(Update: Shortly before 5 p.m. Thursday, May 21, Gov. Kevin Stitt announced that he vetoed SB 1595, the bill discussed in this story. In his press release, Stitt said the situation described below as “just another example of how a lack of transparency and inclusion holds us back from becoming a Top 10 state.”)

It’s never a great sign when key people involved in changing a state law aren’t sure what they just did. It’s an even worse sign when the House and Senate authors of a bill claim they had different interpretations of its effects.

In the waning hours of 2020’s unprecedented and abbreviated Oklahoma legislative session, the State Senate gave a 44-0 final passage to SB 1595, a bill to suspend employment requirements for businesses receiving property tax exemptions.

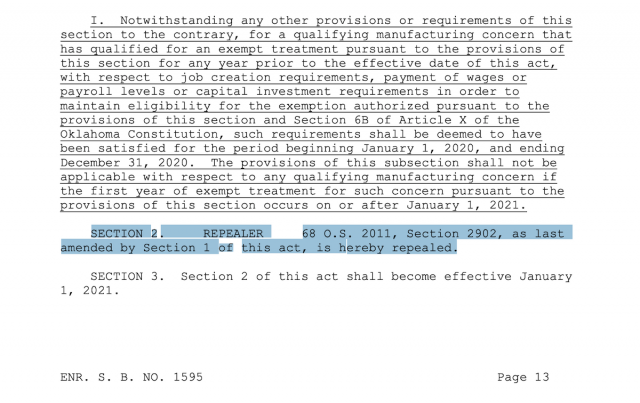

But the bill also contained a repealer — effective Jan. 1, 2021 — that raised eyebrows among media, lobbyists and lawyers over the weekend. If the repealer actually deleted the statute that defines manufacturing businesses that qualify for local property tax exemptions in its entirety, it would be the largest reform of state tax incentives passed all session. In short, the bill would stop new property tax exemptions for which the state is supposed to reimburse counties.

“I started getting calls on Saturday stating that repealer — instead of just repealing the section about giving the one-year exemption to these companies — actually repealed the whole section,” Senate Appropriations and Budget Chairman Roger Thompson said early Monday afternoon.

Around 6:20 p.m. Friday, Thompson (R-Okemah) had presented the bill on the Senate floor and was asked by Sen. J.J. Dossett (D-Owasso) what the repealer did.

“Only the underlined portion is what we are changing in current law,” Thompson replied to Dossett. “I didn’t get to research every point of this particular bill, and I’m not sure what that repealer would be.”

Friday night, Senate President Pro Tempore Greg Treat (R-OKC) said he also did not know the details of SB 1595 and said he did not hear Thompson’s answer to Dossett.

“I was not here for the debate, so I did not hear that,” Treat said. “I would have freaked out on the floor and jumped up and started asking questions of my appropriations chair.”

Representatives of various industries who benefit from the property tax exemption for manufacturing did freak out, jump up and start asking questions this weekend.

“This bill is the biggest woolly-booger I’ve seen in a decade,” said a lobbyist aware of SB 1595. “(There was) not a peep from the authors as to what the bill really did.”

Thompson: ‘I want to make sure we take care of these businesses’

On Monday, Thompson said he is the one asking questions now, and he said he has requested that Gov. Kevin Stitt veto the bill out of precaution.

“I’m looking at possible avenues,” he said. “First of all, is it really doing what we now believe it might be doing? We are still examining that to make sure that is true. And then, if it is, I want to make sure we take care of these businesses that need to be taken care of during this COVID-19 (pandemic).”

But Thompson’s counterpart, House Appropriations and Budget Chairman Kevin Wallace, says Senate leadership should have known the purpose of the bill’s repealer.

“The repealer is (repealing) the definition of the (property tax exemption) qualifiers,” Wallace said Monday afternoon. “I’m very well aware of everything the bill does.”

Wallace (R-Wellston) said SB 1595 was intended to repeal the definition of “manufacturing facilities” that qualify for exemptions of county property taxes, also called ad valorem taxes.

“It’s time to come back to the drawing board,” Wallace said. “That incentive was created in the late 1980s. It’s over 30 years old, and it was back when we used to manufacture stuff. But we went back in there and changed that definition so now everything under the sun qualifies, including just a warehouse with no employees. So the benefit back to the state is not a positive one.”

