(Editor’s note: Michael Clingman is the head of the Oklahoma Coalition for Workers Rights, which advertises with NonDoc.)

As the state wrestles with one of the worst budget shortfalls in our state’s history, many in the oil and gas industry, including the Oklahoma Oil and Gas Association, have responded to calls to increase the gross production tax rate.

In response, industry proponents claim they currently pay more than their “fair share” of taxes relative to the industry’s size and compared to what other types of businesses pay. Such defenses frequently cite a September 2016 RegionTrack study commissioned by the Oklahoma State Chamber Research Foundation, Economic Impact of the Oil and Gas Industry in Oklahoma.

The following is an excerpt from that report:

In fiscal year 2015, direct state and local tax payments by oil and gas firms and employees totaled an estimated $2.55 billion. Tax payments to the state totaled $2 billion, or 22% of the $9.29 billion in total state tax revenue collected in FY2015. By any measure of industry size, the mining sector is paying proportionately more taxes than any other major industry sector in the state. In FY2015, the industry paid a 22% share of total state taxes yet accounted for only 7.4% of total state employment, 13% of state household earnings, and 17% of state gross domestic product.”

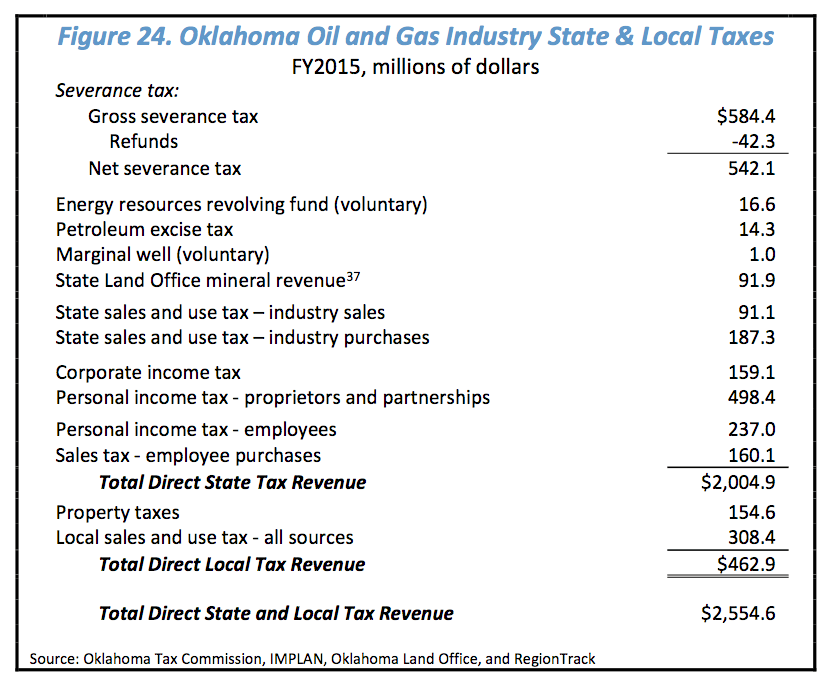

The report includes a table that lists the Oklahoma state and local taxes the oil and gas industry reportedly paid (the $2.55 billion figure referenced above). Below is a screenshot of that table:

While what follows is not a comprehensive analysis of all of the figures and assumptions included in the reported state and local tax burden, there are several questionable claims in the report.

Why use estimates when actual data exist?

The report specifically claims that the,

… industry also pays a disproportionately high share of statewide Corporate taxes, paying an estimated 22 percent in FY 2015. The share of total corporate taxes is likely much higher (approaching 50 percent) in years of peak oil and gas prices such as 2007 and 2008.

The authors go on to estimate that the oil and gas industry paid $159.1 million in corporate income tax in FY 2015.

