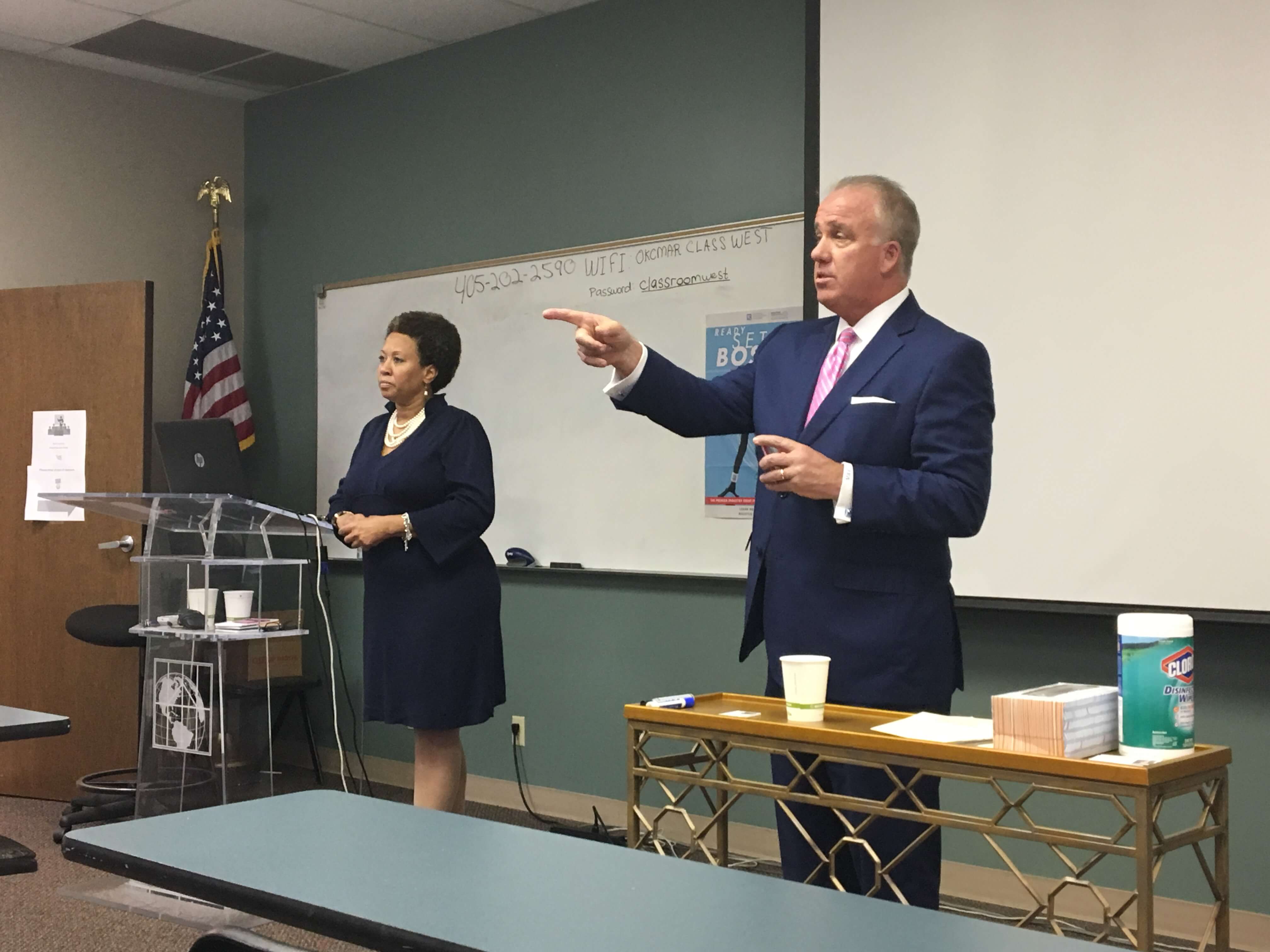

The two candidates for Oklahoma commissioner of insurance spoke to a group of real estate appraisers Thursday, Oct. 18. Republican Rep. Glen Mulready and Democrat Kimberly Fobbs stated their cases and answered questions on why they should be the next insurance commissioner.

Oklahoma’s current insurance commissioner is John Doak, who was elected in 2010. He ran unopposed in 2014 cannot serve again due to term limits.