To Wallace’s point, warehouses were added into the expansive set of qualifying “manufacturing facilities” in 2019 via SB 695.

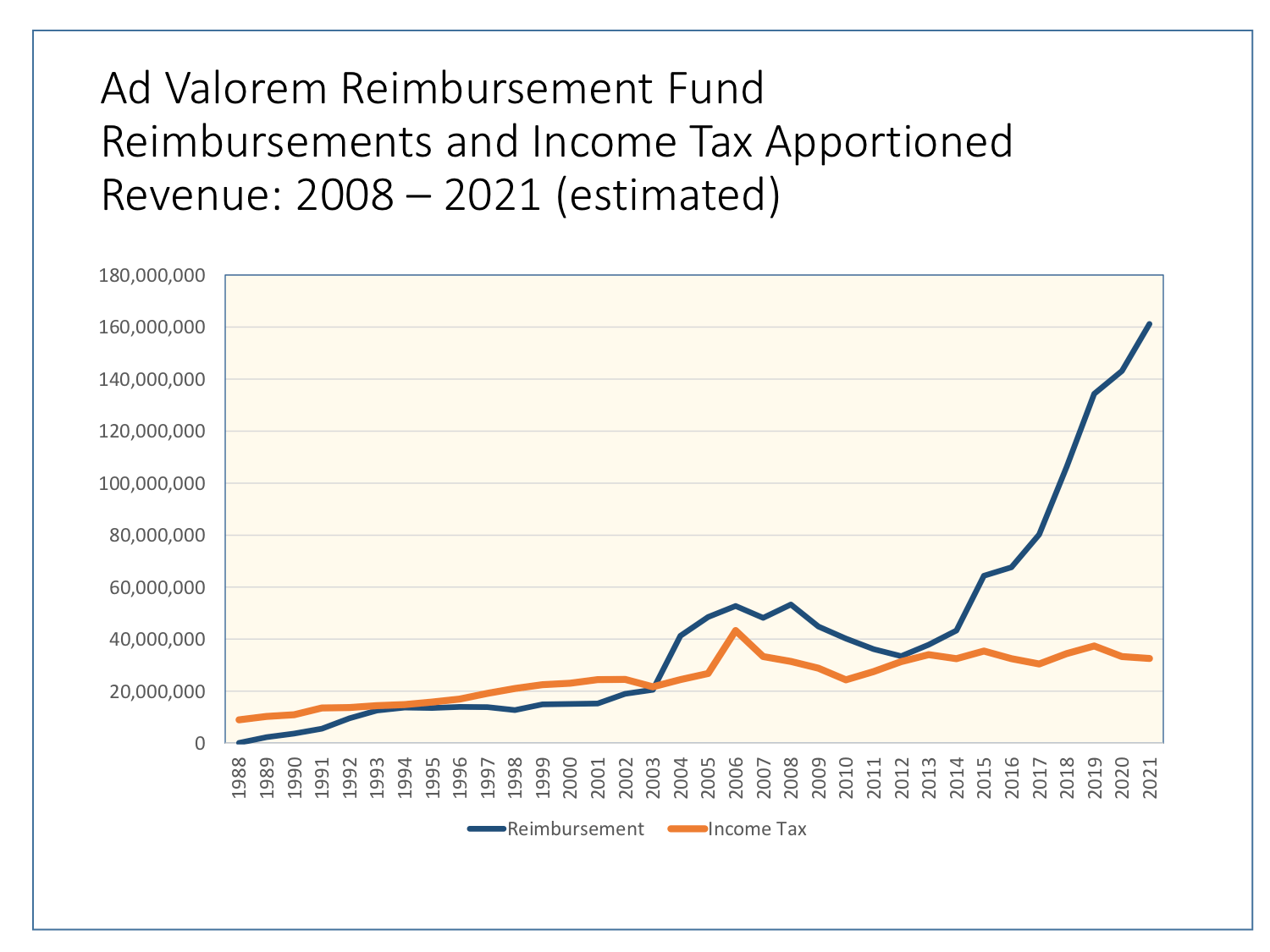

Wallace referenced the Incentive Evaluation Commission‘s 2016 report on the property tax exemption, which tracked and estimated growth of the exemptions, which are reimbursed to counties with state dollars.

