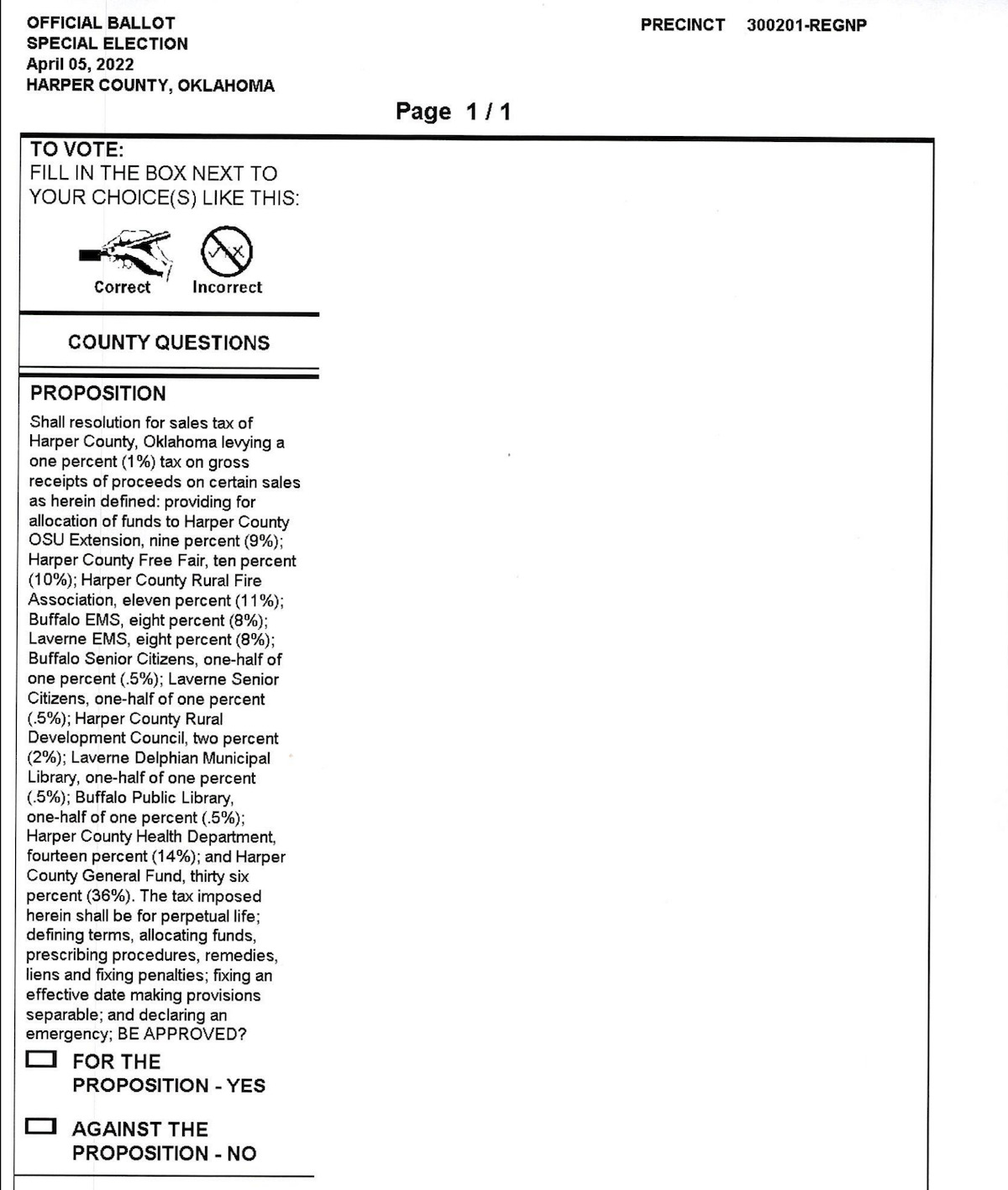

(Update: On April 5, voters in Harper County approved the 1 percent sales tax increase, with 79.91 percent support. Neither of the Laverne Public Schools bond proposals passed.)

