In the months following the 2018 teacher walkout, questions about support for public education defined many of the campaigns for seats in the Oklahoma Legislature.

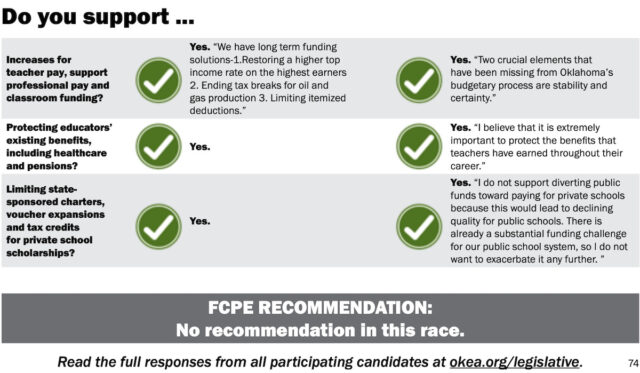

As part of their 2018 “voter guide,” the state’s largest teacher union, the Oklahoma Education Association, asked candidates a slate of questions about their support for various public school issues. One question focused on so-called school choice programs.

“Do you support limiting state-sponsored charters, voucher expansions and tax credits for private school scholarships?” the OEA asked candidates up for election in 2018.

Published in the OEA’s general election guide (embedded below), responses to that question then help show how attitudes and the atmosphere around education policy have changed five years later.

More than a dozen Republicans who pledged in 2018 not to support expanding school choice tax credits ultimately voted for HB 1934, which establishes refundable tax credits for families of homeschool and private school students.

Listed with their current leadership titles, three senators and 11 representatives who voted for HB 1934 had told the OEA in 2018 that they favored limiting school choice tax credits and vouchers:

- Senate Appropriations and Budget Chairman Roger Thompson (R-Okemah)

- Sen. Darrell Weaver (R-Moore)

- Sen. John Michael Montgomery (R-Lawton)

- Rep. Chris Sneed (R-Fort Gibson)

- Rep. Randy Randleman (R-Eufaula)

- Rep. Scott Fetgatter (R-Okmulgee)

- Rep. Jim Grego (R-Wilburton)

- Rep. David Smith (R-Arpelar)

- Rep. Sherrie Conley (R-Newcastle)

- Rep. Dell Kerbs (R-Shawnee)

- House Appropriations and Budget Education Subcommittee Chairman Mark McBride (R-Moore)

- Rep. Daniel Pae (R-Lawton)

- Rep. Stan May (R-Broken Arrow)

- Rep. Tammy West (R-OKC)

Despite numerous requests for interviews and comments about why lawmakers may have changed their minds since 2018, Oklahoma Education Association leaders did not respond over the past month prior to the publication of this article.

While tax credits differ from vouchers, both programs allow tax revenues to be used for private school enrollment.

Education establishment figures, including most teachers’ unions, oppose both schemes, saying they hurt public schools — particularly in rural areas — by decreasing enrollment and the amount of money available to support districts.

School choice proponents, however, argue that the programs give parents options to pick the best education plan for their kids.

‘I think we’re going to have to support both’

Thompson, who now serves as the Senate Appropriations and Budget Committee chairman, responded affirmatively to the OEA’s 2018 question about whether candidates favored limiting tax credits and vouchers.

Days after the House sent the tax credit bill to Gov. Kevin Stitt’s desk in May, Thompson said his deciding factor in voting for HB 1934 was the historic public education funding package included in a slate of other bills.

“I’m still very much in favor of public education, but in order to get money into public education, we were going to have to do the tax credit bill — the bill we did,” Thompson said. “And so, I was very interested in voting for that, as long as it was tied to more funding for public education.”

Thompson emphasized the need for compromise to support education in the state.

“If I had my druthers, I’d be all 100 percent on public (education funding) than the others,” Thompson said. “However, that’s not the world we live in. I think we’re going to have to support both.”

Thompson also said he thought the homeschool and private school tax credits were a better way to expand school choice than traditional private school vouchers paid directly to the school, a version of which the Senate failed to advance in 2022. (Thompson voted in favor of that bill as well.)

