While the first nine weeks of session have yielded critical report cards from each legislative chamber about the other’s budget negotiation processes, the general public now has access to more materials and transparency guardrails than any time in recent Oklahoma history.

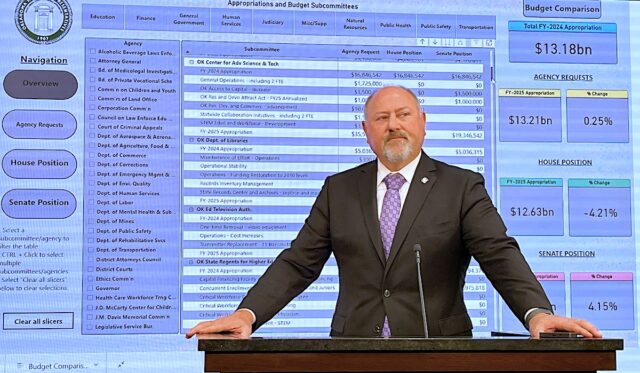

This morning, after weeks of uncertainty about how they would respond to the Senate’s new transparency approach, House leaders launched an online budget dashboard for public comparison of each chamber’s official negotiating position, as well as state agency requests.

House Speaker Charles McCall (R-Atoka) and House Appropriations and Budget Chairman Kevin Wallace (R-Wellston) presented highlights of the House Republican Caucus’ negotiating position, which includes a 0.25 percent personal income tax rate reduction, a proposed $71 million increase for transportation, a proposed $10 million one-year commitment for compensation boosts at county sheriff offices, and a proposed new headquarters for the Oklahoma State Bureau of Investigation, whose cadre of liaisons and executives has been present at the Capitol more than usual this session.

“We think it’s a conservative budget. We think it’s a strong budget,” McCall said. “This budget reflects the House’s position. As you kind of dig through this budget, you’re going to see a theme probably within that budget. The House believes that the people of the state of Oklahoma need to get a pay raise through a tax cut.”

McCall said the House GOP Caucus has been operating all session on its online budget portal, which he called “a new layer of transparency.”

“When I came in as speaker, that was probably the biggest criticism from our caucus, that they would like to see more transparency in our processes,” McCall said. “We had criticism from the public that they thought the processes were too closed and they would want to see them opened up. So this has been an eight-year revolution for the House of Representatives.”

Similarly, McCall reiterated his pledge to make sure budget bills advance through the Joint Committee on Appropriations and Budget process only after they have been published for at least 24 hours prior to consideration.

“Keep the members of the Senate and the governor aware of that internal requirement of ours for transparency purposes and for comment by citizens and just their overall understanding and knowledge before we put up budget votes in the [JCAB],” McCall said.

Senate, House start about $1.1 billion apart

Senate Appropriations and Budget Chairman Roger Thompson (R-Okemah) said he watched the House press conference Tuesday morning and called it “a great start,” a distant departure from criticisms logged a fortnight ago when an appropriations committee was cancelled abruptly.

“The overall goal was transparency. Who gets credit for that in the end, I really don’t care,” Thompson said. “But the people of Oklahoma have a right to know what we’re doing with taxpayer dollars.”

Thompson and Wallace are set to have lunch today to continue their annual negotiation conversations. A Senate Appropriations and Budget Committee meeting has been set for 10:15 a.m. Thursday, indicating that the upper chamber will extend its deadline to hear House budget-related bills it had held up while waiting for House spreadsheets.

According to the online portal, the House and Senate are about $1.1 billion apart in their negotiations. The House’s proposed income tax cut — which would be triggered by at least $400 million of revenue growth — carries a $96 million price tag for Fiscal Year 2025 and a $230 million annualized cost for subsequent fiscal years. On the Senate’s side of the ledger, proposed common education appropriations are about $120 million higher than the House’s mostly flat proposal. Senators have also proposed $120 million in grant funding for local water projects.

“I like the portal. I think it looks good,” Thompson said. “Some of the numbers they have on there we would question, for instance like the $145 million where I ran a bill to pull back from (the Department of) Commerce, they’ve actually got that on the Senate side as an expenditure. It is not. We just kind of pulled it back, so it should just be in the base.”

A pair of Thompson’s colleagues also praised the concept of the House portal, although they had yet to see it while conducting floor work Tuesday morning.

“I love transparency,” Senate Floor Leader Greg McCortney (R-Ada) said.

Assistant Senate Floor Leader Lonnie Paxton (R-Tuttle) agreed, calling it “a positive development.”

Gov. Kevin Stitt called it “fantastic” after speaking on the House floor Tuesday.

“Right now the House and Senate are arguing about how to be more transparent. I think it’s awesome,” Stitt said. “When I called the special session after last year, I said nobody likes budgets being done at the very, very last (moment). We want to be able to review those budgets. Oklahomans need to review them. So that was the whole idea: Let’s just put some transparency — let’s get the budget process more out in the open, and I applaud both the Senate and the House for doing that. They’re doing great.”

Stitt reiterated his call for an income tax rate reduction, which he emphasized during his annual State of the State address.

“Oklahomans need to ask themselves this question: If the House and Senate can spend a $1.5 billion in savings, can they at least do a quarter-of-a-point tax cut?” Stitt queried. “Think about that realistically. (…) Every time we’ve done that, we’ve actually increased (revenue collections). If you look at Arkansas now, if you look at Iowa, if you look at Nebraska, all of these other states are starting to move down below our tax rate. We cannot let that happen and be an outlier with higher income tax rates and business tax rates than states around us.”

Senate Republican leaders, however, have said they already approved the only major tax cut they intend to pass this session. In February, the Senate approved a pending House bill to eliminate the state’s portion of sales tax on groceries, which is expected to have a roughly $418 million reduction in revenues on an annualized basis.

“First of all, I have never supported [the income tax cut] because we’re going to need the revenue down the line,” Thompson said. “Second, [President Pro Tempore Greg Treat] has been very strong. We did the grocery sales tax (elimination), and he said whenever we did that that it was all the tax cuts we were going to do this year. That is still his position, he has not changed that position, and I support him in that position.”

Asked if the majority of the Senate GOP Caucus still feels the same way, Thompson responded affirmatively.

“As far as I know,” he said. “There has been no discussion otherwise.”