The insurance commissioner heads the Oklahoma Department of Insurance, which implements insurance policy from the state Legislature. The Department also serves as a regulatory body for insurance companies operating in the state, with mandated investigations every three years.

Glenn Mulready: ‘I’m a big free market guy’

Mulready (R-Jenks) has served House District 68 since his election in 2010. He said he has spent 35 years in the insurance industry.

“I’ve pretty much been in the thick-middle of anything to do with insurance [at the Capitol],” Mulready said at the Oct. 18 forum. “Including some things I’ve never dealt with in my career, so it’s exposed me to a lot. I chaired the (House) Insurance Committee for a few years in there as well, but I’ve pretty much been the insurance guy at the Capitol.”

Mulready talked about his accomplishments in the Legislature, including legislation he said increased the number of captive insurance companies in Oklahoma from four to more than 70. He talked about his desire to increase the number of insurance companies in Oklahoma, which he described as his second priority.

“That will be a big part of my agenda moving forward in the Insurance Department is being business friendly and trying to attract more competition to our state,” Mulready said. “I’m a big free market guy. I believe competition drives down costs, increases efficiency and innovation.”

Mulready defined his first priority as consumer protection, calling it the primary goal of the insurance commissioner. He pointed specifically to ensuring solvency among insurance companies who protect Oklahomans.

“What you don’t need to be worried about is the insurance company abiding by the contract they’ve committed to and if that insurance company’s financially solvent,” Mulready said. “If a tornado comes through, is it going to wipe out the insurance company as well as my house? And so making sure they are there to pay the claims and fulfill the commitments.”

He said identifying and eliminating fraud was his third priority.

“Third would be the fraud side of things. I have jokingly referred to it when speaking about insurance as the high blood pressure of insurance. The silent killer, if you will,” Mulready said. “And I jokingly say that, but every one of you is paying for fraud. Small percentage of your premium, no matter what policy that is, you’re paying for that.”

Mulready said current commissioner John Doak has done a good job bolstering anti-fraud protections. He also clarified that many fraud costs come from contractors who charge more than they’re supposed to in the wake of disasters like tornadoes.

He called attention to his endorsements, which include U.S. Rep. Jim Bridenstine, former Gov. Frank Keating, the Oklahoma House and Senate Insurance Committee chairpersons, Sen. John Sparks (D-Norman) and former Insurance Commissioner Kim Holland, a Democrat.

Kimberly Fobbs: ‘We’re not going to use rhetoric’

Fobbs, a Democrat, has spent more than 30 years in the insurance industry, almost 20 of which were in management with MetLife Insurance. She said she worked primarily in consumer relations and investigations, but also worked in life insurance, annuities, claims, employer eligibility and customer service.

“The reason that is important is my experience was not to profit from selling insurance policies, but to actually work with both employers and consumers and policy holders to make sure the provisions in all 50 states were upheld,” Fobbs said. “Sometimes I defended the company members, other times I gave back money when the insurance agents were wrong.”

Fobbs also served under two governors on the Judicial Nominating Commission, where she said she helped screen and interview candidates for appellate judicial positions. She is a small-business owner and consultant, and she has served as chairwoman of the Tulsa Democratic Party.

“We need an insurance commissioner who is not just focused on insurance, not just focused on a cozy relationship with the [National Association of Insurance Commissioners], but is looking at leadership and responsibilities to regulate every agency that is under its responsibility,” Fobbs said.

She raised concerns about both Doak and the state Legislature in fulfilling their responsibilities.

“There are incidents after incidents that have not been policed by the current commissioner,” she said. “We also know that our legislation has been dictated by the agenda of the [National Association of Insurance Commissioners] and we need to make sure that office is not political and we have someone in that office who is going to do what is best for all people.”

Fobbs agreed with Mulready that Oklahoma needs more competition in its insurance markets. However, she urged voters not to elect someone with a corporate or political agenda.

“We’re not going to use rhetoric,” she said. “We’re going to use fact, we’re going to use transparency, we’re going to ensure that everything from the multi-industry trust fund, which is on the brink of insolvency, to looking at also the receivership office.”

Fobbs had no shortage of concerns for Oklahomans’ insurance.

“What we do know today is that there have been challenges in the industry,” she said. “I just left a meeting that had to do with, while fraud is prevalent in our state, it goes on both sides. We have insurance companies that are failing to provide full claims. (…) And refusing to pay claims where OSHA and building permit standards apply.”

Oklahomans will elect their next insurance commissioner on Nov. 6.