Many other lawmakers who previously opposed school choice reforms but who voted for HB 1934 this year echoed Thompson’s take. Weaver, Montgomery, McBride, Randleman, Grego, Smith, Conley and May all expressed similar sentiments. (Only West and Pae declined to answer questions about their change in position.)

“If it hadn’t have been tied to that other (public education funding) bill, I would have voted ‘No’ on it,” said Smith, a typically quiet McAlester-area representative.

Conley, a more vocal representative and former teacher who ousted a Republican incumbent in 2018, also equated her vote on the tax credit bill to the vote for the public-school funding increase.

“If I would have voted ‘No’ on that, then I would have voted ‘No’ on sending all of that money to the rural schools as well,” Conley said. “And so, I felt like it was a good compromise in funding our rural schools and allowing the tax credits for some of those parents that want other options for their kids.”

Also calling the tax credits a “compromise” compared to other proposals, McBride said he has not liked the lobbying efforts of some voucher proponents.

“I’ve never been against school choice,” McBride said. “I think the attacks of those (school choice advocacy) groups on members, as they began to become more and more intense, the more I started disliking these groups that were promoting them.”

McBride also said he failed to understand how programs such as vouchers would benefit students besides those whose families were already wealthy.

“Multiple, multiple times, not once, but multiple times, I would tell them to bring a family to my office — or have me meet them anywhere — that’s middle to lower income that this would benefit. I never had anyone come to my office,” McBride said. “The people that would come to my office were upper-middle class or wealthy, and so at that point, I was like, ‘How is this going to benefit Oklahoma?'”

Though he is “not a huge fan” of the private school and homeschool tax credits, McBride said another reason he voted for them is because they were not vouchers, a feeling he shared with Weaver, Conley and Kerbs.

“If I can make that trade and be able to put the tax credit in the general appropriations side instead of into the education budget, that’s what I want to do,” Kerbs said.

While he said that passing the public education funding package was a “big, big thing for me,” Weaver also said “the tax credit was easier for me to stomach” than vouchers.

“I didn’t feel like it was taking directly from the public ed (funding),” said Weaver, who had voted against last year’s more voucher-like education savings account proposal.

Conley, who said she sees how some families need more options when they face problems with their local public school, took her assessment of this year’s compromise even further.

“If this had been anything other than the tax credit, I would not have supported that,” Conley said.

‘Game-changing numbers’ for public education

Rep. Ronny Johns (R-Ada) told the OEA in 2018 that he would oppose tax credits and vouchers, and the 30-year former educator kept his word when he voted against HB 1934 this year.

Ironically, the 2018 OETA voter guide endorsed one of Johns’ opponents, a Democratic firefighter who drove a school bus route for Byng Public Schools. At the time, GOP leaders saw the OEA’s endorsement of a Democratic firefighter over a career Republican educator as proof the organization often made partisan decisions.

Five years later, however, Johns is one of the strongest public education voices in the House GOP Caucus. Even though his name was red on the board for HB 1934, he said he understood his colleagues’ reasons for voting in favor of the private school tax credit bill.

“On this particular plan that we passed this year, it was more of the funding that was going to go to rural Oklahoma and to our rural schools. That outweighed the tax credit or whatever,” said Johns, who sits on the House Common Education Committee. “Look, under the House plan, Ada was going to get $2.8 million. That’s on-top money. That’s off-formula stuff. I mean, that’s a game changer.”

Johns said the funding that districts across the state are preparing to receive next fiscal year will allow for higher teacher pay and a variety of other opportunities.

“Those are game-changing numbers, and I think that is absolutely the reason that some members went that way (and also voted for the tax credits),” Johns said.

Other legislators previously opposed to school choice seemed to feel the same way.

“I think that what’s changed is we’ve put so much money into public ed, they can’t say you’re squeezing us out because of this tax credit over here,” Grego said. “That’s just not true.”

Similarly, Montgomery said “the fact that we continue to keep making big public investments in public education” allowed him to support the tax credits bill as well.

Rep. Stan May is a former firefighter who defeated a hard-line Republican in the 2018 primary and then a Democrat retired teacher and OEA member in the general. (The OEA did not endorse either candidate in that race.)

May said that, in 2018, his constituents “overwhelmingly” opposed school choice programs. When the proposal came up again this year, he said the national landscape and extra public education funding were enough to change his and his constituents’ minds.

