(Editor’s Note: NonDoc believes in creating a responsible forum for the rational and respectful discussion of topics and ideas. As such, we run Letters to the Editors of 300 words and reserve the right to edit lightly for style and grammar. To submit a letter for publication, please write to letters@nondoc.com. We simply require your name, the town in which you live and your contact information.)

To the editors:

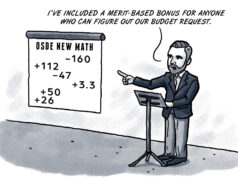

In an article last Friday on NewsOK.com, reporter Paul Monies and source David Blatt described sizable missing state revenues. There is some simple math missing from the gross production tax issue and Chad Warmington’s statements on this issue.

The current gross-production tax rate for new wells is now 2 percent for the first 36 months and 7 percent thereafter. The clever folks at the Oklahoma Oil and Gas Association think all will be fine for state coffers after three years, but let’s take a closer look.

There was no mention of horizontal well-production decline rates. Rates of decline vary by geological region, but they apply to every well and are typically about 50 percent in the first year of production and somewhat less in years following. To look at the effect of decline rates on state income, let’s assume a second year at a 40 percent decline rate and a 30 percent decline rate in the third year.

Considering the above well-decline rates, the effective well-revenue tax rate on a new well after the first 36 months would be the 7 percent tax rate multiplied by the decline factors in the first three years:

- Year four — 7 percent x 0.5 = 3.5 percent

- Year five — 3.5 percent x 0.4 = 1.4 percent

- Year six — 1.4 percent x 0.3 = 0.42 percent

It appears the highly productive early years for a typical well are taxed at the giveaway rate of 2 percent and the final tax rate is essentially nothing due to natural well-production declines.

The energy community has put one over on our Legislature to the long-term detriment of our entire state. Our elected and appointed officials have utterly failed to both understand and properly tax the energy industry.

Proper taxation is also a check on business by causing management to reflect on their larger community responsibilities.

Bill Arnold,

Nichols Hills, Okla.