The director of the Oklahoma Development Finance Authority told his board Friday that he expects the state Supreme Court to validate OG&E’s proposal for up to $800 million in ratepayer-backed bonds intended to securitize and pay off massive debt accrued during the historic February 2021 winter storm.

“I have every confidence that they will validate the bonds, and at that point in time we are moving forward with structuring the bonds, marketing the bonds and issuing the bonds,” said Mike Davis. “We have indicated with our brief and our filing of the validation that time is somewhat of the essence here, with OG&E’s short-term financing here in March, every day of delay is additional interest cost and additional cost for the ratepayers.”

Davis said he hopes ODFA will be issuing the bonds in March, quickly using the proceeds to pay off the OG&E debt. Over the next 28 years, revenue from a line-item tariff on customer bills of roughly $2.12 per month will be passed-through to pay off the ODFA bonds.

“Time is of the essence. Each day delay it gets more expensive,” Davis told the board of bankers. “You guys are in the market. Rates are going up.”

ONG, PSO and CenterPointe in the pipeline

Davis also discussed other utility bill securitization proposals with regulated companies that racked up monumental bills when the price of natural gas spiked nearly one year ago. Last week, the Oklahoma Corporation Commission voted 2-1 to approve up to $1.37 billion in ODFA-issued bonds for Oklahoma Natural Gas.

“We have that [financing order]. We are still waiting on [Public Service Company of Oklahoma], and we are still waiting on CenterPointe (Energy),” Davis told the board. “We feel like we are going to have the three remaining financing orders final and available to take action on those at the February board meeting. If our dates of final application are right, it does look like one of them may be coming to us right on or about Feb. 23.”

Davis reminded the board that the regulated utilities were choosing to securitize their ratepayer debt under the parameters and rules of SB 1050, a bill passed last session by the Oklahoma Legislature. The Legislature also passed SB 1049, which created a similar securitization opportunity for unregulated utilities. The Oklahoma Municipal Power Authority had already announced that it would not securitize any of its members’ debts.

Davis updated the board Friday about the calculous of the Grand River Dam Authority, a state-owned public power utility serving municipal and commercial electric customers in northeast Oklahoma, Kansas and Arkansas.

“They took a deep dive kind of looking at the program,” Davis said. “I did receive word this month from Dan Sullivan, their director, they are basically going to issue bonds in their own name to take care of the long-term financing.”

John Wiscaver, executive vice president of GRDA, told NonDoc on Sunday that GRDA would not be using bonds. Rather, he said the agency will use cash reserves and manage the payoff of gas debts internally with their customer base.

Either way, Davis said that means “right now I know of no entity” planning to take advantage of SB 1049’s utility bill securitization program.

Companies could be ordered to disclose gas purchases

Regarding last week’s 2-1 Corporation Commission vote to approve the financing order for Oklahoma Natural Gas, ODFA board member Keith Ventris asked Davis about the dissenting vote from Commissioner Bob Anthony. Davis said that SB 1050 established only a 180-day window for Corporation Commission review of the proposals, which he believes was included because “at some point, every day you delay here, the bill is going up.”

“I think there is some frustration of, ‘Did that allow a window big enough to do a thorough investigation?'” Davis said. “I think another point of concern was the issue — these utilities, when they go and have these extraordinary fuel charges, obviously the [Public Utility Division] needs to have micro-level details (…) Who did you buy the gas from, when did you buy it, and what did you pay for it? Typically those things have been shielded from public view.”

