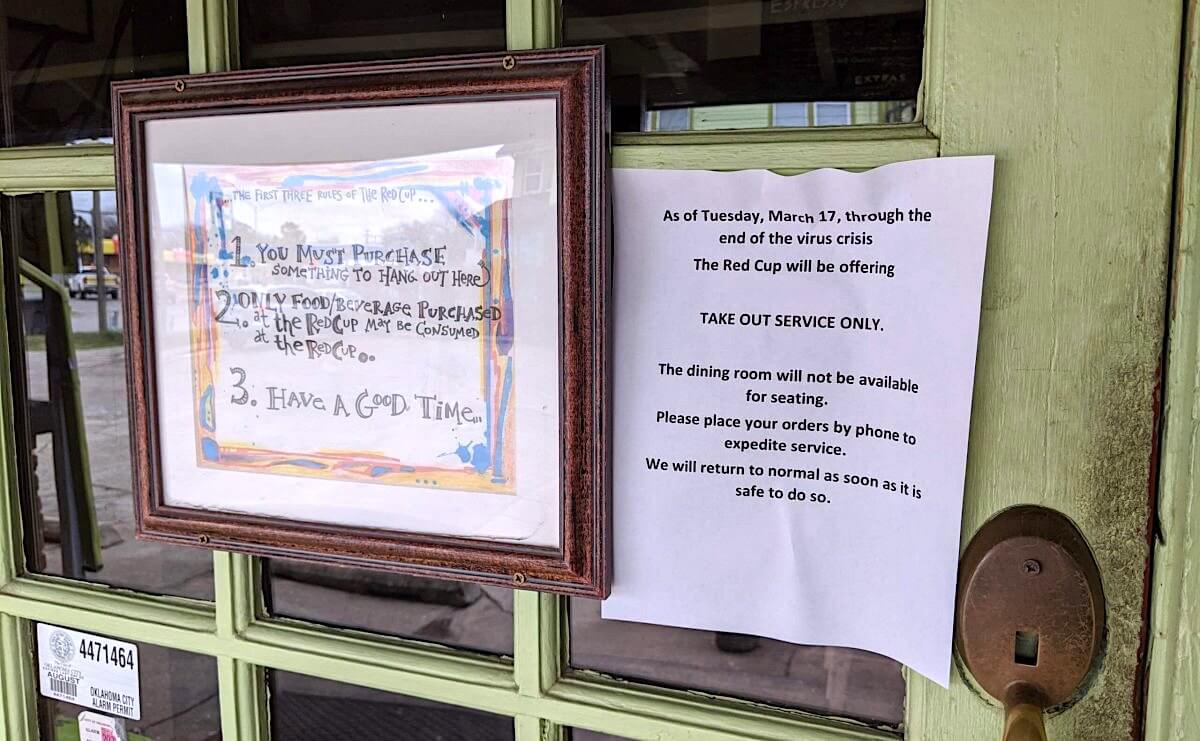

COVID-19: A buzz kill for state’s bars and restaurants by Matt Patterson

While receiving unemployment benefits, claimants who were laid off are required to be actively seeking new employment and must register at okjobmatch.com within seven days of filing their claim. People filing because of a temporary furlough or a reduction in hours are not required to meet these job-search requirements, according to Charlie Hannema, a spokesperson for the governor’s office.

Applicants for Oklahoma unemployment benefits must have made at least $1,500 during a year-long base period that includes the first four calendar quarters of the five quarters preceding the claim.

If approved, weekly payments will be equal to 1/23 of the amount earned during the highest-paid quarter of the base period. Total payments per week fall between a minimum of $16 and a maximum of $520. According to this informational booklet on the OESC’s website, “most individuals are eligible to receive benefits for approximately 20 weeks.”

(Editor’s note: A member of the Sustainable Journalism Foundation’s board of directors also serves on the Oklahoma Employment Securities Commission. This post was updated at 5:15 p.m., Friday, March 20, to include additional information.)