With about 19 days left before a potential school and state employee walkout, two funding plans for salary increases are emerging ahead of full negotiations. Meanwhile, lawmakers are grappling with what the Oklahoma Education Association’s April 2 walkout might look like, with more than 80 local school boards passing resolutions in support.

“I think it’s much easier for metro-area teachers to get here, but I’m even hearing of teachers getting together online and finding a way to bunk up together,” House Majority Floor Leader Jon Echols (R-OKC) said Tuesday. “I think you’ll have teachers from rural districts who will find a way to come up.”

Sen. Roger Thompson (R-Okemah) said educators in his eastern Oklahoma district “want a resolution.”

“My teachers do not want to walk out, but they see that we must do something in education. I’ve voted for about every revenue package that has come along just so we can get this thing done,” Thompson said, adding that he believes his school employees will show up at the Capitol but is not sure how long they will stay. “I think you’ll see our school board resolutions have supported that to this point. I think we’ll have some schools up here on the 2nd who are back into class on the 3rd.”

Echols disagreed.

“I think they’re serious, and I think the strike is going to continue until some movement is made,” Echols said. “I think it’s going to continue until we get a plan passed.”

Thompson’s comments came about an hour before Senate Republicans met in Caucus to discuss a floor substitute filed on HB 1033XX, the Step Up Oklahoma bill that passed the House but failed to receive a required 76 votes there for revenue-raising measures. The Senate amendment would turn the bill into a new proposal that borrows a $0.01 statewide sales tax increase from State Question 779, which only 40.6 percent of voters supported in 2016. But the Senate adjourned Tuesday without calling it up for a vote.

Thompson said the Senate’s potential plan — which does not include controversial tobacco and fuel taxes — would be more palatable than SQ 779 because it exempts the state portion of sales tax on groceries.

“I think that’s major,” Thompson said, emphasizing that county and local sales taxes would still apply to groceries, which are a sizable portion of local revenues. “I’ve already been contacted by one of my city managers that said we are going to do away with sales tax on groceries for counties and cities. That’s not even true. That’s not even being talked about. So there’s a lot of bad information that’s out there.”

Echols said he appreciated the Senate proposal as “new and innovative” but questioned its political viability.

“Taking out the groceries part does make it more palatable, but you’re still going to have to deal with the issue that the public did vote [a penny sales tax] down,” he said.

Rep. Sears on Bartlesville teachers: ‘They wanted to come up with some solutions’

The Senate’s proposal was not the only revenue option to come to light Tuesday. Education leaders from the northeast Oklahoma community of Bartlesville — a traditional Republican stronghold since the days of broad Democratic control of the Legislature — have released a plan called The Time is Now.

“Bartlesville approached me and communicated with me that their teachers were going to walk and they were going to vote to allow them to walk,” said GOP Rep. Earl Sears, a former principal. “But they were also going to develop a plan for us to review to keep teachers from across the state from walking. That was the genesis of their plan. They wanted to come up with some solutions.”

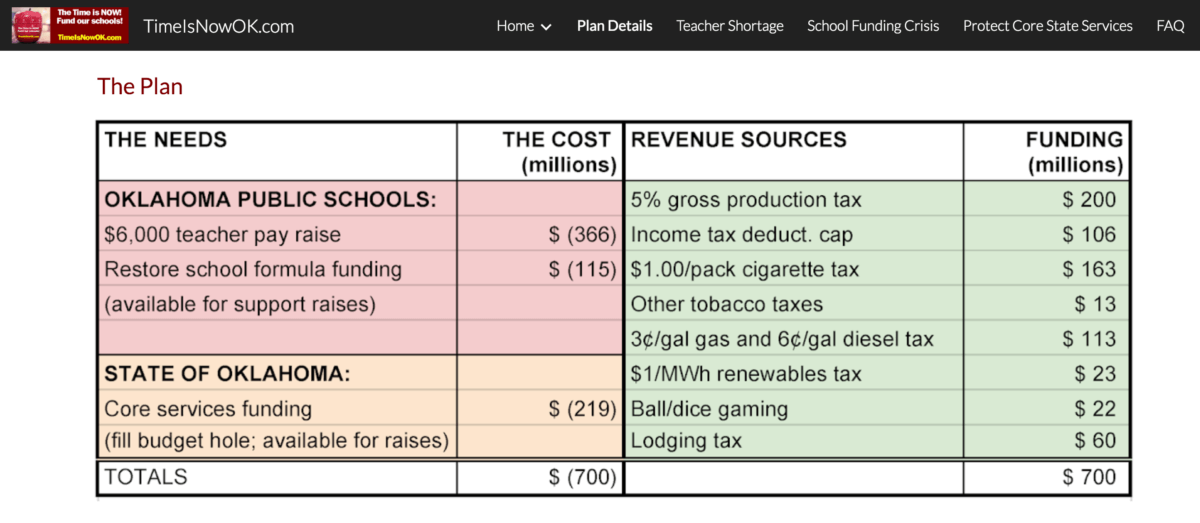

That plan calls for:

- a hike from 2 to 5 percent on the gross production tax incentive rate for oil and gas wells

- a $1-per-pack cigarette tax

- a $0.03 increase in gasoline taxes

- a $0.06 increase in diesel taxes

- a cap on income tax deductions

- a new production tax on renewable energy

- an expansion of tribal gaming

- and a $5-per-night lodging tax.

