(Update: While the article below remains unchanged, the manager of the Oklahoma Schools Risk Management Trust announced in June 2021 that the self-insurance pool will no longer offer new policies beginning July 1, 2021.)

The Oklahoma Schools Risk Management Trust, a self-insurance pool that provides property and casualty insurance for public school districts in the state, recently sent an email to its 78 member districts saying the program needs an additional $850,000 in order to operate for the rest of the 2020-2021 school year, the cost of which will fall on the backs of these districts.

Between this financial deficit and its loss of membership in recent years, OSRMT runs the risk of going out of business by July, which some worry could leave a hole in the school insurance market.

“I hate to see the loss of competition,” said Mike Woods, superintendent of Hennessey Public Schools. “I’ve seen how much it costs to insure schools without that.”

The OSRMT began operations in 2009 and gives school districts the opportunity to jointly self-insure for property and casualty coverage. In 2014, OSRMT absorbed the school districts that formerly received coverage through the Oklahoma Schools Property and Casualty Collective when it went out of business owing to financial troubles. That leaves many public school districts in the state with only three current options for casualty and property insurance coverage: the OSRMT, the Oklahoma Schools Insurance Group or self-insuring.

“OSRMT has paid about $53 million in claims on behalf of school district members,” Oklahoma Schools Risk Management Trust program manager James Woodard said. “That’s everything from a large tornado loss at El Reno that was in the $6 or $7 million range. It’s a very serious bus accident for Norman Public Schools on a student field trip to Texas where the program paid out the full policy limit of $1 million on that bus accident.”

The email, sent to districts by OSRMT marketing development manager Daniel O’Neil on March 5, states that to make up the $850,000 deficit the OSRMT is facing, each member district will receive an additional invoice in the amount of 11 percent of the district’s 2020-2021 plan year contribution/premium. If a district’s contribution for the year was $100,000, they would be invoiced for an additional $11,000 for the current school year.

Further, the email explained that OSRMT will not be able to continue operation unless its program can attain a total of 100 membership districts, or the financial equivalent of 100 districts, by the end of the school year. In this instance, member districts will be sent an invoice for an additional 42 percent of their 2020-2021 plan contribution to pay for the estimated $4,000,000 “run-off” of the program.

“In the case of a trust or a pool, like OSRMT or OSIG, the shareholders are the member school districts. If there’s a profit on a year or collection of years, that profit belongs to the school districts that actually help build that profit. If you were ever to give that profit back, instead of paying out dividends of your stock as a shareholder, you would give that money back to the school districts because it’s their money,” Woodard said. “The converse of that is, if there’s a loss on a year or a set of years, then that also is the responsibility of the school districts.”

Follow @NonDocMedia on:

‘We’re upset about the way the information was delivered to us’

According to Woodard, OSRMT membership currently includes 78 Oklahoma school districts, although its website still lists 87. Some administration officials from member districts were surprised to learn about the additional invoices they will be facing.

“It took me a little bit by surprise. We would certainly have to look at the situation and determine the best path forward,” Woods said. “That would be something we would have to discuss as a board. I’m sure we would seek outside counsel from our school attorney. I hate to see the loss of competition. I’ve seen how much it costs to insure schools without that.”

Woods will be retiring at the end of the school year after 19 years at Hennessey Public Schools, and he said the district has had a wonderful working relationship OSRMT. This includes the recent claims process the district has been undergoing owing to an initial estimate of $135,000 in structural damages caused by February’s winter storm.

“[OSRMT] certainly made a tremendous difference in the cost of our premiums when there was a little competition in the marketplace,” Woods said “My personal experiences with how OSRMT has functioned is they’ve saved schools a significant amount, 10 percent to 20 percent, over the other option. Every time we’ve had a claim, they have been very easy to work with, very fair in their settlements, and if everything were still moving forward, I would continue to try to stay with them if that was possible.”

Woods worries that if OSRMT dissolves owing to financial difficulties, school districts will be limited in their options for casualty and property insurance, leading to price hikes.

“The reason you have OSRMT is because other schools weren’t satisfied with the situation prior to them coming into the marketplace,” Woods said. “What has happened too many times — and I’m afraid is going to happen again this time — is there’s a very small group that schools have to select from, and while the prices were being held in check by the competition, I would be concerned that that probably isn’t going to happen now.”

