In a short floor session today, Oklahoma House members voted to override Gov. Kevin Stitt’s veto of a bill extending state-tribal motor vehicle compacts and to extend their special legislative session through July 31.

Both measures will now head to the Senate, which was not in session Monday, reportedly owing to issues over whether enough senators were able to report to the Capitol, although both chambers had agreed to return Monday to address overrides when they began collecting signatures May 16 to call the special session.

“There is some degree of disappointment because this was a date that we discussed before adjourning the constitutional session,” House Speaker Charles McCall said of the Senate’s absence. “Because the Senate did not keep to that agreement, that’s going to cause the House to potentially have to come back in for a second day down the road, and we’re willing to do it.”

Senate Appropriations and Budget Chairman Roger Thompson (R-Okemah) said the Senate plans to come back into session Monday, June 26, to take up the compact veto overrides — SB 26X (tobacco) and HB 1005X (motor vehicle) — and the resolution to extend the special session to July 31. Veto overrides must begin in their chamber of origin, so House members were unable to vote on SB 26X today owing to the House’s absence.

The pending special session extension could give the House and the Senate time to work out disagreements on other budget bills that have stalled. The special session was originally scheduled to adjourn sine die June 30.

McCall (R-Atoka) said that taking up other legislation besides the overrides will be a possibility, but he expressed skepticism that the two chambers could overcome the disagreements to get the five unapproved budget bills to the finish line.

“There are three budget-related bills in the House that we did not take up because the Senate failed two of the budget bills in their chamber,” McCall said. “So, we’ve had communication about are they going to reconsider those bills and pass them or not. And we’re still waiting. But as of right now, they do not plan to bring those up for reconsideration. So, unless that dynamic changes, we will only come back to hear their overrides.”

Those three bills stalled in the House are:

- SB 11 to turn the Tourism and Recreation Commission back into a governing body;

- SB 22 to establish a fund and rules for the Oklahoma Museum of Popular Culture to receive $18 million contingent on matched fundraising;

- SB 27 to direct $12.5 million to the County Community Safety Investment Fund, which was created in line with State Question 781 to reallocate criminal justice reform savings to community mental health efforts.

The two bills that failed in the Senate are HB 1022X to create a new “judicial performance evaluation” program and HB 1026X to increase future statewide elected official pay.

‘Fundamental misunderstanding’

Stitt vetoed two bills relating to tribal compacts May 31: HB 1005x, regarding motor vehicle registration, and SB 26x regarding tobacco. Veto overrides must originate in the chamber of the bill’s origin, so the House could only vote on HB 1005x. If the Senate votes to override the SB 26x veto, the House will then be able to override that veto.

The two bills would not change the compacts the state has with the tribes but rather extend them through Dec. 31, 2024.

In his veto message, Stitt challenged the legality of passing the bill through a special legislative session and the legality of the Legislature’s ability to act on tribal compacts at all. Stitt also said that tribal compacts were outside the scope of the call of the special session, which reads in part that the purpose of the session is to address “legislation related to implementing and administering budget related funds.”

“Both because this bill amounts to circumvention of the executive’s authority to negotiate compacts and because it is not in the state’s best interests, I must veto it,” Stitt said in his veto message, embedded below.

House members addressed each concern on the floor before voting to override the measure, 74-11. Sixty-seven House votes, or two-thirds majority, are necessary for an override.

Calling Stitt’s concern with the legality of the special session a “fundamental misunderstanding of how days occur and the legislative process,” House Majority Floor Leader Jon Echols said nothing constrains the Legislature from running a concurrent special session to pass bills.

Echols also said that because the potential failure of the compact extensions would cause the state to lose revenue, the bills do fit into the scope of the special session call.

“Any time you are talking about either cutting or lowering revenue — either one — it clearly goes towards budgets,” said Echols (R-OKC).

House Democratic Leader Cyndi Muson agreed, saying in a statement that without the continuation of such compacts, there would be a negative effect on the state budget due to loss of revenue.

“The 38 federally recognized tribes in Oklahoma are sovereign nations and are important partners in developing and growing our state’s economy,” said Munson (D-OKC). “The tribes send millions of dollars of revenue to the state and the compacts have worked very well over the years. Simply put, if it’s not broken, don’t fix it, especially if it will involve long, expensive legal battles in court that may result in less revenue for the state of Oklahoma.”

Echols also addressed questions whether the compact extension circumvents the governor’s power to negotiate with sovereign nations while emphasizing his support of Stitt.

“I think the governor is doing a great job. I’m supportive of the governor,” Echols said. “That doesn’t mean that I support everything that’s done. (…) I’m married to my high school sweetheart, I promise you she doesn’t support every decision that I make, and she loves me. So, no, the Legislature exercising their authority has no bearing as to whether or not another branch of government can exercise their authority, and that’s what we’re doing, we’re exercising our authority.”

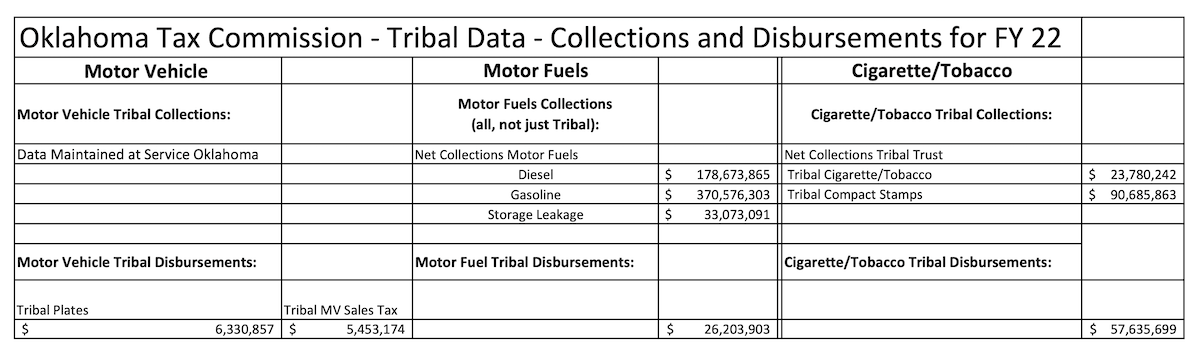

Last week, the Oklahoma Tax Commission provided NonDoc with data related to compact-related collections and rebates. For Fiscal Year 2022, $90.7 million in excise taxes were collected on cigarettes sold to tribal-owned businesses, and $23.8 million in excise taxes on pipe tobacco, chewing tobacco and large cigars.

With most state-tribal tobacco compacts featuring a 50 percent split on the taxes, the state of Oklahoma rebated more than $57.6 million back to compacting tribal nations in Fiscal Year 2022.

Data provided by the Oklahoma Tax Commission is less clear for motor vehicle tax revenues, with the agency noting that applicable data are “maintained at Service Oklahoma,” a separate state agency.