Late last week, as the Oklahoma Legislature passed additional funding measures for education, the Oklahoma Education Association (OEA) announced new demands, including the elimination of the exemption from capital gains taxes on assets located in Oklahoma.

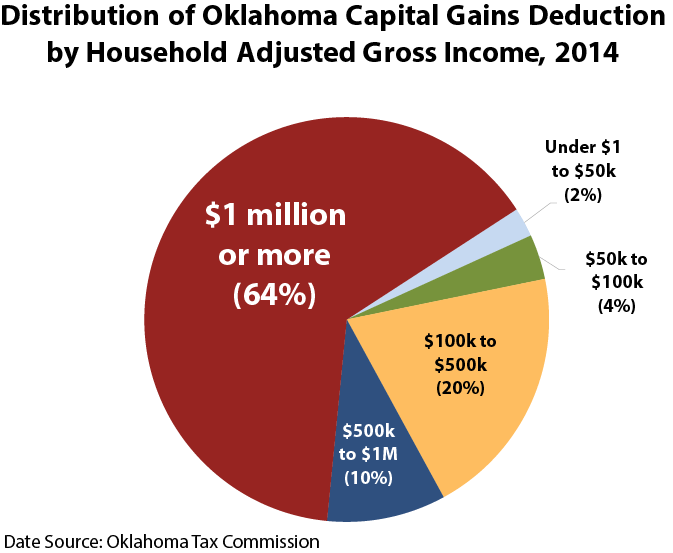

The argument for repealing the exemption is that it costs the state government more in revenue than it generates in economic activity, and that its benefits primarily accrue to those with higher incomes. One gets the feeling, however, that it is this second aspect of the exemption that most concerns advocates of repeal.

In fact, one chart (below) shared widely via social media is used to demonstrate that those who benefit the most from the deduction are “millionaires” — as though it should come as some surprise that those who have the most income would also have the most assets that appreciate in value.

Capital gains taxes explained

Before deciding whether or not it’s a good idea to eliminate this deduction, we need to make sure we all understand what capital gains are and what impact taxing them has on economic activity. A capital gain is generated when you purchase an asset (a home, for example) and then sell it for more than you paid for it. The difference in the price when you purchased the asset and the price when you sell it is the “capital gain.” It reflects the increase in value of the asset over time.

In 2004, Oklahoma voters passed a referendum (State Question 713) to exempt the sale of assets located in Oklahoma from the state’s capital gains tax. This exemption has become the target of the OEA and others who believe it is nothing more than a giveaway to the wealthy.

In the United States, we tax capital gains when they are realized, meaning when the asset is sold and you actually benefit from the increase in value. This is important. Since capital gains are paid when transactions occur, one has to know whether such transactions are more or less sensitive (what economists call elasticity) to changes in the tax rates assessed on these transactions to determine their impact.

Impact of capital gains taxes

So, how sensitive are capital gains transactions to changes in the taxes assessed on them? Very. One study found that higher capital gains taxes reduced economic growth, investment and rates of entrepreneurship.

One should be cautious when presented with revenue projections regarding capital gains taxes because of this sensitivity. It is easy (and common) for those who have assets they would like to sell to choose not to if the tax on capital gains significantly reduces their net income from the sale of the asset.

‘Sticking it to the rich’ doesn’t really hurt the wealthy

Perhaps the most important factor to consider is who will be harmed by the increase. Refer back to the chart above. One might be tempted to say that those millionaires who receive the majority of the current capital gains deduction will be the ones most harmed by its repeal, in that they would have to pay more in taxes. But there are two other factors to consider.

First, many of those so-called millionaires are millionaires on paper only. In other words, their income is passed through from a business entity and may not be realized at all. In short, their incomes are inflated as a result of the business structure they have. These are most often small-business owners, not major executives and wealthy entrepreneurs.

Second, those who are wealthy are much more likely to be able to hold onto an asset they would prefer to sell than those who are less wealthy. Remember, small businesses, family farms and inherited stocks can all be included in capital gains.

Example: A daughter who inherits the family farm from her parents may not be able to maintain it and wish to sell it. The capital gains taxes owed, however, will impact her gain from that sale. If the tax is too high, she may be stuck with a low-performing asset that someone else could make use of, but she cannot sell because of the tax burden. In Oklahoma, such individuals would be subject to the second-highest combined capital gains tax (federal and state) rate in the region if the exemption is removed.

The wealthy business owners, by contrast, may have several assets that would allow them to offset the cost of holding onto a low-performing asset. Those in the lower-income brackets more than likely do not have that option.

Since it is easier to delay a transaction that has a high cost, the state’s ability to increase its revenue through eliminating the capital gains exemption may be (and likely is) much less than what has been reported. If no transaction occurs, then no tax can be assessed, which means no revenue is collected. Only those who believe individuals respond irrationally to changes in the tax code would argue otherwise.

Consider the trade off

Eliminating the capital gains tax exemption won’t hurt the wealthy as they will have resources to offset the increased taxes, or the financial wherewithal to sustain holding onto a low-performing asset a while longer. It will, however, negatively impact those who have modest incomes and inherit an asset, or who are small business owners who have been able to acquire a few financial assets over time and need to sell one.

We need to consider whether it’s an acceptable trade off to negatively impact small business owners, family farmers and others so we can stick it to the rich and whether we trust revenue projections on a source that is highly sensitive to tax changes.