El Reno Public Schools Superintendent Craig McVay said he wasn’t quite surprised by the email and current financial position of OSRMT. However, how the news of additional premium payments was delivered to membership districts was disappointing.

“I’ve been doing this for 35 years. I’ve been a superintendent for 15 years. I’ve been a decision maker in education administration for 25 years. This is the first time I’ve ever heard of something like this happening like this,” McVay said. “I wasn’t at all caught off guard about the trouble they were having. What I was caught off guard with was the way that they presented it. We got caught off guard with additional premiums after we paid our premiums in advance in July. We’re upset about the way the information was delivered to us.”

McVay said El Reno Public Schools has been with OSRMT for more than 10 years and was one of the program’s original members.

“We’ve been through some tough times where they did cover us. We’re right in tornado alley, so we’ve had a lot of opportunities for being covered with insurance over the years, and they’ve always come through for us,” McVay said. “I have said publicly for several years now that they have done everything they said they would do. An insurance settlement means that two parties have to come together and agree on what that settlement is going to be. We’ve never had any problem at all agreeing on coverage.”

McVay said he assumes OSRMT will make a renewal proposal to the El Reno Public Schools Board in the next few months, but he doesn’t know that he can recommend it to the board from a practical standpoint.

“This all came as a disappointment. Not a surprise because in a year of pandemic this is the least surprising thing that’s happened,” McVay said. “It’s really disappointing. It’s costly. You hate to base everything on the dollar, but this is taxpayer money, and this is money that is taken out of the pockets of kids. We have to make a solid decision for our taxpayers.”

The law of large numbers

Woodard said since the program’s inception, OSRMT has saved school districts more than $10 million in insurance costs by providing competition. However, he said with fewer and fewer districts participating in the program and the rising costs of property reinsurance in recent years, the program has been put in a difficult spot.

“There was another program, the Oklahoma Schools Property and Casualty Collective, that crumbled under that same concept in that their competition essentially put enough pressure on them that they weren’t able to have enough members. I think at the end they might have had 25 school districts,” Woodard said. “It’s simply not a large enough number to sustain.”

OSRMT has tried to keep its membership up. The trust pays for the exclusive right to use the Oklahoma State School Boards Association’s name and logo for marketing and administration purposes. Oklahoma Insurance Department records indicate that the trust had previously paid between $130,000 and $230,000 each year to OSSBA for the marketing agreement, an expense that has been criticized. For the year ending June 30, 2020, the OSSBA expense totaled only about $55,000.