“This year, when this [vote] came up, it was obvious that it was going to pass,” May said. “And at that point, I listened to my constituents again, and I said, ‘We can get you a whole bunch of cash for your schools that you need desperately, or we can fight this to the end and wind up with a flat budget, and we’ll fight it again next year.’ And once they’d seen the numbers, they thought, ‘Well, OK.’ I got buy-in from all the superintendents and most of the education people.”

The OEA itself has supported the public education funding package, praising the deal lawmakers announced May 15 without mentioning the tax credit bill that was unlocked as a result of the deal.

“When we invest in the 90 percent of families who choose public schools and the professionals who serve them, we are investing in the future of Oklahoma,” OEA President Katherine Bishop said in a statement posted to Twitter. “The current education plan is a great step towards making public education a core value of Oklahoma and lifting us out of the bottom of the region in per-student funding. We look forward to a continuing, long-term commitment to public education values to be competitive in the region and give every Oklahoma child the best chance at success.”

‘You’re bombarded with that every year’

While many lawmakers pointed to the public education funding package as the main reason for their support of the school choice tax credits, changes to the national education landscape over the last five years also played a role.

While a push for private school vouchers in the Texas Legislature failed during this year’s regular session, other states including Indiana and Arizona have created or expanded their school choice programs in recent years. Multiple national advocacy groups have pushed state legislatures across the country to expand programs allowing families to use public funding for private schools.

“I think [the national school choice landscape] is part of the discussion,” said Thompson, the Senate budget chairman. “There’s always talk in this building of, ‘Is it good on a campaign card, or is it good in policy?’ And I want to make sure we do what’s good for policy.”

Johns suggested that national organizations pushing school choice may have influenced Oklahoma legislators to pass the tax credits bill.

“I don’t want to speak for my fellow reps, but (…) once you get elected, and you see just the different groups that come at you for parental choice, school choice, (…) you’re bombarded with that every year,” Johns said. “And we have been. I mean, every year, they’re here.”

While acknowledging the strong push for school choice, Thompson said that most Oklahoma lawmakers focus on what is best for the state, rather than falling in line with the national Republican Party.

“I do think that the Republican Party tries to lean (into) more what the national agenda is, and Oklahoma does not always, as I believe, need to go along with the national agenda,” Thompson said. “What’s good for Oklahomans? And so, if this is an agenda item, I’m not interested. If it’s good policy, I’m interested.”

Conley acknowledged the pressure to expand school choice while explaining her vote for HB 1934.

“There’s been a lot of pressure on Oklahoma legislators to do something in the school choice realm. And I think that I like the direction that it’s gone — that we’ve been able to make a compromise,” Conley said. “I think that if we hadn’t addressed that this year, then we would have had other maybe not so favorable votes that we would have had to take [in the future].”

Some legislators referenced the COVID-19 pandemic as a reason for changes in education reform conversations.

While calling the tax credit and public education funding package a “win,” Sneed said that more parents had been calling him and asking about school choice after schools shut down during the pandemic.

Fetgatter, whose district has just one private school, also cited parents’ frustrations over pandemic-related school closures as reason for the increased pressure to pass school choice programs.

“I have always supported everything I could to get more funding to teachers and get (money) into the classroom and fund public education,” Fetgatter said. “But, you know, I mean, I just hear enough people saying they’re not happy with the education system — the way it is — and they do want the choice even though, in my district, there’s very little option. They will still say that.”

While he did not discuss the pandemic specifically, Grego also said frustrations with public education in recent years motivated him to support the tax credit bill.

He said he felt some public schools have not been complying with the state’s new open transfer law and could be denying entry to transfer students unlawfully.

“My response is, ‘Well, that’s fine. You don’t want me going to your school. I’ll just take my tax credit, and I’ll just go somewhere else,'” Grego said.

Looking back on the past five years, Randleman said his support for HB 1934 stemmed from a need for change.

“What have we done year after year? Given raises and raises and raises. Did that raise scores? So maybe this will,” Randleman said. “So I think looking at a different way, I think I really kind of support those kinds of things.”

Revisit the 2018 Oklahoma Education Association voter guide

Loading...

Loading...