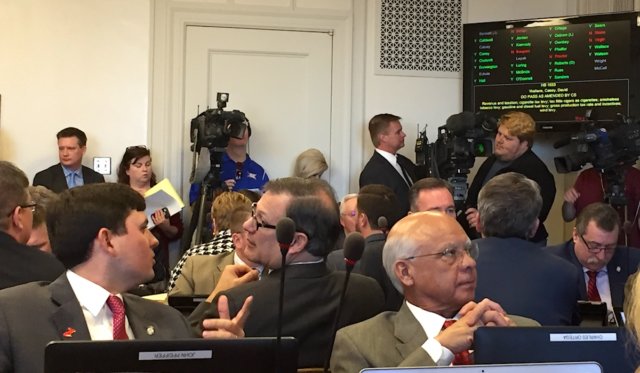

The Step Up Oklahoma revenue plan took a step forward just before noon today. Multiple bills cleared the House Joint Committee on Appropriations and Budget, including an 83-page bill that could create $581 million for Fiscal Year 2019 if it passes the full House and the Senate next week.

That, however, will be no easy task, as five of the seven Democrats on the House committee voted against the major tax proposal, which mirrors the major revenue bill that fell five votes short in November, with two primary differences.

First, a new $1-per-megawatt-hour production tax on wind energy has frustrated some members. Second, taking all existing oil and gas wells currently taxed at the 2 percent incentive rate to 4 percent has been included as a concession to Democrats, many of whom have requested the GPT rate go to 5 percent, if not 7 percent. HB 1033XX passed 21-5, with Rep. Jason Dunnington (D-OKC) and Rep. Ben Loring (D-Miami) as the only Democrats voting in favor. No Republicans voted against, with tax critics Rep. Kevin Calvey (R-OKC) and Rep. John Bennett (R-Sallisaw) absent. (Bennett arrived to the meeting for other bills.)

As a revenue bill, HB 1033XX would need to receive 76 votes in the House, which could hear it as soon as Monday. Republicans have 73 members in the House, and Democrats have 28. In November, 23 Democrats voted for what was called the “A+” plan, as did 58 Republicans. Between then and now, state business leaders formed Step Up Oklahoma, endorsing the tax increases many of them opposed in November so long as they were paired with the new wind tax and a series of government reforms.

“If I vote for this, I will certainly hold my nose and do it for the greater good,” said Rep. Todd Russ (R-Cordell) “The fuel tax makes me very uncomfortable for the middle class.”

Russ voted for the “A+” plan in November, and he supported the revenue bill today, but minutes later he voted against HB 1035XX, which places an $18 million cap on wind industry tax credits. It passed 15-12, with a combination of Republicans and Democrats opposing it.

Rep. Earl Sears (R-Bartlesville) carried the wind tax credit cap bill, saying the industry will receive about $70 million this year.

“I absolutely have no problem with wind, but I truly believe that the wind credits are extremely lucrative, and we need to have some reform,” Sears said. “There is no question we made a huge mistake. We need to roll these credits in.”

But Rep. Emily Virgin (D-Norman) questioned why GOP leadership was pushing the cap now.

“Why are we being retroactive now because the Step Up group asked us to?” Virgin asked.

Scott Inman presses Republicans

Virgin’s line of questioning was similar to that of Rep. Scott Inman (D-Del City), the former House Democratic Caucus leader who surprised lawmakers with an October announcement that he would resign only to surprise them again with a December announcement that he would not.

Inman peppered Republicans with questions Thursday, arguing that oil and gas companies need to pay more than the proposed 4 percent GPT incentive rate while opposing the new wind generation tax.

“How does it not hinder business growth for an entire industry in our state?” Inman asked of the wind generation tax, which House JCAB Chairman Kevin Kevin Wallace (R-Wellston) said would yield about $20 million per year starting in Fiscal Year 2019.

“I believe I’ve heard a lot of the state arguments as we’ve been through the last session with oil and gas,” Wallace replied.

Inman emphasized the benefits of wind energy.

“Our neighbor to the south is doing incredible things with the wind industry and what it’s doing to energy prices by bringing down home-heating costs for senior citizens and middle class families,” Inman said. “I’m trying to understand why it would be the policy of a conservative House of Representatives and a chairman like yourself (…) I’m trying to figure out how this fits into fiscal conservatism.”

Inman voted against the main Step Up Oklahoma revenue plan bill as well as the cap on wind tax credits, but he voted in favor of capping coal industry credits at $5 million — a figure higher than last year’s claimed credits — and capping a railroad tax credit at $2 million per year, which is also slightly higher than this year’s number. He also joined with all other members of the committee in voting to raise teacher pay.

Bills heard in committee Thursday included:

- HB 1030XX would establish $5,000 increases in the minimum salary schedule for Oklahoma teachers. It passed 26-0.

- HB 1032XX would replace $50 million in county roads and bridges funds that lawmakers used for other purposes in 2017. It passed 21-5.

- HB 1034XX places a $5 million cap on coal industry tax credits. It passed 22-4.

- HB 1036XX caps a railroad tax credit at $2 million annually. It passed 26-2.

- HB 1031XX establishes “ball and dice” gaming as legal under the state gaming compact. It passed 21-3.

- HB 1037XX (modified with a committee substitute) reinstates the refundability of the earned income tax credit, and lowers the state standard deductions for those earning above $50,000 per year. After a recess, it passed 14-11.

(Update: This post was updated at 4 p.m. Thursday, Feb. 8, to include the final vote on HB 1037XX.)