(Correction: An earlier version of this story incorrectly listed the cigarette tax rate. Story has been updated below to reflect the proper rate. NonDoc regrets the error and any confusion it may have caused.)

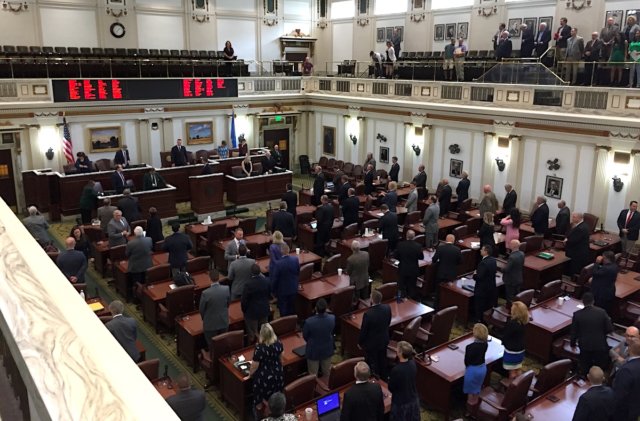

After Oklahoma’s 56th Legislature gaveled in this afternoon for the state’s first special session since 2013, House of Representatives leadership said passage of the storied $1.50 cigarette tax is top priority in filling a $215 million budget hole.

“First priority of the House (…) will be to take up the tobacco tax,” House Speaker Charles McCall (R-Atoka) said Monday. “That is the issue that will fix the hole that’s been created, and to the extent we can do that, that dictates other conversations we’ll have.”

HB 1099 would implement a new $1.50 per pack cigarette tax. House Majority Floor Leader John Echols (R-OKC) said the bill will be on the JCAB agenda when members meet tomorrow.

“Once we know what happens with the cigarette tax, I think that’s going to clear up everything,” Echols said. “And, hopefully, if we can pass the cigarette tax, I would put chances very high that we would have the ability to fill this hole and accomplish a teacher-pay raise this session. My guess is it would run between two weeks and three weeks.”

But with 76 House votes needed to pass a cigarette tax that would fill the majority of the state’s $215 million hole, Echols’ “guess” remains just that. Republicans hold only 72 House seats, and about a dozen of those members showed strong opposition to any revenue measures during regular session.

House Minority Leader Scott Inman (D-Del City) said his 28 caucus members will vote their conscience if the cigarette tax reaches the House floor Wednesday as anticipated.

“If they bring that up on Wednesday, my caucus will vote according to what their constituents have called for,” Inman said. “Some have said they wanted to vote for it outright. Some have said they want to vote for it with more revenue than just that. Our caucus will give the speaker ample votes to pass it if he can lead his caucus.

“He needs at least four of our members. He will have many more than that if he can lead his team to do what he thinks is right, he can pass it outright.”

‘The gross production tax’

During regular session, Inman led calls for Oklahoma to raise the gross production tax incentive rate, which applies to the first 36 months of oil and gas production after a well is spudded.

Monday, the Democratic gubernatorial candidate reiterated that GPT should be part of a recurring revenue package that would restore funding for state agencies providing health care, education and infrastructure.

“I think what we need is a grand bargain that honors the will of our constituents. My members have gone back home the last several months and listened to folks at the coffee shop and the church and at local business,” Inman said. “They’ve heard loud and clear the cigarette tax isn’t the only solution. We’ve got to find real recurring revenue to try to increase teacher pay, reinvest in health care and roads and bridges. And most people are saying that part of that has to be an increase in the gross production tax. A gross production tax increase married to a cigarette tax increase is something our caucus would support.”

Asked multiple times each whether GPT is on or off the table, Echols and McCall offered slightly different answers, but both noted oil and gas tax incentives taken off the books over the past two years.

“We addressed GPT in the last regular session. We moved the largest group of wells from 1 percent to 4 percent, which put $100 million in the current budget,” McCall said. “We also took away some tax incentives for oil and gas that took about another $50 million. The previous year we hit them on the marginal wells about $100 to $110 million. There may be some further discussion on that this special session, but in terms of what the Legislature has done the last two session, we’ve addressed GPT to the fullest extent we’ve had consensus for.”

But pressed as to whether GPT is on or off the table, McCall responded: “Right now, it’s not what our caucus is focused on.”

Echols gave a broader answer.

“Everything is on the table for House leadership. That includes GPT. That includes wind. That includes reforms,” Echols said. “Now, do we want to balance the budget of the state of Oklahoma by continuing dependence on an oil and gas industry while we’re experiencing an economic resurgence? We really need to look at that. We have real problems if drilling slows down. We need to make sure we don’t do anything that slows down drilling.”

Inman disagreed.

“The gross production tax absolutely should be on the table for the House Republicans. It has been in negotiations between myself and the governor,” Inman said. “The constituents that we’ve heard from, the citizens of this state, are much more behind an increase in the gross production tax than any other increase out there.

“It’s got to be part of the solution. It’s not the only solution. It has to be part of it, and for them to ignore the will of their constituents is wrong, and they may pay a price for it at the next election cycle as they have the last two special elections in the House.”

Estimated timelines

While exactly what will happen in the special session remains speculative, the requirements of Oklahoma’s Constitution and the House and Senate’s rules offer a basic time frame of action.

For instance, all revenue measures must originate in the House of Representatives, thanks to Article 5, Section 33 of the Oklahoma Constitution. (Additionally, that section requires revenue measures to be voted on prior to five days before the end of a session. Functionally, that means lawmakers will likely remain in session for one working week after any revenue agreement is finalized.)

Lawmakers filed far more bills — 51 in the Senate and 143 in the House — than will actually be heard in the special session. To view those bills, the public can go here and click “Introduced” under “Selected Step Reports” on the left side of the screen.

House JCAB set to hear cigarette tax Tuesday

House bills received “first reading” today, and at least six appear scheduled for a “second reading” Tuesday. That would allow them officially to be assigned to committees.

The House Joint Committee on Appropriations and Budget’s agenda includes the following bills:

- HB 1018 allows for adjustments to agency allocations.

- HB 1019 also allows for adjustments to agency allocations and appears identical to HB 1018.

- HB 1031 is currently a shell bill titled the “FY 18 Budget Adjustment Act.”

- HB 1042 is also currently a shell bill titled the “FY 18 Budget Adjustment Act.”

- HB 1043 is also currently a shell bill titled the “FY 18 Budget Adjustment Act.”

- HB 1099 implements a new $0.75 cigarette tax.

Lawmakers have returned for special session owing to the Oklahoma Supreme Court’s ruling that a $1.50 cigarette “fee” was unconstitutional for its violation of Article 5, Section 33 of the state Constitution.