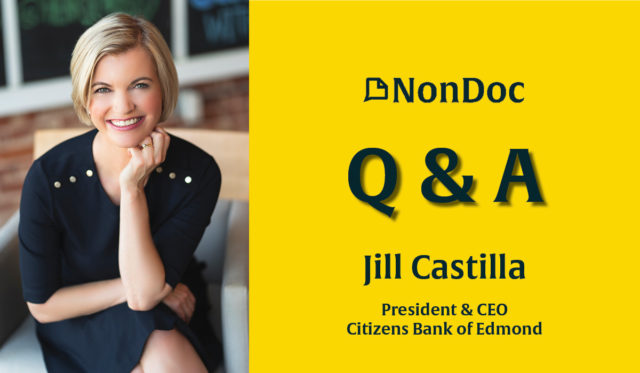

Not many bankers host monthly street festivals, but Jill Castilla does.

As president and CEO of Citizens Bank of Edmond and the founder of the monthly Heard on Hurd festival, Castilla works to promote local business and commerce in the Edmond community.

Come say hi!

NonDoc has been selected as Heard on Hurd‘s featured nonprofit for September. Stop by our booth at the Saturday, Sept. 17, Heard on Hurd event.

Castilla recently spoke with NonDoc about her life and career path, which wound through Texas, Hawaii and Minnesota before ending up back in Oklahoma.

In this Q&A, Castilla discusses how she rose from a minimum-wage position at Citizens Bank to become the bank’s CEO, as well as her time in the military and her love for Edmond. The following conversation has been edited lightly for grammar and clarity.

Tell us about yourself. Where did you grow up, and what drew you to banking?

I grew up in Okmulgee, with my dad and younger sister. I initially went to Oklahoma State University, but quickly found that my grocery store job couldn’t keep up with my school and living costs, so I enlisted in the Oklahoma Army National Guard.

When I returned home, a family member had written checks from my bank account, and I again didn’t have any money for school. I found a college in south Texas that provided a great scholarship, and it’s there that I met my husband, Marcus.

When we received orders for Hawaii, my manager encouraged me to consider changing my studies from engineering to business. I finished school at Hawaii Pacific University and started a master of arts program in economics at OU while in Hawaii. When we moved back to Oklahoma, I worked at Citizens Bank of Edmond for minimum wage in the bookkeeping department.

I applied for my dream job at the Federal Reserve Bank and served there for nearly a decade. The Fed sent me to the graduate school of banking where I just fell in love with the community banking model, remembering the impact the local community banker in Okmulgee had on me. I took a job as the finance leader at a bank in northern Minnesota. Two years after moving there, Citizens Bank asked me to rejoin to assist with a turnaround during the financial crisis.

In May 2020, you partnered with entrepreneur and Dallas Mavericks owner Mark Cuban to help small business owners with their loan forgiveness applications. Can you speak to how that collaboration came about, and what that program meant to you?

It came about initially through Twitter. Cuban posted a tweet looking to partner with a bank to help individuals receive their stimulus checks faster. After pitching our solution to him, within days, we rolled out a program to help our customers gain early access to their stimulus checks, and he challenged other banks to do the same.

Cuban and I stayed in constant contact throughout the Paycheck Protection Program launch and partnered again to streamline the PPP forgiveness process. Both of these projects were hugely impactful to families and businesses during such a trying time. It is one of my proudest accomplishments, and I’m grateful to our team for going all in during such an uncertain time.

You were recently appointed to the Federal Reserve’s 12-member Federal Advisory Council to represent the Kansas City district, which includes Oklahoma, Kansas, Nebraska, Colorado, Wyoming and parts of Missouri and New Mexico. How will your perspective on the Federal Advisory Council be different from members of other districts?

I serve on the council with 11 CEOs of the largest banks in the world. The responsibility to bring the perspective of small, community banks and the communities we serve is imperative as the Board of Governors determines monetary policy and balance sheet strategies.

In my role at Citizens, I am able to have more intimate knowledge of our customers, what their business needs are, what concerns they have, where they are thriving. I will bring these stories to the Board of Governors so they know real-life examples speak volumes. It is also important to share the perspective of families and businesses in middle America.

What’s one of your favorite things about Edmond, and what’s something that Edmond needs to work on?

There is so much to love about Edmond — its parks are my favorite. The community comes together in times of need for its residents, schools and small businesses. Edmond is a growing and thriving population yet it still feels like a small town with vibrant, independent small businesses. I hope that we can continue to maintain a friendly small-business environment, improve accessibility to affordable housing and increase pedestrian safety.

Do you have any top goal in mind for Edmond to reach by 2030?

I’m really excited to see the investment of ARPA dollars to increase Edmond’s walkability, such as the investment in trails and pedestrian safety.

Follow NonDoc’s Edmond coverage:

I recently learned that you grew up in Okmulgee. What was your favorite thing about coming of age there?

Similar to Edmond, I love the small community feel. I used to carry out groceries for the local community banker there, and she is the reason for so much in my life. The community was very supportive of me and my family growing up. It felt like I was being raised and rooted for by the entire town.

We heard that you play golf. So, what’s better, your long game or short game?

Golf has been a part of my life since I was really young — we even had a makeshift driving range in our pasture! Unfortunately, I was in a pedestrian/truck accident three years ago and still have trouble hitting the ball. Right now, I only have a mean putt-putt game, but I hope to get back on the course soon!