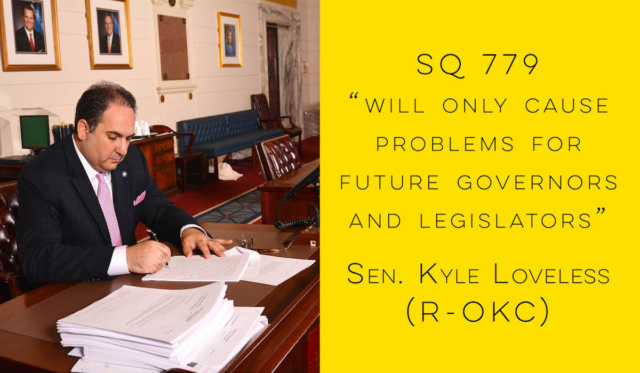

(Editor’s Note: NonDoc asked two sitting Republican state senators to author Point/Counterpoint commentaries on State Question 779, which would add $0.01 to the state’s sales tax and adjust the Oklahoma Constitution to ensure higher funding for public education. Here, Sen. Kyle Loveless of Oklahoma City writes in opposition to the ballot question while Sen. Brian Crain of Tulsa offers support in a separate piece.)

When Oklahomans go to the polls Nov. 8, there will be a number of important state questions on the ballot, including liquor modernization, criminal justice reform and a measure to allow the Ten Commandments monument to return to the State Capitol. None of these, however, is likely to receive as much attention as SQ 779, the penny sales-tax increase for “teacher pay.”

I don’t believe saddling our citizens and future generations with a tax increase is the right solution to any problem. Another solution must be found. We have been told this proposal is just “a penny for the kids,” but that’s not an entirely accurate statement. While the tax is increasing by one cent, it is in all actuality a 22 percent tax increase.

By raising the sales tax, we would make it virtually impossible for local governments — especially cities and towns — to increase local taxes for local projects. Much like Oklahoma City has done with the MAPS program, city and county governments can increase sales taxes for a variety of projects, from improving public safety to quality of life. However, if the state sales tax is already high, voters will likely turn their noses from these proposals.

If SQ 779 were truly about improving teacher pay, I would think more of the funding would be used for that purpose. Instead, only 86.33 percent of revenue will be set aside for teacher pay increases. However, university presidents have ensured higher education, which already receives a large chunk of the state budget, will receive 19.25 percent of all the revenue generated from this tax increase. The vague requirement to use the funds to improve college affordability leaves me with little comfort. The remaining funds will go to various education programs and the state’s Department of Career and Technology Education.

By increasing the sales tax by 22 percent, we will be disproportionately affecting lower-income Oklahomans where it hurts — the grocery store. Higher-earning Oklahomans will be able to afford the increase with little pain, but single parents and the working poor, who already struggle financially, will face an additional obstacle on their way to next payday.

Inscribing a tax increase into our state’s already outdated, cumbersome constitution is not the most effective solution. This will only cause problems for future governors and legislators by denying them the flexibility needed to balance a budget and provide government services.

Throughout history, we have voted on measure after measure to address school funding. Yet, now we are being told the only solution is a massive increase of our state sales tax. The Oklahoma Lottery didn’t address the problem as promised, and I doubt this will either.

Many who support increased funding to education claim our schools are failing students even though our ACT scores have remained in line with the regional average. I know our teachers face challenges every day, and many struggle to make ends meet in and out of the classroom, but SQ 779 is not the solution we need.

Instead of a tax increase, we need to improve management of the money that is already made available to schools. Of state spending for FY 17, 34.8 percent was appropriated to K-12 — that’s nearly $2.5 billion and doesn’t even include additional so-called off-the-top money, which is diverted straight to common education and is out of the hands of legislators.

I urge you to join me in voting no on SQ 779 and working toward real education reform.