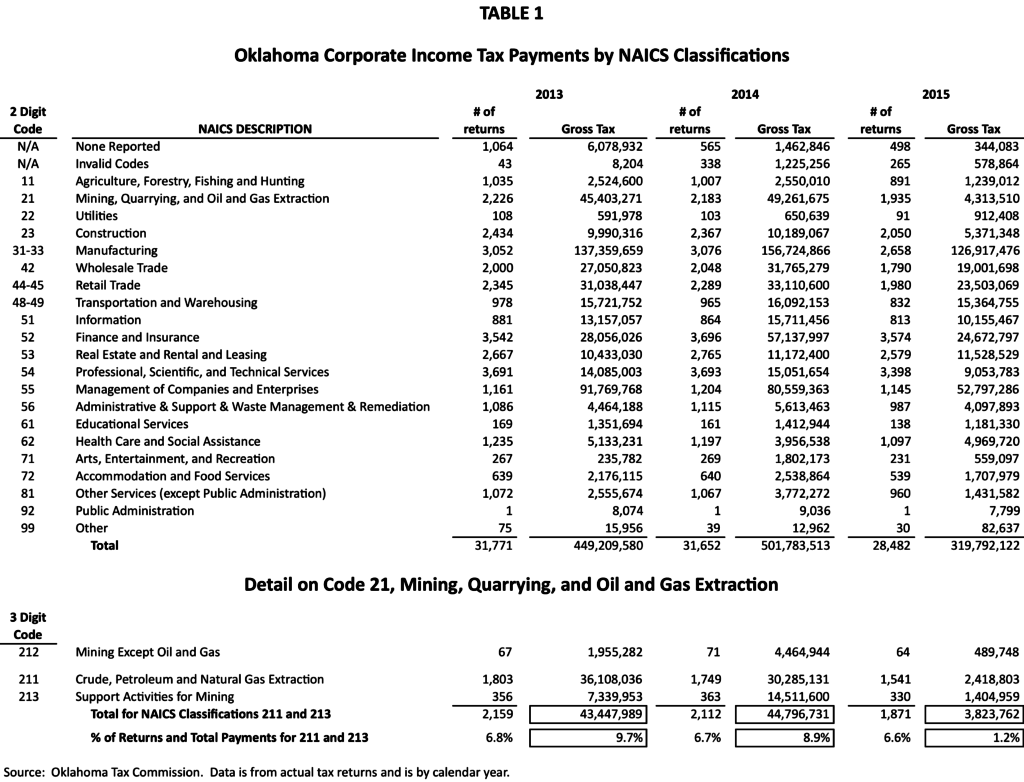

A review of actual corporate income tax payments in Oklahoma from companies classified by NAICS code as Oil and Gas Extraction and Support Activities for Mining, however, shows far lower numbers.

The oil and gas sector paid $43.5 million worth of corporate income tax in 2013 (9.7 percent of total payments) and $44.8 million (8.9 percent of total payments) in 2014. Data for 2015 show this sector paying less than $4 million (1.2 percent of total payments) in corporate income tax compared to the more than $315 million other Oklahoma industries paid.

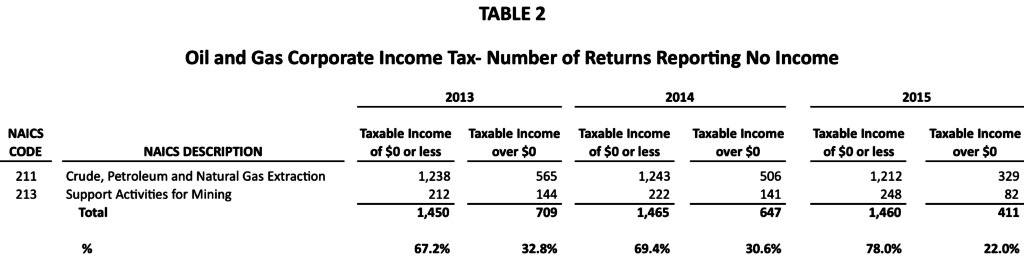

For 2015, 78 percent of the oil and gas companies filing corporate income tax returns paid no tax (see Table 2 below).

In explaining how their estimate of corporate taxes paid was determined, the report states:

… the 22% estimate of income taxes paid is derived from a quarterly regression model linking Oklahoma corporate tax receipts to the market value of oil and gas production and the profitability and tax payments of oil and gas firms nationally.

It appears that the estimate looked at overall Oklahoma corporate tax collections, the value of production in Oklahoma and what other oil and gas companies pay in other states. It could be argued that this is an estimate of a fair amount for the industry to pay (or, more bluntly, what they should pay).

Yet, as the NAICS data cited above show, they pay significantly less.