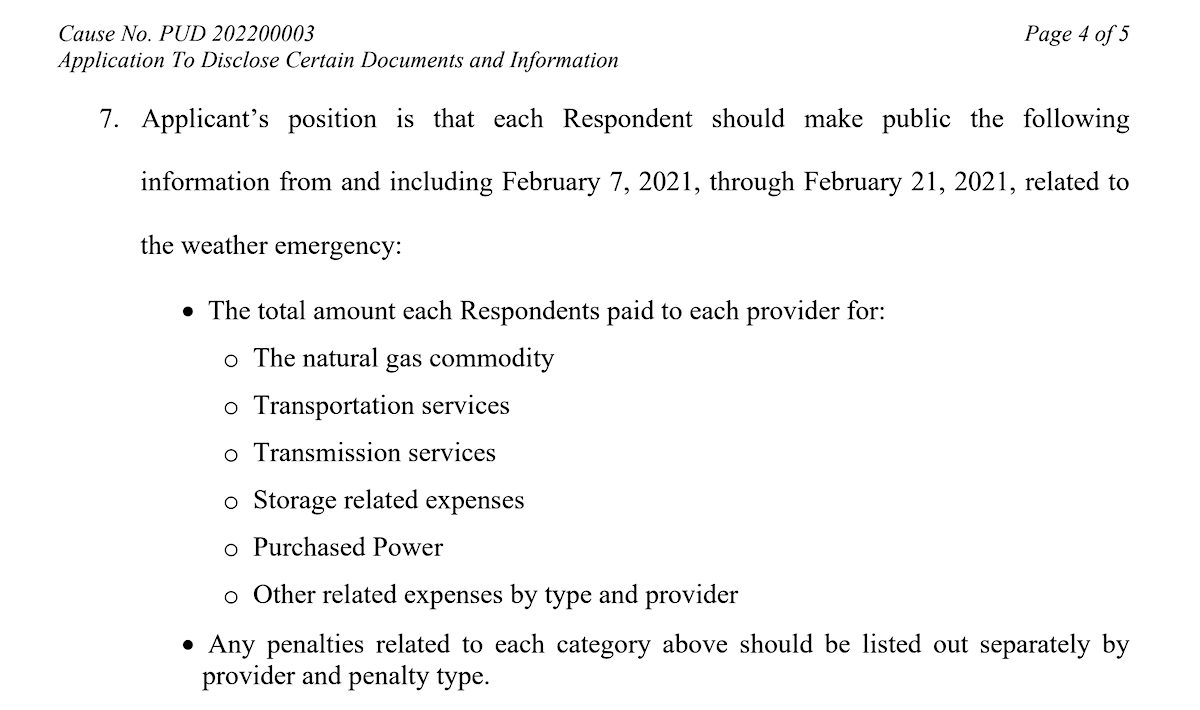

But Davis noted the pending Oklahoma Corporation Commission application of Brandy Wreath, director of the agency’s PUD, asking that the commissioners require 10 companies and entities to reveal information related to their natural gas purchases between Feb. 7 and Feb. 21, 2021.

“Providing the above-described information in this cause allows the general public to view summary information for this historic weather emergency on the commission’s website in one, easily-accessible repository and in a uniform format,” Wreath wrote. “The information being sought in this cause is not anticipated to give an unfair competitive advantage to providers of these services as this weather emergency has been considered an anomaly.”

ODFA board member Bridger Cox asked Davis if he thought Anthony, the longtime elected Corporation Commission member, would be likely to vote against all of the proposed utility bill securitization financing orders.

“I am confident he will,” Davis said. “Again, I think any and all of us involved in this would prefer that we are not having this conversation and we’re not having to put this solution in place. We’re all ratepayers, too. (…) But for this model and this solution, in the ONG case, they are basically saying you would pay double what you are going to pay (if we didn’t do this).”

Davis said the ONG monthly bill tariff is expected to be about $7.82, but he said the company would charge $15.56 per month if it sought its own financing in the private utility lending market. He said the bond market that ODFA can access will have a weighted average cost of interest of roughly 2.35 percent, as opposed to an 8 to 10 percent interest cost if the company pursued their own loans.

Davis noted one major change in the ONG financing order as approved by the commissioners. An initial proposal included a $687.50 “exit fee” for customers who convert their natural gas systems to fully electric systems.

“There was this concept of an exit fee, so if a homeowner and a business shifted 100 percent away from gas. This is a non-bypass mechanism,” Davis said. “But when the final financing order came out, there is no exit fee on ONG, so that’s not going to be an issue, at least not at the court level.”

Department of Commerce executive director Brent Kisling, who serves on the ODFA board, asked a question about the ONG securitization situation.

“If the price of natural gas skyrockets three years from now or five years from now, and a lot of people convert [to electricity], does that mean then that the fee for all of the other users goes up?” Kisling asked.

Davis said he was not sure.

“Conceivably, yes,” Davis said. “The utility is the borrower, and the revenues to repay these bonds is the separate line item tariff we are all going to see our bills, and that could go up or down through that true-up mechanism we have talked about.”

‘It’s not the homeowner, it’s the address’

The OG&E financing order also features a “true-up” mechanism to correct for cost fluctuations, meaning the bill tariff can be adjusted slightly higher or lower depending on the actual collections and the ultimate bond interest payments.

During a Dec. 22 meeting of the Council of Bond Oversight, ODFA-contracted securities expert Michael Newman said the OG&E plan ties the debt repayment tariff to every customer address on the grid, not to human or corporate customers themselves.

“You pay the charge if the address is connected to the grid. It’s not the homeowner, it’s the address,” said Newman, managing director of Hilltop Securities. “It stays with the home.”

Newman said that even a new OG&E customer who moves to Oklahoma this year from another state and builds a brand new house would still have to pay the monthly fee.

“Everybody benefited from the availability of the electricity, and if those who could afford to make a change to opt out from their source of power — if I could build my own wind farm, and so forth — the people who are left still have to pay the bill, and what they would have to pay goes up,” he said. “If someone is left, it’s going to be those least able to afford it. So when they looked at this, they wanted to make sure it is equitable.”

At the same Dec. 22 meeting, state bond adviser Andrew Messer said a utility customer who added solar panels or other alternative energy sources to their home would still be required to pay the new fee as long as they were on the grid.

“Typically, when someone installs solar panels, they remain connected to the grid in some capacity for when the sun doesn’t shine or to sell power back to the investor-owned utility,” Messer said. “In that case, they would remain a customer of the investor-owned utility. So long as they are a customer, they will be paying the tariff. If they were to completely disconnect from the grid entirely, then they would not have to pay the tariff, would be my understanding.”

Follow @NonDocMedia on:

State regents finalizing capital bond projects

Beyond discussion of the utility securitization plans, Friday’s ODFA board meeting also foreshadowed another significant issuance of bonds by the obscure state agency.

Next week, the State Regents for Higher Education is expected to submit to the Oklahoma Legislature a list of proposed bonds for college and university capital projects. ODFA has managed the “master lease program” for the higher education agency since 2001.

“It allows us to pool projects from various universities,” said ODFA’s Jeremy Stoner. “Many of the colleges and universities would not have the access to the market and certainly would not have the state’s credit to their benefit.”

Legislative leaders will have 45 days to review the list of proposed capital bond projects and make any potential objections. Stoner said ODFA issued $45 million last year for college and university capital projects. He said the agency did $81 million the year before.

ODFA will also issue bonds for higher education technology projects, which is statutorily capped at $50 million per year under the master lease program.

“We have not been over $20 million in the last seven years in this program,” Stoner said.

(Correction: This article was updated at 11:58 a.m. Monday, Jan. 31, to correct Brent Kisling’s title.)