Oklahoma oil and gas companies are good at fracturing rock to procure petroleum, but the enormous pressure of an ongoing special session has exposed fissures in the industry’s advocacy efforts.

The House of Representatives punted last week on a Senate-requested increase in Oklahoma’s gross production tax incentive rate, but a bill passed Wednesday would make specific (yet publicly unclear) Oklahoma companies swallow a separate GPT increase that would not last as long.

HB 1085X would bring in more immediate money to fill the state’s current budget hole for health services, but its net impact would last only a year and a half because affected wells are set to reach 7 percent GPT on July 1, 2019.

The result? Individual players in the oil and gas industry have been debating among their advocacy organizations whether to support, oppose or remain neutral on HB 1085X, according to more than a dozen lawmakers and lobbyists who discussed the issue with NonDoc on the record and on background.

“They are all over the board, both on the pure gross production tax and on the legacy wells,” said one elected official who is privy to budget negotiations and petroleum company lobbying efforts. “More so on the legacy wells. There are less oil and gas guys willing to say they are for the 4 percent gross production tax, but they are out there.

“This is a huge internal strife, mainly in OIPA, but somewhat in OKOGA as well.”

Underscoring that point, the vice president of communications for the Oklahoma Independent Petroleum Association told NonDoc the group wanted to “refrain from public comment until the Senate takes action” on HB 1085X.

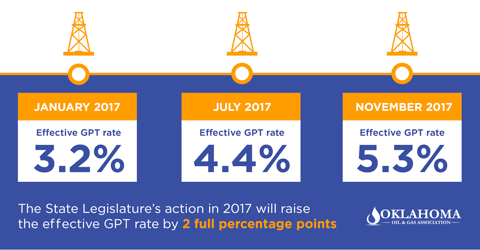

Meanwhile, the Oklahoma Oil and Gas Association distributed a press release Wednesday that noted four tax increases the industry has shouldered since 2015.

“With this bill, the Legislature will raise the effective GPT rate by two full percentage points since 2016 to the tune of $412 million additional tax dollars from the oil and natural gas industry,” OKOGA president Chad Warmington said in the release. “These GPT increases, and the constant chatter of another tax increase next year, has made Oklahoma’s business environment uncertain and unreliable. This is going to slow valuable momentum for achieving Oklahoma’s full energy recovery.”

OKOGA’s vice president for communications Donelle Harder said the organization’s board met and voted in September to oppose gross production tax increases.

“OKOGA’s board has met since that vote took place to discuss tax proposals at the Capitol, and we continue to be opposed to any further increases to GPT,” Harder said.

‘Fix this mess’

Whether the Senate hears the bill raising legacy-well GPT — for a second time this year — remains to be seen. Early Wednesday evening, a half-dozen GOP senators discussed their frustrations.

“We still want to have what I call A+, the original package with the gross production tax that got the 11-11 vote in committee,” said Senate Majority Floor Leader Greg Treat (R-OKC). “We still want that, but if that’s an impossibility, we’re looking at how do we close this special session out? That’s part of the discussions we’re having ongoing with the House and the governor. The 4 to 7, as I call it, the legacy wells deal is part of that discussion.”

RELATED

Seven percent GPT initiative ‘could exacerbate’ oil and gas tension by William W. Savage III

Asked what he is hearing from constituents, freshman Sen. Adam Pugh (R-Edmond) said the public’s message seems simple to him.

“It’s the same thing I heard when I was campaigning: Fix this mess,” Pugh said. “I think people are hurting in this state. I think they’re rightfully frustrated. I’m not sure that one-time money and a bunch of cuts is the way to get out of here.”

Gathered in the office of Sen. Roland Pederson (R-Burlington), Sen. Marty Quinn (R-Claremore) and Sen. Paul Scott (R-Duncan) expressed their disappointment over the House preventing a compromise vote.

“We had an opportunity to make a deal where we went from 2 percent to 4 percent on new wells for 36 months, and we unlocked a lot of other revenue — cigarette tax, fuel tax — that would have been a long-term solution to the problem we’re in,” said Pederson, a rancher and retired educator. “We’re going to be right back in patching these holes with small revenue, and next session we’re going to be under water again with the same argument we had this time.”

Quinn summed up the legacy wells bill as a “short-term Band Aid for a long-term problem.”

“It’s not going to solve our issues. We’re still going to be trying to balance the tax structure, and the only way you’re going to balance the tax structure is you’re going to have to include the industries like oil and gas,” Quinn said. “You’re going to have to include the people who want to make Oklahoma a better place. It has to be top to bottom. It can’t just be oil and gas.”

Scott said he and his Senate colleagues came to the Capitol to vote, either up or down, on proposals, but House leadership prevented that.

“My guys in my area, I got a lot of vertical drillers,” Scott said. “A lot of them are members of the OIPA and they’re also members of OEPA, and their thoughts are that they want all GPT to go to 7 percent across the board. New wells, legacy wells, whatever well it is. They just want it back to 7 percent where it was before.”

The Oklahoma Energy Producers Alliance (OEPA) is pushing a 7 percent GPT ballot initiative.

Sen. Gary Stanislawski (R-Tulsa) said the legacy wells bill could be part of a special session solution, but he wants more budget details.

“We’d heard it could be as much as $48 million. It’s certainly a possibility,” Stanislawski said. “There’s a number of us that would consider supporting legacy wells if we can see more details on the rest of the budget plan. We just don’t want to piecemeal a budget.”

Follow NonDoc:

Legacy wells: ‘A piece of the fix’

On the House floor Wednesday afternoon, Rep. Dennis Casey (R-Morrison) was asked numerous questions by Democrats about the accuracy of the bill’s revenue estimates and how many wells would be affected by the change.

“This would obviously be off of wells that are producing. It’s not like they threw a dart at the board and picked a number,” Casey said. “This (report from the Oklahoma Tax Commission) says 6,600 wells, but I couldn’t tell you the number of wells we’re talking about.”

But Rep. Jason Dunnington (D-OKC) emphasized the difference between spudded wells — meaning drilling was started — and completed wells, meaning wells that are producing oil and gas. He also pointed to a release from Oklahoma State Treasurer Ken Miller, saying it showed the original raise of GPT from 1 to 4 percent on legacy wells is bringing in less money than GOP leaders claimed it would.

“I just hear a lot of frustration from the Senate that they believe the House is just playing games,” Dunnington said at a House Democrats press conference following Wednesday’s vote.

The bill ultimately passed 64-31 with the emergency clause passing 75-18. That means the bill, if heard and passed by the Senate, would take effect Dec. 1.

“I’m optimistic, and I’m hopeful that the Senate will pass this,” said House Majority Leader Mike Sanders (R-Kingfisher). “Yes, the measure does hit the oil and gas industry.”

Sanders noted that HB 1085X would bring in more money for the current fiscal year, though in the long run it would do less for recurring revenues.

“This issue is completely complex. Somewhere, the narrative has been lost,” Sanders said. “Some media outlets and some members say, ‘Just raise gross production taxes and that fixes everything.’ That’s not true. That’s not true at all. Is it a piece of the fix? This right here, what we passed in the House on legacy wells, is a piece of the fix.”