Oklahoma teachers will see their first state-paid raises in more than a decade — and the largest raise in state history — if Gov. Mary Fallin signs HB 1010XX, which passed the Senate this evening.

But proposed amendments to other bills and an apparent agreement between the Senate and the House to repeal HB 1010XX’s new $5 hotel-motel tax via a trailer bill means lawmakers have more work to do to finalize the funding plan.

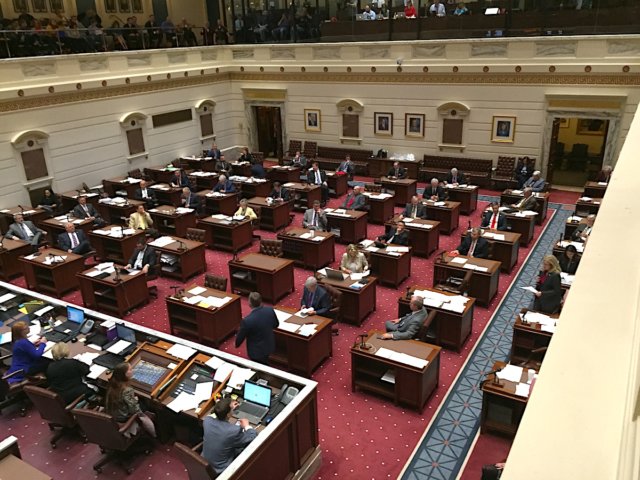

Senators asked no questions and offered no debate on the bill. The vote stood open about 18 minutes. Sen. David Holt (R-OKC) arrived to cast the 35th vote in favor. The body erupted into applause when Sen. Anastasia Pittman (D-OKC) walked back onto the floor and cast the final vote in favor, making the total 36-10.

Holt walked onto the floor with his arm around Pittman as she cast her vote in favor.

Snapshot of HB 1010XX

The revenue package within HB 1010XX includes:

- Raising the gross production tax incentive rate from 2 percent to 5 percent

- Adding a $5-per-room tax on hotel stays

- A $0.03 increase to gas taxes

- A $0.06 increase to diesel taxes

- Adding a $1 cigarette tax and other tobacco taxes (sans “moist” smokeless tobacco)

The hotel-motel tax is expected to be removed via an amended version of HB 1012XX. That would be a trailer bill originating in the House later this week, according to multiple lawmakers.

Taken with other measures passed by the House on Monday, the roughly $450 million revenue bill would fund:

- An average hike in the state minimum teacher pay scale of more than $6,000

- Public employee raises

- Support staff raises

- Additional education funding.

Fallin has five days to act on a bill after she receives it.

The Senate also passed HB 1011XX, which caps itemized deductions on income tax returns at $17,000. That bill will also head to Fallin, but HB 1023XX — which sets the new minimum teacher pay scale — will need to head back to the House for approval or rejection of the amendment the Senate added to it Wednesday night.

That amendment would codify that teachers who were already earning above the previous salary schedule would receive a pay increase as well.

“We are so grateful and have a tremendous sense of accomplishment that the voices of teachers have been heard,” State Superintendent of Public Instruction Joy Hofmeister said after the vote. “This is an important step forward. Of course, our work is not finished. Our students have great needs for which we will continue to advocate.”

Senate President Pro Tempore Mike Schulz (R-Altus) said after the vote that the bill funds “more than a 15 percent” teacher pay raise.

Schulz and Senate Majority Floor Leader Greg Treat (R-OKC) said the difference from the hotel-motel tax’s pending repeal would be made up by an additional tax agreement levied on third-party sales from the online retailer Amazon.

Gov. Mary Fallin praised the “historic” nature of the revenue bill.

“I think solving this financial crisis has been a big, historic moment for the state of Oklahoma,” she said. “It was just two years ago that we had a $1.2 billion shortfall.”

Asked what she would say to the energy industry, which opposed the inclusion of the 5 percent GPT incentive rate, Fallin offered appreciation to oil and gas leaders.

“I hope that the energy sector knows how much the Legislature and I both support all the jobs (and benefits) they bring to the state,” she said.

Coburn slams Legislature for tax measures

Tuesday, Oklahoma Education Association president Alicia Priest said teachers will continue with their planned walkout and Capitol rally on Monday regardless of whether HB 1010XX advanced to the governor. She said the event could become a “thank you” to lawmakers. The OEA issued a Facebook request earlier Wednesday saying the organization hoped senators voted for the measure.

The Senate’s vote came hours after former U.S. Sen. Tom Coburn spoke at an Oklahoma Taxpayers United press conference blasting House members who had previously pledged not to raise taxes but voted in favor of HB 1010XX.

“I think you have failed leadership in the House,” Coburn said. “We’ll see if we have failed leadership in the Senate.”

Tax Commission Fiscal Impact analysis

Loading...

Loading...

RELATED

Historic vote: House hits supermajority on revenue plan by William W. Savage III

(Update: This story was updated at 8 p.m. Wednesday, March 28, to include additional quotes.)