Less than one month before the start of the 2018 legislative session, a handful of state business leaders has formed Step Up Oklahoma, an organization that will advocate for a “compromise” package of reform and revenue ideas.

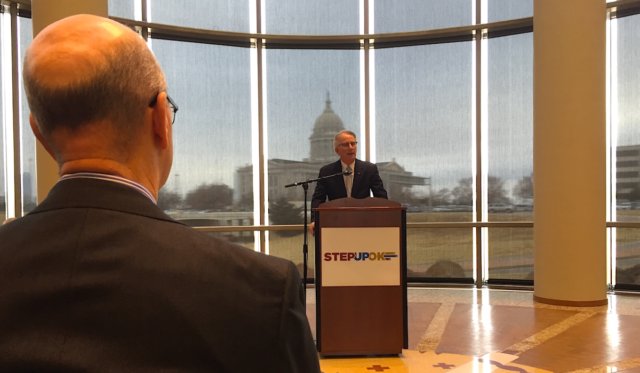

“We’ve been fighting over tax reform, fighting over revenues. Frankly, I’m here to say the business community has been part of that problem,” BancFirst executive chairman David Rainbolt said seconds after taking the podium at the Oklahoma History Center this morning. “When we were at the Legislature, you could see, as we’ve discussed this issue over time, lobbyists would be walking the halls supporting each of our various businesses and interests, and the next one would come in and be on the exact opposite side of the issue.”

Rainbolt was joined in his remarks by Tucker Link, chairman of Knightsbridge Investments, Phil Albert, president of Pelco Structural, and Glenn Coffee, a former president pro tempore of the Oklahoma State Senate and current attorney.

“We no longer can be part of the problem,” Rainbolt said. “We’ve been in contact with the executive branch and leadership of both parties in both houses. We’ve got a revenue problem, and we’ve got a reform problem. Both. Not one or the other.”

To that end, Step Up Oklahoma distributed an overview of the compromise components that Rainbolt said have been carefully paired together.

The group listed 11 “reforms”:

- Increase teacher pay by $5,000

- Revise the state budget to reflect accurate numbers

- Require line-item budgets

- Modify term limits

- Lower the supermajority required to raise revenue

- Establish a budget stabilization fund

- Give the governor direct appointment power over the largest state agencies

- Make the governor and lieutenant governor running mates

- Change the process to fill Supreme Court vacancies

- Create an independent budget office to assist with eliminating waste

- Allow voters to decide the structure of each county’s government

Step Up Oklahoma also listed “a broad compromise plan which affects taxes in seven areas”:

- Cigarettes, little cigars, chewing tobacco and e-cigarettes

- The energy industry, including the gross production tax

- Motor fuels

- Wind-power generation

- Refundable income tax credits

- Gaming activities

- Personal income tax

“Every little detail you read in your summary is there for a reason, is there as a trade off. There was lots of compromise that went into this proposal,” Rainbolt said. “So if you begin to pull out even the smallest piece of it, there’s going to be an opposite and equal reaction and the whole thing begins to fall apart. By definition, every single piece of this has been negotiated.”

Follow NonDoc:

Step Up Oklahoma discusses wind industry

With a November 2017 grand revenue bill falling just short of the required votes in the Oklahoma House, Step Up Oklahoma’s proposal has grown to add some sort of tax revenue component from “wind power generation” as a way to appease oil and gas leaders who have fought a hike in the gross production tax on their industry. One of those people is Continental Resources CEO Harold Hamm, who Rainbolt said is part of Step Up Oklahoma.

RELATED

Wind investors send Fallin letter: ‘We must have a voice’ by William W. Savage III

The Wind Coalition has criticized the effort, saying their leaders have not been included in discussions and negotiations. Thursday, as attendees joked about the 50 mph winds outside, Coffee said he was glad to see Mark Yates of The Wind Coalition in the audience listening and invited him to the conversation.

Rainbolt, on the other hand, attempted to make a distinction that Step Up Oklahoma does contain “Oklahoma wind companies” like OG&E, Public Service Company and Albert’s company, which he said manufactures wind components. Rainbolt then pointed to a list of wind companies printed in the Journal Record and read aloud the locations of their non-Oklahoma headquarters, emphasizing one based in “Rome, Italy.”

“The Oklahoma wind energy is with us,” he said.

But Yates countered that after Thursday’s press conference, arguing that all wind companies should have a seat at the table when the state is discussing the tax policies affecting their industry.