“State payments associated with this incentive had increased sharply since returning to pre-recession levels in 2012,” the report said, noting that reimbursements were ended in 2017 for wind projects, which made up a substantial portion of expenses in the program.

Still, Wallace said the commission’s analysis of the ad valorem exemption for manufacturing should be noted by lawmakers and the governor.

“It’s on a projection straight up,” he said. “The graph is off the chart.”

Wallace: Program should not be ‘corporate county welfare’

Wallace said SB 1595 was “a package deal” with SJR 31, a bill that sought a statewide vote to reform the property tax exemption program and require boards of county commissioners to authorize any ad valorem exemption for manufacturing. SJR 31 also would have ended the practice of state dollars being used to reimburse counties for those exemptions, but the bill failed 4-41 in the Senate after business groups and education groups called for its defeat.

“For the education groups to come out strong against SJR 31 and say it’s taking money away from education, the real irony behind that is this ad valorem reimbursement takes money away from public education with schools on the formula,” Wallace said. “We had to write a $112 million check off the top, out the door, off book (for Fiscal Year 2020) to the schools that are in these districts that have wind farms, Google, oil tanks.”

While Wallace said he even represents a school district that receives ad valorem reimbursements, he said the current slew of business ventures benefiting from the property tax exemption is bad for the state as a whole.

“Stroud, Cushing, Pryor, Google — wind farms out the wazoo,” Wallace said. “And then all the other schools that are on the funding formula are fighting over the dollars we still get to appropriate.”

Treat voted in favor of SJR 31 and said Friday night he believes the ad valorem reimbursement issue needs to be examined, even if the end of an unusual session did not provide enough time for robust discussion.

“It’s always been interesting to me that I have businesses in my district — now this dealt with manufacturing, but on the overall ad valorem exemption — that people in Okemah and Altus and Tulsa are paying for economic development in my area,” Treat said. “Why isn’t there more skin in the game on the local county?”

Thompson said he had not talked to Wallace about the House’s intent on SB 1595, although he did present and vote for SJR 31 on the Senate floor.

“That’s not my intent. That’s not what we need to have done. The ad valorem reimbursement is great,” Thompson said. “I don’t know what [the House’s] intent would be. I know that our agreement was that we just want to take care of these manufacturing businesses for one year. I still believe that to be true, but I don’t know if this was intentional or not.”

Wallace said SB 1595’s repealer was intentional, and he expressed skepticism that Senate leadership would have run the bill without knowing what it does.

“Leadership on the Senate side knew what the bills were about or they would not have had a hearing on the floor. They would not have gotten a vote,” Wallace said. “I know that I was on a phone call that evening with leadership in both the House and the Senate, and everybody knew exactly what SB 1595 and SJR 31 was.”

Wallace said he spent his Monday on a variety of phone calls about the issue, with the State Chamber of Oklahoma, members of the Stitt administration and oil and gas lobbyists.

“Right now, everybody is aware it is time to go to work during the interim. We will come back with a plan to start re-setting what the qualifiers are to participate in that program,” Wallace said. “It’s going to have to be tied to jobs and positive impact for the state of Oklahoma and not just corporate county welfare.”

Wallace said he “absolutely” hopes the governor signs SB 1595.

“It’s the right thing to do for Oklahoma,” he said. “I tell you what, I thought I heard the governor talk about wanting to look at tax credits and special knock offs and this and that, so we’ll see.”

Thompson said he spent much of his Saturday on the phone discussing the issue.

“Over the last two weeks we have done two months of work in two weeks’ time,” Thompson said. “I’m back at the Capitol today trying to handle this problem.”

Wallace said he does not view the bill’s repealer to be a problem.

“I think there is misinformation,” Wallace said. “Anybody who has qualified is there. The exemption didn’t go away. It’s got new parameters starting in 2021. Everybody who is on it is on it. And section one of [the bill] gave the exemption away for tax year FY 2020, so now you don’t even have to meet the low threshold of the employee requirement, which is very low to begin with.”

Wallace said he hopes concerned parties can discuss the issue over the interim and return for the 2021 session with a new definition for the manufacturing property tax exemption program.

“Something more than, ‘Hey, we’re going to build something that costs a lot of money but there’s not jobs tied to it,'” Wallace said.

(Update: This story was updated at 5:40 p.m. Monday, May 18, to clarify the repealer’s impact.)