A new poll commissioned by a group of longtime Oklahoma oil and gas executives says two-thirds of the voting public wants to eliminate the state’s low gross production tax (GPT) incentive rate.

New oil and gas wells drilled (or spudded) in Oklahoma are taxed at a 2 percent rate for the first 36 months and a 7 percent rate thereafter.

While the state’s largest petroleum companies and the influential trade associations they control oppose elimination of the incentive rate, the strong support indicated by the Oklahoma Energy Producers Alliance poll means the Oklahoma Legislature should take a vote on increasing the incentive rate during the special session set to begin Sept. 25.

To do otherwise would be ignoring the desires of the people.

What GPT percentage is ultimately put on the board for a vote in the Oklahoma House of Representatives will be up to GOP leadership, but Republicans would be foolish not to recognize that citizens want oil companies — especially the largest ones and especially those headquartered out of state — to pay an Oklahoma GPT more equivalent to what they face in other states.

GPT change supported across political spectrum

The OEPA released its gross production tax polling data Thursday evening during a media a dinner at Paseo Grill in Oklahoma City. The OEPA is headed by more than a dozen former directors of the Oklahoma Independent Petroleum Association (OIPA), including Mike Cantrell, Dewey Bartlett and Darlene Wallace.

The OIPA is hosting its own media “seminar” on the GPT today.

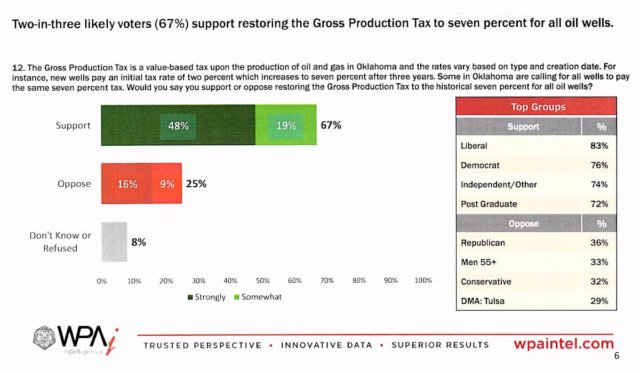

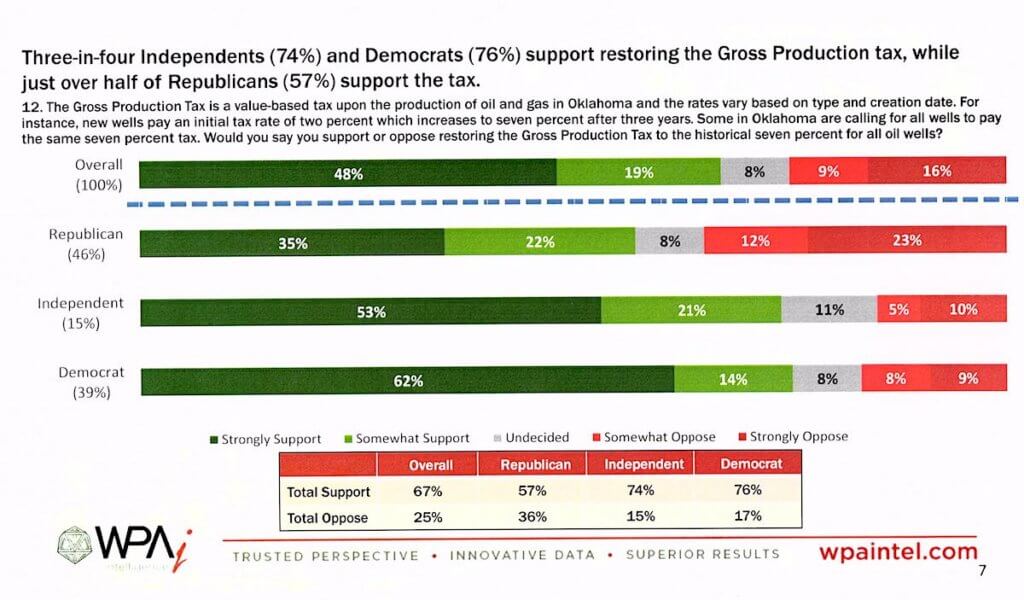

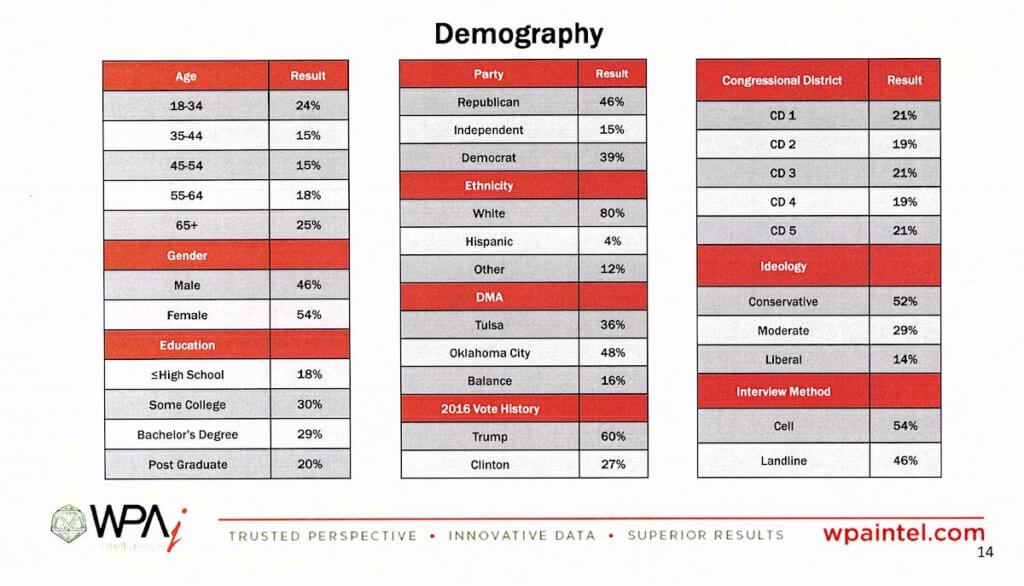

With a sample size of 503 likely voters and a 4.4 percent margin of error, OEPA’s poll showed 67 percent support for “restoring the gross production tax to the historical 7 percent for all oil wells.” The poll was conducted Aug. 28-30 by WPA Intelligence, a firm run by Oklahoman Chris Wilson.

The poll found support for eliminating the GPT incentive rate among 74 percent of independents, 76 percent of Democrats and 57 percent of Republicans surveyed. Republicans opposed the question at the largest rate — 36 percent.

“With a special session coming up in two weeks, we’re hoping to get some ground-swell about this,” Cantrell said during the OPEA dinner.

Who will McCall listen to?

Facing a string of losses in special elections for legislative seats, GOP leadership would be foolish not to consider the public’s opinion on a list of items including the GPT incentive rate and teacher pay.

But House Speaker Charles McCall (R-Atoka) has released multiple statements saying the only new revenue effort he supports for this special session is the long-discussed and oft-bungled cigarette tax. Democrats declined to support that tax in this year’s regular session unless it was paired with an increase to the GPT incentive rate, and both sides failed to strike a bipartisan deal while arguing over small percentage points and who offered what to whom when.

But the polling data released by OEPA indicates the public supports Democrats’ request that the GPT incentive rate be changed. As a result, McCall will not be doing himself any favors with the public if he refuses to consider GPT in special session.

The only favors he’d be doing would be for oil and gas leaders who disagree with OEPA’s call for a flat 7 percent GPT rate.

28-30 poll. (Scan)