As quickly as the Step Up Oklahoma coalition launched at the start of 2018, it phased down Tuesday with a one-paragraph press release hours after the group’s primary revenue bill failed to receive 76 House votes.

“While Step Up Oklahoma’s effort has run its course, there should be no mistaking that the future of Oklahoma is a cause worth the fight,” the group’s statement began before ending with, “Yesterday’s solid turnout of supportive advocates at the Capitol shows us that Oklahomans are ready for a change. They want our problems fixed. We are thankful for the widespread support we’ve received since proposing Step Up Oklahoma.”

Roughly 48 hours later, however, lobbyists, advocacy leaders and members of the public are trying to determine where the Legislature will go next — both in terms of budgetary challenges and the government-reform proposals that had been part of the Step Up plan.

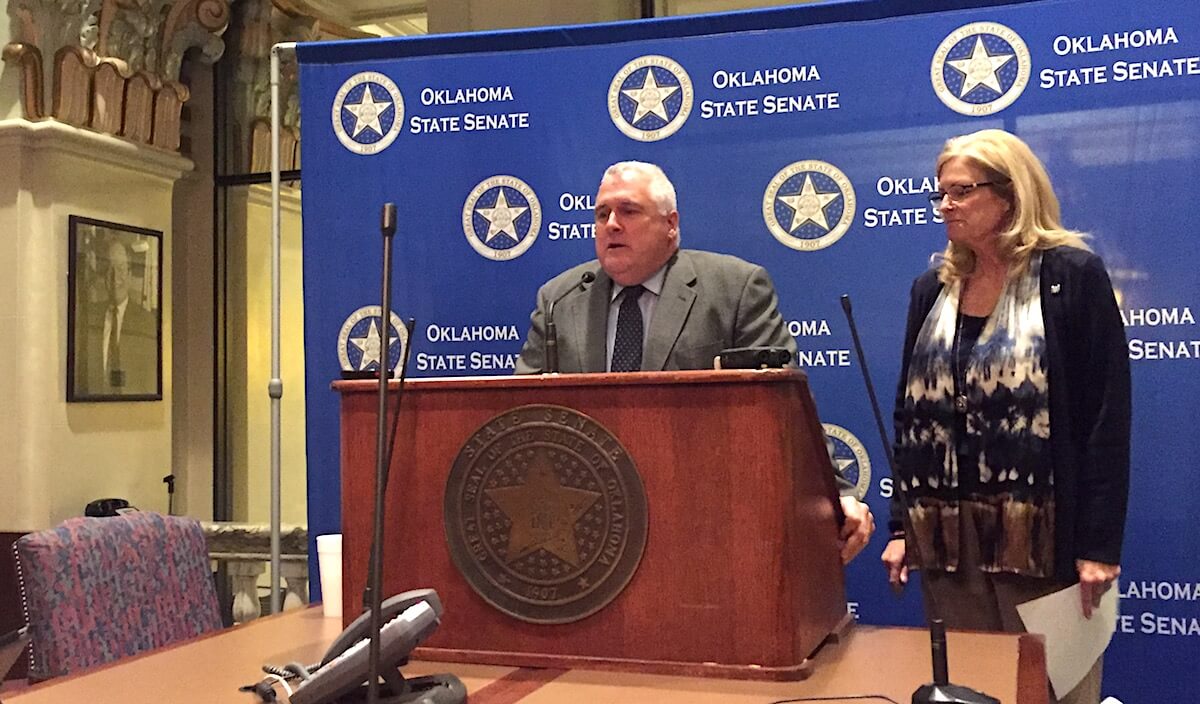

“The reforms are something we’ve worked on in this building for a decade,” said Senate President Pro Tempore Mike Schulz (R-Altus). “We will work diligently to get some of those passed. They are good ideas over the last decade, and they are still good ideas today, and we will work diligently to get those passed.”

Schulz confirmed Thursday in a press availability that lawmakers could look to place some revenue-raising measures on the 2018 ballot for a vote of the people, though he said those discussions will be fleshed out further down the road in session.

Cuts and buts

On the revenue side, both the Senate and House advanced bills Thursday to spread a 0.66 percent annualized cut — which translates to 1.98 percent over the final four months of Fiscal Year 2018 — across all agencies. Recent budget cuts had previously held common education, health care and other agencies flat, but Senate Appropriations and Budget Chairwoman Kim David (R-Porter) said the new cuts would be even among all appropriated agencies.

“We really have no other options going forward from here,” David said Thursday. “Because of the failure of the House to pass revenue, I’m down to making cuts across the board.”

The cuts would allow for appropriations to the state’s two teaching hospitals, which have lost federal support — at least temporarily.

If all three bills — HB 1020XX, HB 1021XX and HB 1022XX — are passed by the full Senate and House and signed by the governor, lawmakers would turn their attention to the next fiscal year’s budget. The Board of Equalization is set to certify revenue numbers Feb. 20, which will provide a clearer picture of whether additional cuts are necessary.

New revenue could be considered in the House through 51-vote measures or 76-vote grand bargains like the Step Up plan, though House GOP leadership has said a deal seems unlikely with House Democrats. But Thursday, House Democrats announced a package they say all 28 of their members would support. Supported by Republican State Auditor and gubernatorial candidate Gary Jones, it would raise:

- the gross production tax incentive rate to 5 percent

- the cigarette tax by $0.75

- gas taxes by $0.03

- diesel taxes by $0.06.