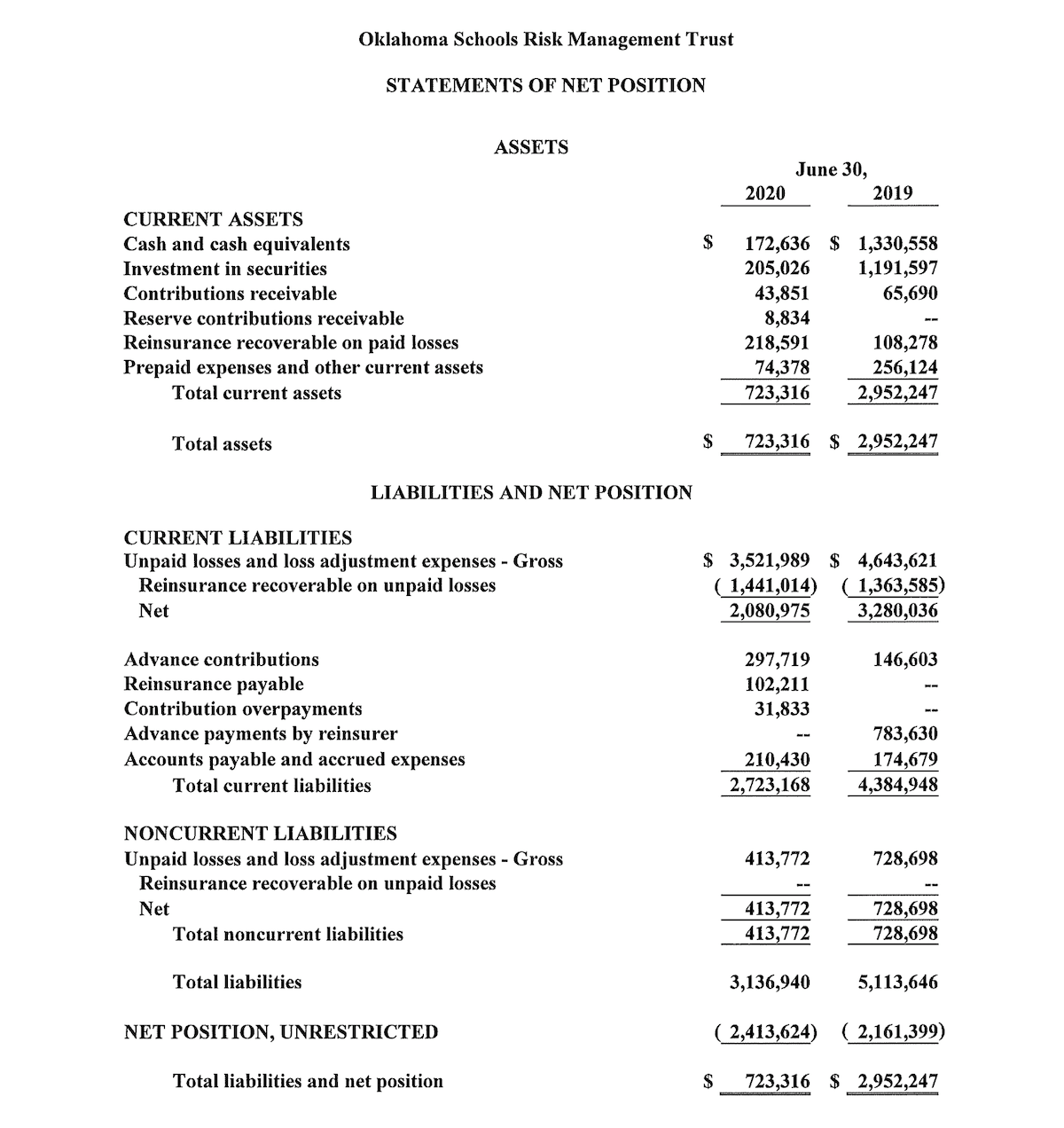

Woodard said the premiums paid by member school districts are the driving factor of the program. Member contributions for 2020 totaled about $7.6 million compared to about $11.2 in 2019. The OSRMT also had a net position decrease of $252,225 in 2020.

“There’s a thing in insurance called the law of large numbers, and the law of large numbers says that the more people you have, the more geographically distributed your risk is, the more diverse your risk is (…) then you will perform better,” Woodard said. “It’s at a point in time where it doesn’t enjoy the benefit of the law of large numbers.”

Like Woods, the Hennessey superintendent, Woodard worries about the lack of competition there would be in Oklahoma’s public school insurance market if OSRMT were to go out of business.

“OSRMT, effective July 1, 2021, would no longer provide coverage. [We] would go out of business. [We] would be obligated to pay claims until all of the claims during the time [schools] had coverage would be satisfied and when all of those claims were satisfied [we] would close the books and walk away,” Woodard said. “There would now be a single market in Oklahoma that once again would have no competition.”

McVay, however, does not share as much concern over lack of competition in the school insurance market if OSRMT were to dissolve.

“I don’t think there’s going to be a lack of competition because I think there are other companies willing to get in the school market. It’s a really good market. Believe it or not, schools don’t have a lot of insurance claims, so there are other people that I think would be willing to get in the game,” McVay said. “I think OSIG’s going to get some competition from the private side.”

Legislation about school insurance groups

SB 738, authored by Sen. John Michael Montgomery (R-Lawton) and Rep. Marcus McEntire (R-Duncan) would require any entity with an inter-local agreement between two or more school districts, or public agencies, that provides any type of insurance to be subject to examination by the Oklahoma insurance commissioner in a similar manner as other insurance companies. The oversight is contingent on there being “substantial reason to believe” that the entity is insolvent or facing potential insolvency.

“Ultimately, we need to be ensuring that our school districts are covered in a way that’s appropriate and make sure they’re buying a product that’s going to work when they need it to work,” Montgomery said. “We want to ensure that we’re not doing that in a way that’s going to be cost prohibitive for the school districts, but at the same time ensuring that when the worst happens and when we do have these catastrophes that they’re covered to an appropriate level they need to be covered at, especially as it relates to how these quasi-insurance deals work.”

SB 738 passed the Senate 45-1 and appears on the agenda — with a proposed committee substitute — for the House Insurance Committee, which is set to meet 9 a.m. Wednesday.