The Oklahoma Supreme Court issued its ruling today in the second of three legal challenges concerning the 2017 Legislature’s budget agreement. While the court overturned the cigarette fee earlier this month, it upheld lawmakers’ repeal of a sales tax exemption on motor vehicle purchases by a 5-4 decision.

State leaders already expect a special session to be called to address a $215 million shortfall for health care agencies created by the court’s first ruling, but GOP leaders had called for patience in waiting for the court’s other rulings.

Thursday’s decision that the motor vehicle sales tax exemption was lawfully removed in the final days of session came from a split court. The majority decision was written by new Justice Patrick Wyrick, who also authored the decision on the cigarette fee. Wyrick was joined by Vice Chief Justice Noma Gurich, Justice Yvonne Kauger, Justice James Winchester and Justice John Reif.

From the decision:

We are compelled to reach this result for three primary reasons. First, our cases have long held that measures making “certain property … theretofore exempt from taxation … subject to taxation” are not “revenue bills” because removal of an exemption from an already levied tax is different from levying a tax in the first instance. Second, while that rule may seem superficially inconsistent with Article V, Section 33’s taxpayer protections, it is actually deeply rooted in our Constitution’s related policies that disfavor special exemptions from taxation and promote uniformity of taxation — policies that are also designed to protect the taxpayers. And third, because we have never before in our history held that a measure revoking a tax exemption is a “revenue bill,” and because we have explicitly held that such measures are not “revenue bills,” to hold otherwise would require us to break new ground and overrule well-established precedents. To do so would be to deprive the Legislature and the people of the legal predictability, uniformity, and clarity that it is our obligation to provide. Accordingly, we must deny Petitioners the relief they seek.

Petitioners in the challenge were the Oklahoma Automobile Dealers Association, L and J Acquisitions, LLC (doing business as Battison Honda) and Caitlin Cannon.

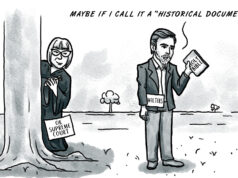

The remaining challenge before the court is from Tulsa attorney and 2018 GOP gubernatorial candidate Gary Richardson.

In the motor vehicle sales tax case, Justice Joseph Watt and Chief Justice Douglas Combs each wrote dissenting opinions. They joined each other’s dissenting opinion, and Justice Tom Colbert joined both. Justice James Edmondson joined Watt’s opinion.

The opinions are embedded below.

Justice Wyrick majority opinion

Loading...

Loading...

Justice Watt dissenting opinion

Loading...

Loading...

Justice Combs dissenting opinion

Loading...

Loading...