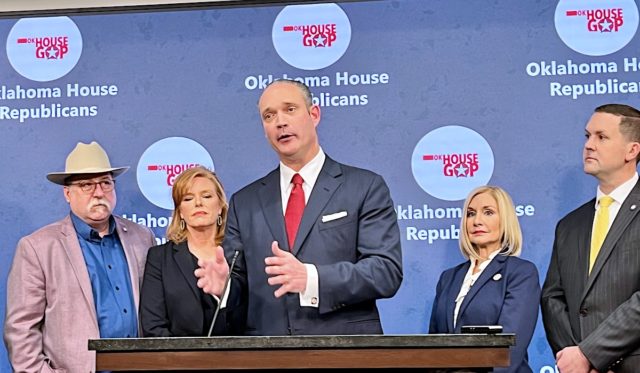

Standing with two dozen of his House Republican colleagues around him, Oklahoma Speaker Charles McCall (R-Atoka) today announced an education proposal that pairs school-choice reform with $500 million of additional public school funding. The House proposal would mandate a $2,500 teacher pay raise and provide districts with up to an additional $2 million each for discretionary investments, while also creating new per-student refundable tax credits for private school and homeschool families.

The plan, announced as one measure but split into two bills to avoid constitutional concerns, changes the public dynamic of education-related negotiations between the House and Senate in only the second week of the year’s regular session. Lawmakers have until the final Friday in May to craft next fiscal year’s state budget, and the House’s proposed $500 million increase for common education would be even larger than the historic teacher pay raise passed in 2018 ahead of the teacher walkout.

“We feel that the plan supports parents and students and also supports teachers and schools,” McCall said. “This is an every kid wins policy and funding plan.”

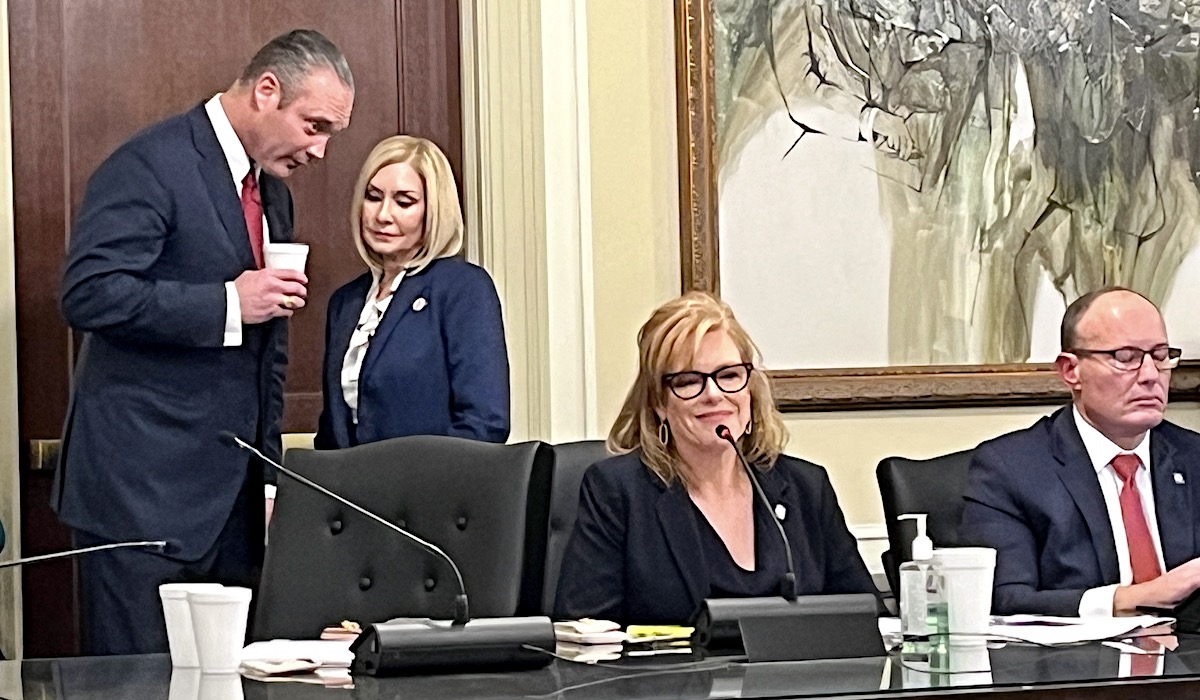

Three hours after McCall’s press conference, as Senate members were still reviewing the details, the House Appropriations and Budget Committee advanced the two measures: HB 2775, containing the appropriations, and HB 1935, proposing the tax credits.