On Tuesday, voters in Harper County will decide the fate of a 1 percent county sales tax hike that would fund a myriad of services. But unlike many other sales tax increases that are up for renewal every five years, this one will be permanent.

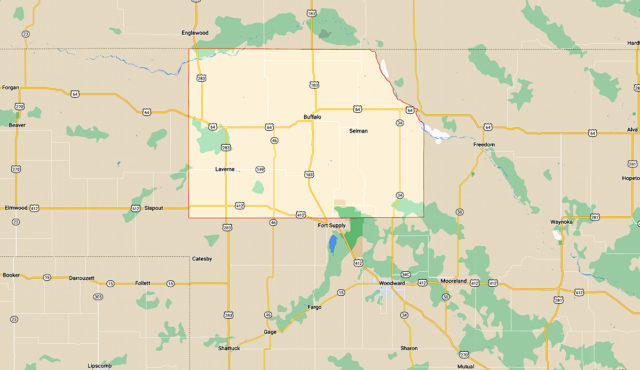

Set in Oklahoma’s northwest corner, Harper County is among the most rural counties in the state, stretching across 1,041 square miles. Its county seat, Buffalo, is home to about one third of the county’s 3,700 residents. The largest nearby city is Woodward, about 35 minutes south.

Harper County’s current sales tax rate is 2 percent, and 21 other rural counties also have a 2 percent rate. Love County has a 2.5 percent rate, and Harmon County has a 3 percent rate, meaning Harper County would be tied for the highest county sales tax rate in the state if voters approve Tuesday’s ballot measure.

The proposed Harper County sales tax hike would fund county services, including EMS service and senior centers in Buffalo and Laverne, the county OSU extension office, the Harper County Rural Fire Association and the Harper County Free Fair.

A separate proposal on the ballot in Laverne, the county’s second largest city, calls for $6.9 million in bonds to remodel that city’s schools and purchase equipment. A second $600,000 proposal would fund the purchase of school buses.

In November, Laverne voters roundly rejected a $14.2 million bond issue for Laverne Public Schools that was expected to increase local property taxes by about 38.57 percent. That proposal drew mixed feedback from community members on the district’s Facebook page, and it only received about 28.83 percent of the vote, with 711 ballots cast. (School bond proposals require 60 percent voter support to pass.)

‘In the same boat a lot of counties are’

Like many rural counties, Harper County has been struggling with declining sales tax revenue on both the county and municipal levels. Buffalo collected $18,555 in sales tax revenue in March, down slightly from the previous year’s total of $19,294.

“We’re in the same boat a lot of counties are,” former Harper County Commissioner Cody Hickman said. “Our county sales tax revenue has been going down for several years, and we don’t have a lot of businesses, so we see more and more money going to Woodward since it’s close and has a Walmart. We don’t have a lumber yard or an auto parts store, so people have to go to Woodward for that, too.”

Hickman said staff at some county offices had been cut in recent years.

“The courthouse budget suffers the most when the sales tax is low,” he said. “That’s been gradually cut down to a skeleton crew. They used to have four employees. Now that’s been cut down to two because the county can’t afford it.”

Current Harper County District 3 Commissioner Steve Myatt said the proposed sales tax increase is important to maintain county services, especially as the area grapples with fluctuating revenues from the oil and gas industry.

“It’s really important to the whole county because it funds so many different things,” Myatt said. “One of the things is senior services, a lot of which are barely getting along. It would be a permanent increase unless someone comes along and changes it.”

Myatt said he expects the Harper County sales tax increase to get the green light Tuesday.

“I think it’ll pass,” he said. “The only thing that might make it go down is if people in Laverne are mad about the school bond or people don’t read the ballot and just vote no.”

Polls are open from 7 a.m. to 7 p.m. on Election Day.

Follow @NonDocMedia on: