After six hours of delay, GOP House leadership ran a new measure on gross production taxes through committee late Monday evening that would raise about $95 million in new state money without technically raising taxes, at least according to Republicans.

HB 2429 raises from 1 percent to 4 percent the incentive rate for gross production taxes on oil and gas wells that went into production between July 1, 2011, to July 1, 2015. Rep. Kevin Wallace (R-Wellston) said more than 5,000 wells fall into that range, which has largely been ignored in broader GPT negotiations.

During the meeting, the bill’s text was not available online to the public or press. It became available soon after the hearing.

“What you have before you is a 300 percent increase on the incentive from 1 percent to 4 percent, and it is going to bring in $95 million and about $74 million for the [General Revenue Fund],” said Wallace, the House Joint Committee on Appropriations and Budget vice chairman.

But House Minority Leader Scott Inman (D-Del City) criticized GOP leadership for refusing to hear a gross production tax incentive hike to at least 5 percent for new wells.

“We need revenue, and the gross production cuts over the last number of years have decimated our budget,” Inman said in debate against the bill. “And when the public cried out loud to go from 2 percent to five or seven, this Legislature said we’ll leave it at two. And if you vote yes on this bill, that’s exactly what you’re doing.”

House Majority Floor Leader Jon Echols (R-OKC) said GOP leadership would raise the entire incentive rate on new wells from 2 percent to 4 percent, but he blamed Inman for not offering the Democratic caucus’ 26 votes to help reach the three-fourths 76-vote requirement on such a measure.

“It became clear that we reached an impasse with the Democrats. I don’t have the votes in my chamber to pass a 5 percent GPT increase,” Echols said. “Rep. Inman knows that. I do have the votes in my [caucus] to pass a 4 percent GPT increase. It became clear there was an impasse, and we had to find a way to pass a budget that only included 51-vote measures.”

Echols said the bill dealt with a raise on a “true incentive” or “rebate,” and he said courts have ruled in the past that rebates can be passed with 51 House votes.

“We’ll have more bills coming out tomorrow, and an announcement of a budget deal soon,” Echols said.

Another bill from Monday

Earlier Monday, HB 2403 passed the House floor 56-40. It limits the state’s itemized deduction to $17,000, excluding charitable donations. Some lawmakers criticized that bill’s passage Monday as being after deadline for bills with a specific purpose of raising revenue.

“Anything that we do now that’s revenue raising should be done in a concurrent special (session), otherwise it will be challenged and could be potentially thrown out,” said Rep. Jason Dunnington (D-OKC) who voted for the bill. “It just doesn’t make sense to do it now and not in a concurrent special session. I think it speaks to the general nonsensical way that we’ve put this budget together.”

Oklahoma Council of Public Affairs president Jonathan Small announced Monday evening that his organization would challenge the constitutionality of HB 2403, as well as two other measures.

“House Bill 2403 is an unconstitutional tax hike on working Oklahoma families and senior citizens. Should House Bill 2403 become law, we intend to challenge its constitutionality at the Oklahoma Supreme Court as a violation of State Question 640,” Small wrote in a release. “House Bill 2403 is designed to raise revenue for state government, but it passed the state House of Representatives with far less than a three-fourths vote. This makes it a blatant violation of Oklahoma’s Constitution, suggesting our state’s highest Court would strike it down.”

Back in JCAB, the ‘swag bill’ gets slaughtered

The only other bill House JCAB heard Monday night was HB 2405, which remains unavailable to the public as of publication of this post.

The bill was said to prohibit executive state agencies from purchasing “non-essential” promotional items, such as coffee mugs, folders, calendars and coasters, all of which Rep. George Faught (R-Muskogee) pulled out of a cardboard box while presenting the bil.

“In 2014, [Secretary of Finance Preston] Doerflinger estimated that the amount of swag that had been spent over the year was about $28.5 million,” Faught said.

But numerous committee members questioned whether the bill would prohibit state agencies from promoting suicide prevention, and other members questioned why high school students might not be able to receive ribbons at competitions under such language.

Dunnington also hammered Faught on whether the bill was an OCPA request bill. Faught said no, though many people in attendance disagreed.

The bill failed 4-22.

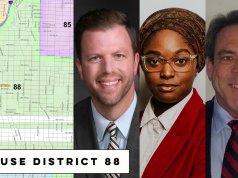

HB 2429

Loading...

Loading...

HB 2403

Loading...

Loading...