The HB 2775 vote finished 27-8, with all Democrats on the committee opposing it after raising concerns about a per-district $2 million cap on the undesignated $300 million section of the bill. Rep. Mark Vancuren (R-Owasso) and Rep. Judd Strom (R-Copan) also voted against the bill.

HB 1935 also advanced out of the committee 27-8, with the same lawmakers opposing. Rep. Melissa Provenzano (D-Tulsa) debated against both measures.

“We’re creating two systems and tracks for kids — the public schools who teach everyone and the private schools who pick and choose,” she said.

McCall, who artfully dodged a question the week prior about whether he is considering a 2026 gubernatorial campaign, sat with his colleagues through the full committee meeting, an atypical occurrence for the busy leader of the House. When Vancuren voted against the first measure, McCall smiled at his colleague and cracked a joke.

After the meeting, Vancuren explained his reason for breaking from the rest of his caucus.

“The main reason was because I discussed it with my district extensively, and over the time of talking with them back and forth trying to explain the bill to them, they came to the conclusion that they did not support the bill,” Vancuren said.

Vancuren added that he will “try to explain” the proposals to his constituents further in the hope “I can represent them with a yes vote on the (House) floor.”

Treat: ‘We are very methodical’

McCall and House leaders held their press conference 30 minutes before the Senate Republican Caucus was scheduled to meet for lunch. The closed-door Senate GOP meeting lasted two hours, with the House’s plan receiving deep discussion. Senate President Pro Tempore Greg Treat (R-OKC) said the meeting could have lasted longer.

“(I) appreciate them putting forth this plan, and we’re still trying to digest it all,” Treat said at his own press availability. “We are very methodical. We went through all the details we knew. Obviously, I am a proponent of school choice.”

HB 2775 would put an additional $150 million into the state funding formula for a mandatory $2,500 across-the-board teacher pay raise, and it also proposes an additional $300 million for public school districts that “basically can be used for anything within the academic realm,” according to McCall. An additional $50 million would address funding disparities for poorer districts through the Redbud framework created last year.

In what would also be a significant expansion of school choice policy in Oklahoma, HB 1935 proposes the so-called “Oklahoma Parental Choice Tax Credit Act,” which would offer parents refundable tax credits of up to $5,000 for a child enrolled in a private school and up to $2,500 for a child who is homeschooled.

The tax credits, which carry an estimated potential fiscal impact of between $246 million and $300 million in lost revenue collections, are slightly different than the education savings accounts — or school vouchers — that failed last session and that have been championed by leading conservative groups and politicians.

The tax revenue impact could affect another 2023 session priority of Republican legislative leaders and Gov. Kevin Stitt: tax reform, which largely fell apart during negotiations last session. Asked how the potential $800 million impact of McCall’s two education proposals could impact tax reform conversations, Treat said the session is still young.

“We’ll take a look at it globally. We’re in week two of session, so we’ve got some time to analyze it and see where we’re at,” Treat said. “I’ve appointed some people from the Senate to work with the House and governor on tax reform ideas, and they have their initial meeting today. So I don’t see these as mutually exclusive. I think the conversation continues. Obviously, if any tax reform were to reduce revenue, this is spending revenue, and you have to balance it all out.”

McCall acknowledged that the education plan has “implications” for other budgetary negotiations this session, and he said to expect “continued discussions throughout the session on tax reform.”

“Everything we do up here has an impact, and everything that we do has to be considered throughout the session,” McCall said. “And ultimately when we come to the budget. We are in a very strong revenue position in the state. We have record level reserves. We want to keep we want to keep the state in fiscal position as well.”