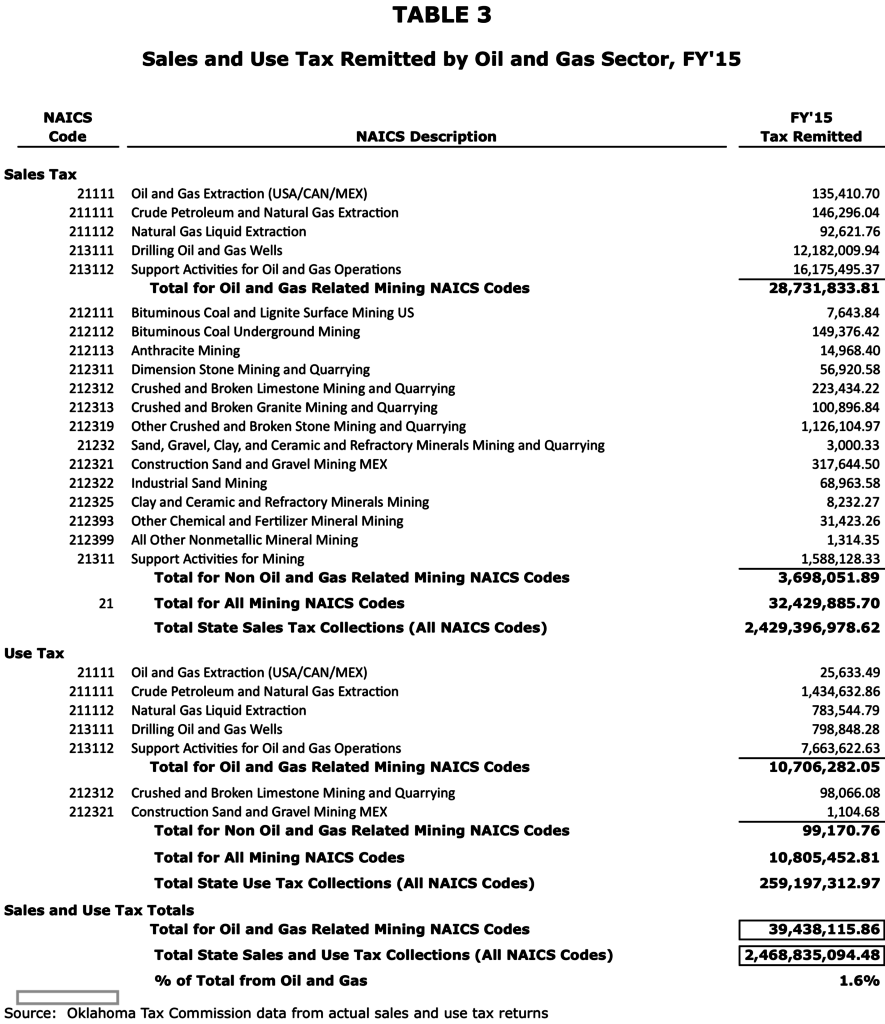

State sales and use taxes constitute another item that was estimated in the report but for which actual data exist. The report shows $91.1 million from this source. The Oklahoma Tax Commission makes data from actual sales tax returns available on its website. That data show the actual amount the oil and gas sector collects is less than $40 million (see Table 3 below).

Severance tax is a common burden

Concerning the payment of severance taxes (gross production taxes) the report includes the following:

The high overall tax burden carried by the industry and its employees is well-known. Much of the added burden is in the form of severance taxes. There is no other tax stream paid by any other state industry that is comparable to oil and gas production taxes.

There are several reasons why the severance tax is appropriate and should not be considered a unique burden on this industry:

- It is false to state that this tax is only applied to the oil and gas industry. The Oklahoma severance tax also applies to other mining and extractive industries operating in the state.

- There is a specific policy reason why the severance tax is unique to the mining industry: It is a tax imposed upon the extraction (or “severance”) of a non-renewable natural resource. It is compensation to the taxing jurisdictions in which the natural resources are found for the permanent loss of those resources.

- In Oklahoma, most of the equipment used for oil and gas production is exempt from property taxes. This is not the case in almost all other oil and gas-producing states, nor is it the case for equipment used in other Oklahoma business sectors (although manufacturers in Oklahoma may be eligible for an exemption from property taxes for five years). The Oklahoma severance tax is a tax levied in lieu of property taxes.

