A group of energy executives has sent Oklahoma Gov. Mary Fallin a letter asking “to be included” in ongoing revenue negotiations that feature new potential taxes on wind production.

Dated Dec. 22, the letter was sent to Fallin’s policy director, Katie Altshuler, by nine energy company executives and the president of The Wind Coalition who expressed “concern and frustration with representations that other industries in Oklahoma’s business community are recommending limiting, reducing or repealing current tax policy for electricity generation facilities powered by wind.”

The letter begins:

Earlier this week, representatives from NextEra Energy, Enel, Southern Power, Apex Clean Energy, E.ON, Invenergy, and Tradewind Energy met with a representative from your office. We were joined alongside our partners at the State Chamber and the Wind Coalition. Not present, but represented through our collective efforts was General Electric, Exelon, Duke Energy and several other companies with investments in Oklahoma.

Together, these companies and their financial partners have brought more than $20 billion of capital investment in energy infrastructure to Oklahoma. We acknowledge the work the Legislature must accomplish in this second special session and appreciate the opportunity to express our concern with various proposals being discussed in the Capitol.

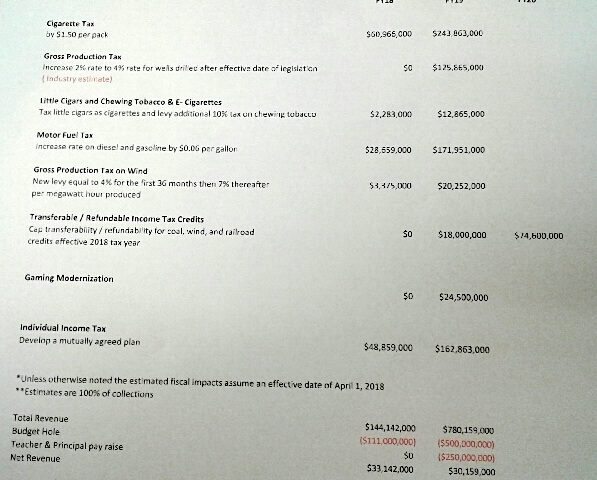

According to a photo of a document obtained by NonDoc, the “various proposals” troubling the industry include a “cap” on the transferability and refundability for “coal, wind and railroad credits effective 2018 tax year” as well as a new “gross production tax on wind.”

Adding a GPT for wind has been pitched by certain oil and gas executives as a way to broaden the state’s taxation burden across the energy industry. Specifically, numerous lawmakers and Capitol insiders have told NonDoc that Continental Resources CEO Harold Hamm has led that charge, but other oil and gas producers have been involved as well.

In a recent interview with NonDoc, Oklahoma Independent Petroleum Association president Tim Wigley noted that fostering at least “a discussion” about wind energy taxes was a “legislative priority” for his group in 2017.

Michael McNutt, Fallin’s communications director, responded to the Dec. 22 letter in a statement.

“The coalition of community leaders interested in helping with our state budget was not formed by the governor,” McNutt said. “This group of community leaders approached the governor’s office and legislative leaders concerned about the future of Oklahoma, saying they wanted to help solve problems and issues facing the state at this time. The governor is always interested in hearing constituents’ ideas and solutions on how to deal with our state’s budget challenges and provide teachers a pay raise.”

‘I don’t think any industry should speak for another industry’

While Rep. Mike Sanders (R-Kingfisher) said Wednesday that he had not heard of the wind industry’s Dec. 22 letter to Fallin, he said those companies should “be at the table.”

“Any industry that we’re looking at for any type of new tax absolutely needs to be brought to the table. I don’t care what industry or what program we’re discussing,” Sanders said. “I don’t think any industry should speak for another industry.”

Sanders said he finds himself in the middle of the ongoing political fight between the petroleum and wind industry, as his western Oklahoma district contains a chunk of the STACK oil and gas play while also featuring substantial wind investments.

“I acknowledge and appreciate both of these industries with their investments in Oklahoma, and I surely don’t want either one of them to take major hickeys when the economy is starting to improve,” said Sanders, who voted in favor of the Legislature’s last grand revenue proposal that featured a hike in the GPT incentive rate for oil and gas.

RELATED

Oil, gas, wind: ‘Uncertainty’ hurts industry investments by William W. Savage III

But Rep. Mark McBride (R-Moore) has taken a slightly different position. Having voted against the GPT measure in November, he said Wednesday that the wind industry being in the discussion is a step in the right direction.

“If wind is in it in some form or fashion, then I’m willing to consider voting for the gross production tax on oil and gas,” McBride said.

McBride is vice chairman of the House Energy and Natural Resources Committee and is known to be one of the House GOP Caucus’ most vocal opponents to raising GPT. Throughout 2017, he has characterized any GPT increase as a way to decrease drilling in the state. At the same time, he has criticized tax credits and ad valorem tax exemptions previously available for wind farms.

“I’m the guy they hate in Oklahoma,” McBride said of wind companies.

To that end, he said wind lobbyists came to his office before Christmas and asked if he would be willing to sit down and work toward a “comprehensive plan” between the two industries. He said he agreed but grew frustrated hours later when he saw wind representatives speaking negatively about him on Twitter.

“I’m willing to have a discussion, but they want to attack me,” McBride said. “Why would you want to have a meeting with someone who continually attacks you?”

While McBride might come to support a grand revenue bargain that included new wind taxes, Sanders said the gross production tax on wind could be a deal-breaker for other lawmakers.

“I think for every vote you may gain on this new tax proposal, you may lose five,” Sanders said. “I think that’s a real possibility.”

Read the full letter sent to Gov. Mary Fallin

Loading...

Loading...

(Editor’s note: The Wind Coalition currently advertises on NonDoc.com. This article was also updated at 3:25 p.m., Wednesday, Dec. 27, to include a statement from Michael McNutt.)