McCall emphasized that he believes in his plan’s benefits for Oklahoma students.

“The House maintains its position that good education policy should work everywhere in the state of Oklahoma,” McCall said. “We believe that this plan benefits every student, parent and teacher in the state of Oklahoma. We have had discussions in the past about the mechanisms of ESAs or vouchers — this plan does not contain those mechanisms. This plan that we will roll out today — the House’s education plan — provides for less government intrusion into local districts and the personal lives and finances of Oklahomans.”

Baker: ‘We figured out the solution’

As proposed in HB 1935, McCall’s tax credit plan would allow parents to claim up to $5,000 per child if they send their children to private school and up to $2,500 per child for homeschool expenses. McCall emphasized that parents would have to provide proof of related expenses to claim the credit.

If the bill passes, it would take affect July 1, but the tax credits would be retroactive so that parents could claim the reimbursement this year. The tax credits would be refundable, meaning parents could claim the credit and receive up to $5,000 cash if they had no state income tax liability.

In the House Appropriations and Budget Committee meeting, House Common Education Chairwoman Rhonda Baker (R-Yukon) said the Oklahoma Tax Commission “would promulgate the rules” for the bill if it becomes law, including receipt requirements and proof of enrollment.

In an effort to ensure the two bills’ permanence if they become law, McCall also said the tax credit program would stop if future budgets passed by the Legislature do not maintain the proposed increased education appropriations.

“The authorization of the tax credit will be tied to the new level of funding for public education in the state of Oklahoma,” McCall said. “(If a) future legislature does not fund education going forward at this new base, then the tax credit will be suspended until funding is restored.”

In his announcement, McCall emphasized the differences between his proposed tax credits and the more controversial private school vouchers, which he has said he opposes. McCall said tax credits form a better school choice plan than vouchers because they do not draw from existing school appropriations.

McCall did say that if every private and homeschool family took advantage of the proposed tax credit, the total cost in revenue could be between $246 million and $300 million. However, he said he did not believe all families would take advantage of the tax credits.

Gov. Kevin Stitt and State Superintendent of Public Instruction Ryan Walters have both argued for a school choice proposal this session, and they have cited their recent elections as evidence for a “mandate” from Oklahomans for such a system.

McCall said Stitt is supportive of his bill.

“Gov. Stitt is aware of this plan and he is supportive of the plan unless he’s changed his mind in the last few hours,” McCall said. “He’s excited about it. I think he really likes the House’s approach where we are ensuring that education for every kid in the state is addressed in this building.”

Stitt’s press secretary, Kate Vesper, offered a brief statement.

“We are encouraged by the House’s momentum to ensure students across Oklahoma can receive a high-quality education,” Vesper said.

Walters tweeted a video of himself at the State Department of Education on Thursday praising the proposal.

“It will empower families across the state to choose the school of their choice,” Walters said. “This is a great step in the right direction. This does a tremendous job of giving that comprehensive school choice to every family in the state of Oklahoma.”

McCall’s tax credit bill comes as Sen. Julie Daniels (R-Bartlesville) and Sen. Shane Jett (R-Shawnee) have already filed their own bill in the Senate to create a voucher or education savings account (ESA) system.

“I’m just learning about it,” Daniels said at the Capitol after McCall’s press conference. “We were just in caucus talking about it. I think it’s a very positive step forward, and I’m still for robust school choice, so I’m giving it new consideration.”

In the House GOP press conference, Baker supported the tax credit plan while appearing to offer veiled criticism of vouchers.

“This House has been very diligent about being careful to protect our constituencies, and I want you to look around the room, and I want to give credit to everyone that’s standing here because when the attacks were upon us, what did we do? We got together and we worked and we figured out the solution without selling out to special interest groups that were putting pressure on us,” Baker said. “What we have seen in the past didn’t necessarily represent or protect every child in the state — this does.”

(Correction: This article was updated at 12:34 p.m. on Friday, Feb. 17, to correct a quote.)