Reforms talked about ‘for decades’

What might happen this session in terms of reforms remains to be seen. Lawmakers interviewed for this story expressed uncertainty about the Step Up Oklahoma reforms.

“A lot of those reforms were stuff we’ve been talking about for decades. I’m supportive of many of the concepts that were included in it. You lose some of the leverage point of, if you’re getting new revenue people will support the reforms somewhat,” said Senate Majority Floor Leader Greg Treat (R-OKC). “But I was never quite confident that we would be able to deliver on all the reforms even if we got the revenue because people are just all over the map on it.”

Treat said he personally supported any efforts that made the Legislature “more robust” in overseeing state agencies.

“They had 15 originally (in Step Up Oklahoma) and they got pared down to eight. Many of the reforms were great reforms,” Treat said. “I just don’t know if they advance or not. There are several vehicles out here to do a lot of those things that they talked about — line-iteming, modification of (State Question) 640, budget office stuff.”

The State Chamber of Oklahoma, however, would like to see lawmakers focus on the reforms.

“The reform portions of the Step Up Oklahoma plan absolutely should be considered this year. The issues facing our state right now are too severe and too consequential to be ignored,” said Jennifer Lepard, executive director of the Oklahoma State Chamber Research Foundation. “Many of the reforms in the Step Up Oklahoma plan aligned with what the State Chamber Research Foundation recommended in December under our OK2030 vision plan.”

Lepard said OK2030 was the result of a year-long process and could result in changes to provide flexibility for the state’s next governor.

“The incoming governor — whoever that individual might be — must be given sufficient authority and positioned for success. It’s virtually impossible for a CEO to excel without the necessary authority and a supportive team,” Lepard said. “Similarly, for our new governor to be successful in leading our state, we need to provide that governor direct appointment authority over key agency directors and run the lieutenant governor on the same [ticket].”

Lepard named other reforms that she would like to see advanced.

“Another timely reform is the creation of a budget stabilization fund. Oklahoma’s current system for funding core state functions during down budget years has proven inadequate during the latest economic downturn,” Lepard said. “And as our economy rebounds, it will be equally as important to restore accountability in the budgeting process. Oklahoma legislators can do this by bringing back the practice of line-item budgeting. While our state agencies are given the responsibility of spending taxpayer dollars, it is the responsibility of our lawmakers to ensure those dollars are spent wisely. Line-item budgeting provides a formal structure for responsible oversight of state agency spending.”

Treat said line-item budgeting is something he could support, so long as it doesn’t lead down a road where lawmakers resided in the not-so-distant past.

“I don’t want it to get into a situation where we are ear-marking projects around the state,” Treat said. “We could easily fall in the trap of going back down that road, and I don’t think that would be a good road.”

Rep. John Michael Montgomery (R-Lawton) said proposed legislation that could have created so-called “budget stabilization funds” — such as his HB 1400 or SB 610, which is co-authored by House Speaker Charles McCall (R-Atoka) and Senate Minority Leader John Sparks (D-Norman) — could be more difficult as a result of the Step Up Oklahoma revenue plan’s failure.

Montgomery calls HB 1400 the “Vision Fund,” which would create long-term investment earnings on individual and corporate income tax collections for the state. SB 610 would create a similar investment fund with gross production taxes off of oil and gas wells.

“With doing like a ‘Vision Fund’ endowment-type deal with GPT, we would need a natural upswing in revenue to make it palatable for members and for appropriations chairs to go along with setting aside some GPT,” Montgomery said. “If you’re just kind of balancing the books, then doing an endowment fund is just not in the budget for a lot of people, unfortunately.”

He said not pursuing these types of reforms ultimately could allow the state to continue its boom-then-bust revenue cycles.

“That’s disappointing because we’re already projecting for the next fiscal year GPT will be the highest its been since 2011 and comparable to some of the early 2000s GPT revenue,” Montgomery said. “So it’s disappointing, and frankly it’s kind of dangerous as we get higher and higher. Everybody’s going to want us to go to $100-per-barrel oil, and that’s great, but if we haven’t set any of it aside, that swing downward will be just as painful, and it will probably come within a decade.”

Attempts to talk with Sparks about SB 610 were unsuccessful over the past two days, but McCall’s communications director, Jason Sutton, offered a statement.

“Any bill contingent upon raising the GPT is not a priority at this time,” Sutton said.

‘We do not like taxes in this state’

In December, Treat told a packed room at an Oklahoma State Chamber luncheon that State Question 640 was “the reason” lawmakers were in special session and unable to raise adequate revenue to avoid cuts. He revealed then that lawmakers would be filing legislation that could ask voters to modify SQ 640’s three-fourths majority requirement for new revenues.

Now, however, he’s not sure if the public would modify it even if they received a chance to do so. But he remains critical of the constitutional language that makes revenue raising so difficult.

“(State Question) 640, I think, has been detrimental to our ability to lead and govern,” Treat said. “It has empowered a small minority to drive the discussion. What it’s done is antithetical to the Republican or conservative movement.”

Treat said it forces small tax proposals to be paired with additional taxes, increasing the overall size of revenue packages.

“Put it to a vote of the people and it probably doesn’t get modified,” Treat said of SQ 640. “It has completely made us unable to be flexible and be able to govern in a responsible manner, but I’m not real hopeful if we put it on a ballot initiative that the voters would approve of a modification to it.”

Montgomery agreed.

“I have a hard time believing voters are going to go along with that,” he said. “We’ve more or less said, ‘We do not like taxes in this state.'”