- The severance tax is also imposed specifically on the mining industry to pay for the unique costs the industry places on state and local governments. This includes road-maintenance costs associated with the operation of heavy equipment and unique regulatory and environmental costs associated with mining activities. In Oklahoma, there are also additional governmental (and private) costs associated with the dramatic increase in earthquakes linked to drilling related activities. A report from the National Conference of State Legislatures (NCSL) states that:

Severance taxes help insure that costs associated with resource extraction—such as road construction and maintenance, and environmental protection—are paid by the producers, helping to alleviate potential impacts on state and local taxpayers.

- When considering the extent to which the severance tax may contribute to this “high overall tax burden” supposedly levied on this industry, one must examine how the Oklahoma severance tax compares to other states. The Chamber report calculates the effective Oklahoma severance tax rate as 3 percent for 2015. This is lower than the rates calculated for Louisiana (6.3 percent) and Texas (3.7 percent) but higher than the rates calculated for Kansas (2.8 percent), Colorado (2.2 percent) and Utah (1.6 percent). The Chamber report avoids taking property taxes levied in these states into consideration.

A 2016 report commissioned by the Idaho Department of Lands calculates effective severance tax rates for FY 2016. Oklahoma’s rate of 3.2 percent is lower than that report’s effective rates for Wyoming (12.3 percent), Montana (9.5 percent), North Dakota (9.4 percent), Louisiana (8.8 percent) and Texas (4.6 percent) but higher than rates for Arkansas (2.5 percent), Utah (2.5 percent) and Idaho (2.5 percent).

But the Idaho study goes on to include the effective rates in each state when including property taxes. When property taxes are included, Oklahoma’s rate of 3.2 percent is lower than all other states. (The average rate for the nine states in the study is more than 9.4 percent.)

Unrelated payments included as ‘tax burdens’

The Chamber report includes payments made to the Energy Resources Revolving Fund ($16.6 million) and for Marginal Wells ($1 million) as taxes paid by the industry to state and local governments. While the report correctly points out that these payments are voluntary, they should not be included as part of the tax burden. These are optional payments that many oil and gas producers agree to pay.

The Energy Resources Revolving Fund supports the programs of the Oklahoma Energy Resources Board. The first-stated statutory purpose for OERB is “to demonstrate to the general public the importance of the Oklahoma oil and natural gas exploration and production industry …”. Such promotional activities paid through a voluntary assessment should not be considered as a tax on the industry.

The study also includes $91.9 million of State Land Office mineral revenue as a tax paid by the industry. Those funds are actually earnings on active oil and gas leases on lands the state manages. Such earnings are not tax payments made by the industry.

Also, the numbers in the Chamber report, for some undetermined reason, do not add up to $2.55 billion. When you add the $542.1 million in Net Severance Tax to the individual Direct State Tax Revenue items listed, the total is $6 million less than shown. When that figure is added to the Direct Local Tax Revenue figure of $462.9 million the Total Direct State and Local Tax Revenue should be $2.46 billion. The figure reported overstates the tax burden by $92.7 million.

A dramatic overstatement

Many of the figures in the report can be easily disputed with actual data or can be shown to be not true tax payments. Other items, such as sales taxes paid by employees on their personal purchases and the income tax these employees pay on their individual wages, are not generally counted as part of the measured tax burden of an industry.

If retail merchants, for example, were to take credit for all income and sales taxes paid by their employees, those payments would likely far exceed the oil and gas industry. Their inclusion would only muddy the waters in determining the actual tax burden for Oklahoma retail merchants as an industry type.

Other items the oil and gas industry cites are estimates based on economic modeling or national data that are difficult to replicate. This does not mean that these figures should be necessarily accepted or rejected.

The clear conclusion is that the reported tax burden is dramatically overstated and that it should not be accepted that the oil and gas industry in Oklahoma is overtaxed. Like all business sectors, they should contribute their fair share of funding for schools, roads, health care, public safety and other government services.

Of course, the oil and gas industry is important to the overall financial health of the state of Oklahoma, but their actual tax burden should not be under (or over) stated.