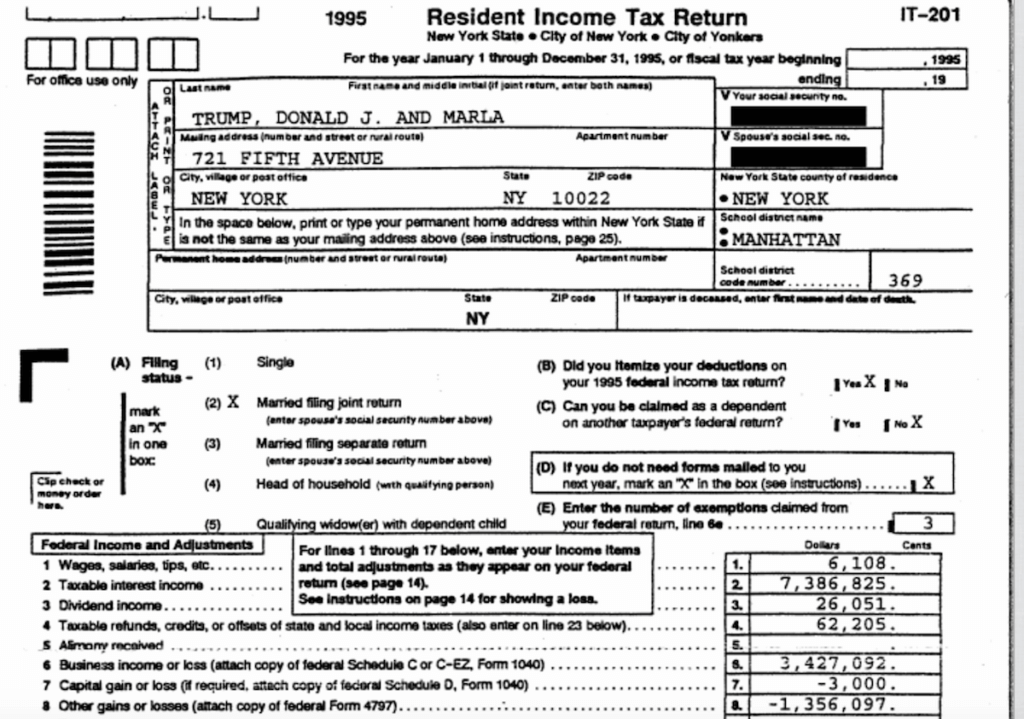

Donald Trump’s tax saga will be heating up this week after the New York Times published details of the mogul’s 1995 tax return Saturday night.

Tax experts cited by the Times noted how a $917 million loss reported that year could have allowed the 2016 GOP presidential nominee to avoid paying income taxes for up to the next 18 years, or roughly until 2013.

That sort of benefit highlights both a weakness of the candidate’s potential appeal to middle- and working-class voters and a weakness of the American tax system.

A busy and boastful businessman

Trump, of course, has filed bankruptcy on six occasions, four times in the early 1990s, once in 2004 and once in 2009.

Politifact notes that “experts told us Trump shouldn’t bear all the responsibility” because several of the bankruptcies were related to struggles of the casino industry overall.

But Trump’s bankruptcies already served as a reminder that he lives in a world most of us don’t; a world filled with complex financial relationships and literally thousands of lawsuits.

The Times’ report on Trump’s 1995 taxes only furthers that impression.

Where there’s smoke, one usually finds fire

If we hearken back to the 2016 primaries and rampant GOP-establishment concerns about Trump’s viability as a general election candidate, many political insiders worried about Trump’s complicated and unusual business record as a political liability. Some predicted an absolute blowout for Democrats, though clearly they were wrong.

But Trump’s survival thus far in the polls does not answer questions about his most controversial business activities, a la Trump University, which is the center of ongoing state investigations as we speak.

Media have also been criticized of late for not asking tougher questions of the candidate. Some have begun being more direct.

Trump was asked in last week’s debate whether Americans have a right to know what his tax returns include, and his answers were not answers at all. They were despicable vagaries that even Trump’s most ardent supporters could see as smoke for a hidden fire.

Just what that fire is, however, remains unclear.

The 1995 tax information gives the public only a minuscule part of the picture. And if Trump takes any umbrage at the Times for running a story about those leaked pages of his tax returns, he has only himself to blame for not releasing them all.

Evidence of a problematic tax code

In the end, Trump’s potential avoidance of 18 years of income taxes highlights the rich-person benefits that many of America’s angriest voters rightly perceive. As has been written before on NonDoc, many Trump supporters and Bernie Sanders supporters appeared angry at the same types of unfairness this primary season. In the video above, Sanders emphasizes that American anger at the government and the desire for change stems largely from a cozy relationship between big business and legislation that provides favorable conditions for billionaires to avoid paying taxes while those making minimum wage lack the same benefits.

But with Trump a beneficiary of America’s problematic tax code, an even bigger question about the billionaire’s candidacy appears: Can the public trust Donald Trump to close the loopholes to which he owes some of his success?