“At the end of the day, the utilities in Oklahoma do not represent the wind industry as a whole,” Yates said. “To come out and attack companies that are out of state and not based in Oklahoma is a detriment not only to this plan moving forward but also to the state of Oklahoma.”

Larry Nichols: ‘It is a balance’

One other Oklahoma energy industry giant who is with Step Up Oklahoma did not speak during Thursday’s event, but he was in attendance.

Larry Nichols, chairman emeritus of Devon Energy, said afterward that everyone knows the state has long-term and short-term problems that need to be addressed.

RELATED

Leaders push teacher pay raise rhetoric in face of past failures by William W. Savage III

“They’re interrelated. The reforms — which you don’t have to be clever to figure out they came right out of the State Chamber 2030 package we worked on all summer — we all want the same thing: good schools, balanced budgets, reasonable regulations, etc. etc. etc.,” Nichols said. “And we started asking at the State Chamber, ‘Why do we not have them already? What are the impediments that our state elected officials have in doing the job they would like to do?’

“A lot of these problems are caused by the weak governor system and problems in the Legislature. That’s why we’re in this mess. So let’s not just help the Legislature fix the short-term, let’s deal with long-term reforms so that we don’t get back here two years from now.”

Nichols said business leaders have to value both an educated workforce and a competitive tax environment.

“It is a balance. As citizens of the state, we want good schools because graduates of schools will ultimately be our employees,” Nichols said. “And it’s embarrassing. It hurts recruiting to have four-day school weeks, to have the state constantly in national headlines for not being able to balance the budget, for all this rancor that’s going back and forth. That’s embarrassing and it hurts business.”

He said that the Step Up Oklahoma proposal’s increase in gross production taxes — which would take the incentive rate from 2 to 4 percent for the first 36 months of a well’s production — makes much more sense when paired with the type of government reforms included in the group’s plan.

“If you were to ask would we support an increase of the gross production tax just to go into the black hole of how things are run now, no, absolutely not,” Nichols said. “But when you take care of the teacher problem so that the teachers are paid a fair wage, a regional average, and you do it right now, not these other promises that people have come up with where they’ll give you $1,000 this year and maybe next year and maybe over a long time, you do all these reforms where you have good government that stops waste, fraud and abuse and you have an effective governor and an effective Legislature, that’s worth the effort.”

Nichols’ participation in Step Up Oklahoma displays the effort’s powerful nature, though Coffee said Thursday that he did not know who its officers would be at the moment.

According to multiple people in attendance of this week’s House GOP Caucus retreat, Rainbolt, Albert, Coffee, Nichols and Hamm presented their plan along with other members of the coalition, including Bill Lance (Chickasaw Nation), Randy Swanson (OG&E), David Griffin (Griffin Communications) and Gary Pierson (The Oklahoman Publishing Company).

The group’s website, StepUpOklahoma.com, added a list of supporters after the original publication of this story.

AFP: ‘40,000 activists stand ready and willing to fight’ tax hikes

While Thursday’s announcement from prominent business leaders represents a sizeable advocacy group in favor of a new-revenue grand bargain, anti-tax conservatives have been rallying their own supporters.

Wednesday, the Oklahoma chapter of Americans For Prosperity sent a letter to House Speaker Charles McCall (R-Atoka) arguing that the state “can do better” than raising taxes.

The letter was signed by John Tidwell, Oklahoma’s AFP state director (sic):

I would simply point to the situation at our state Health Department as an example of the negligence, waste and abuse of precious state resources. Without your leadership and the State House committee charged with publicly investigating the mismanagement of funds, the truth about what is going on at the Health Department would never be known.

We know that dozens in your caucus have rejected ‘taking the easy road’ by just raising taxes, and I assure you that our activists will not remain silent if the legislature take the path to increase taxes.

I also believe that our state is in dire need of real leadership and could benefit greatly from several of the real reforms which you have proposed over the past many months. Several of those bills are eligible to be heard and considered in the House and Senate. In all honesty,we know that we have the money – we just need to spend it wisely.

Session timeline

The 2018 regular session is scheduled to start Feb. 5 with Gov. Mary Fallin’s annual State of the State speech, but lawmakers are technically still in a special session that started in December 2017. That means they could conceivably begin meeting to consider budget issues ahead of Feb. 5 if an agreement is reached.

Step Up Oklahoma revenue estimates

Loading...

Loading...

(Update: This story was updated at 3 p.m. Thursday, Jan. 11, to include a link to the Step Up Oklahoma site that lists supporters and embed the PDF of estimated revenues.)