(Update: The afternoon after this piece was published, the IRS released new guidelines saying, “A payment made to someone who died before receipt of the payment should be returned to the IRS.”)

When Brian Davis got a letter from the IRS addressed to his deceased father Monday, he initially assumed it was a refund owed to his dad’s estate from several years back.

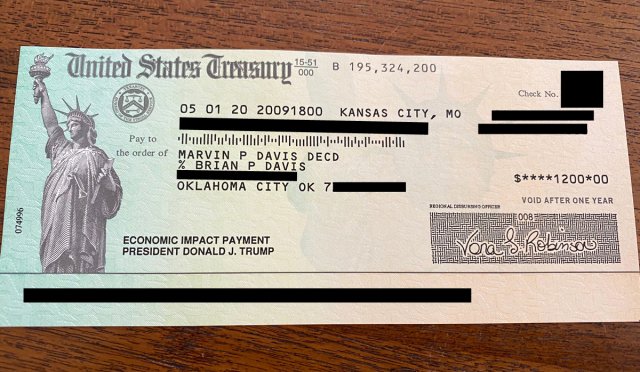

Instead, when the retired Oklahoma City Thunder television announcer saw the check totaled $1,200 and was marked “Economic Impact Payment, President Donald J. Trump,” Davis realized that his father, who died in January 2018, had just received one of the stimulus checks promised in Congress’ $2 trillion COVID-19 relief package.

“The thing about it is the check is made out to ‘Marvin P. Davis, deceased,'” Davis said. “So clearly they have it in their records that he’s been dead. He died in January 2018, and they went ahead and cut the check.”

To return or not to return?

Davis’ story is not unique. There have been reports of stimulus checks and direct deposits being sent to dead people all over the country. KFOR reported last week that a man in Midwest City received a check made out to his deceased mother with “DECD” after her name. Like Davis, the man interpreted that to stand for “deceased.”

So far, it is not entirely clear what people are supposed to do with these checks if they receive them. Trump was asked at an April 17 press conference whether the government would get back any money sent to dead people.

“Sometimes you send a check to somebody wrong. Sometimes people are listed, they die, and they get a check. That can happen,” Trump said. “We’ll get that back. Everything we’re going to get back. But it’s a tiny amount.”

Secretary of the Treasury Steve Mnuchin concurred.

“You’re not supposed to keep that payment,” he told media. “The heirs should be returning that money.”

For those who receive paper checks, they come in an envelope printed with a box saying, “If recipient deceased check here and drop in mailbox.”

However, a spokesperson for the Internal Revenue Service said it has not yet been determined whether the money will in fact be recalled or what the procedure would be. The IRS is currently telling those who receive stimulus checks for deceased people to “hold on to that money until we come out with further guidance, which will be very soon.”

Oklahomans ‘need clear guidance for what to do’

As the Los Angeles Times recently reported, some tax experts argue the deceased person’s heirs are legally allowed to keep the money because the CARES Act, as the stimulus package is known, does not have a clawback provision. And this situation has happened before.

An audit of the 2010 federal stimulus package found that checks worth a total of about $18 million were sent to 71,688 deceased Americans. The government was not permitted to reclaim much of that money.

But it might be too early to assume that will be the case again. Danielle Brand, an attorney with the Oklahoma City-based firm Travis Watkins Tax, said that while it’s possible beneficiaries of deceased stimulus recipients will ultimately be allowed to keep the money free and clear, people should be careful.

“One thing about this that a lot of people don’t know is that it’s actually a tax credit for your 2020 tax return,” Brand said. “They can track this stuff. It’s just a matter of do they have the manpower — historically, no — to come back on every person and get it. But, again, because it ties into your tax return, it is possible that they may find you that way.”

Chris MacKenzie, a spokesperson for U.S. Rep. Kendra Horn (D-OK5), confirmed in an email that the congresswoman’s office had heard from constituents facing this issue and had requested guidance from the IRS.

“For the time being, we are advising constituents facing this issue not to spend the money,” MacKenzie said.

U.S. Sen. James Lankford (R-OK) has “repeatedly urged” the IRS to issue guidance, according to a spokesperson.

“Oklahomans want to do the right thing the right way,” said Kelly Ferguson. “Those who receive additional funds at no fault of their own need clear guidance for what to do with the funds.”

‘I wouldn’t even know where to begin’

Davis, who said he is not eligible for a stimulus payment himself, said he does not plan to cash the check sent to his father. But he believes others may make a different decision.

“There are probably a lot of people who will,” he said.

Millions of living Americans have encountered glitches and delays while trying to access payments and loans meant to help sustain the economy during the pandemic. For Davis, receiving a payment for his deceased father did not inspire confidence in the way the stimulus checks are being carried out.

“My first thought ran to the potential that exists for fraud in a situation like this,” Davis said. “And my next thought had to do with all the people who have been trying to get relief in one form or another and haven’t been able to get it. And here the government is sending checks to dead guys.”

Davis said he might try to return the check, although he might not.

“I wouldn’t even know where to begin dealing with the Department of the Treasury,” he said.