“I do like the fact that they’ve come up with a plan. But I do not endorse their plan, because from their plan I have developed my own plan,” Sears said. “The difference between my plan and the Bartlesville plan is gross production. They have it at 5 percent, I have it at 4 percent. And they have the lodging (tax), and I don’t have that.”

Neither the Senate’s most recent plan nor the Bartlesville plan would create enough revenue to cover teachers’ requested $6,000 raise in year one, but both plans could cover raises for public employees if teacher pay hikes were lower.

GPT increase crucial for Democrats

All lawmakers interviewed for this story noted that any proposal to raise significant revenue will need bipartisan support to reach three-fourths thresholds. But House Minority Leader Steve Kouplen (D-Beggs) and House Minority Caucus Chairwoman Emily Virgin (D-Norman) each said their Caucus believes the higher gross production tax is key to a package.

“I think it’s a good plan,” Virgin said of the proposal pitched by Bartlesville educators. “It doesn’t provide quite enough revenue for the first-year demands that OEA has asked for, but I think it’s a great start. I think there are a couple other things that could be added to it.”

Kouplen said negotiations have not fully started this week as lawmakers attempt to meet a floor deadline for policy bills.

“We haven’t really changed a whole lot of our position in thinking the gross production tax needs to be significantly higher, to 5 (percent) at least,” Kouplen said. “I think we need to have a true negotiation between all sides up here. It concerns me that plans just get thrown out. It seems like you throw something against the wall and see if it sticks, and that is not the approach that should be taken. I don’t believe it’s going to be fruitful to take that approach.”

Asked about perception that Republicans have been protecting oil and gas interests while Democrats have been more opposed to tobacco taxes, Kouplen chuckled.

“I think standing on the outside looking in there are a lot of different perceptions that can be made. Most of the time, they are not really spot on to what is actually happening,” Kouplen said. “The fact that we are in the pocket of big tobacco always was amusing to me. I thought that was kind of interesting. Or big wind or whatever. We just want a fair tax policy that doesn’t push the burden down to the working-class individuals.

“I think the general public — even the teachers I have spoken to — think the gross production tax should go back to 7 (percent). Now, realistically in this building, we’ll probably never get 7 percent gross production tax. But I don’t think 5 percent gross production tax is unreasonable. I think that’s a pretty reasonable ask in the circumstances we are in.”

He said he also believes an income tax increase on high earners should be considered.

“I know it won’t happen to restore a 0.25 percent income tax, but some version of a tax on high earners to bring in some income tax revenue I don’t think is unrealistic either,” Kouplen said. “We need to do those things first, and then if we need more revenue let’s look at other sources, such as cigarette tax. I don’t think the fuel tax is completely off the table either.”

Common education funding formula complicates matters

Kouplen said he believes each of the state’s 512 school districts may conduct the April 2 walkout differently.

“I don’t know that the rural communities are going to take the same approach to the walkout,” he said. “My concern as a rural legislator is there are going to be expectations when additional funding is given to the school, and my biggest concern is there will be some forced consolidation issues brought up. I’m a local-control individual. I think if communities want to continue to vote ad valorem taxes to keep their local schools open, they should do that, and if they want to consolidate they should do that as well. But I’m a little concerned with the strings that may come with more funding.”

Any attempt at forced school consolidation could alienate rural lawmakers who are more likely to represent tiny districts. Similarly, rural lawmakers are also more likely to have districts in their areas that are “off” the state funding formula for common education. That means those districts have local, county and state-aided revenues from structures in their areas that exceed what state appropriations would otherwise provide.

“That’s the big deal,” Sen. Casey Murdock (R-Felt) said of how any teacher pay increase might be passed. “In my Senate district, and I was actually just talking to the superintendent from Freedom, they’re off the formula, and he’s worried it would cost their district $87,000 (if the raise is passed through the state formula).”

Echols said teacher pay raises have traditionally been passed through the formula.

“The flip side is that if you are off the formula, when we cut we don’t cut you,” Echols said. “If you’re off the formula, I don’t know if you want to go down that road (of seeking funding for a raise outside the formula) because all the on-formula schools would turn around and say, ‘Then take the good with the bad. Then when we get cut because we don’t hit our projections under the formula, they get cut the same percentages that we do.’ So I don’t think that would be good for those (off-formula) schools.”

Murdock disagrees, saying that a hike in the state’s minimum teacher salary without additional money for off-formula schools would result in an unfunded mandate that could cost some districts as much as $100,000 or $500,000 to meet on their own.

“I think that the plan we are working on will put this teacher pay raise outside of the formula, which would be fair to all the schools,” Murdock said. “I’m really supportive of that.”

Data provided by the Oklahoma State Department of Education indicates that 40 of the state’s 512 school districts are fully off the funding formula. In the spreadsheet linked here, those schools with a “1” in each of the final two columns are “off” the formula entirely.

Murdock said schools from his district — which covers Oklahoma’s nine most northwestern counties — are likely to approach the April 2 walkout date differently.

“I’ve heard there are several teachers in Guymon that are going to walk out,” he said. “I’ve talked to smaller schools throughout my district that are not going to walk out. It’s their choice, their decision.”

Virgin panned the Senate’s proposal for including the sales tax component.

“The voters had the opportunity to say they wanted teacher pay raises to be done this way,” she said. “I think it was about 60-40 (percent) against, and so I think it’s clear that the voters don’t want teacher raises to be funded on the sales tax.”

HB 1033XX substitute: Senate proposal

Loading...

Loading...