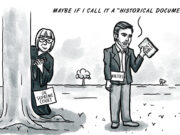

While many in the Oklahoma Legislature seem to have an appetite for pulling state revenue from the wind industry, two separate proposals are receiving separate reactions among wind companies. The result is a difference of opinion within an industry often viewed as monolithic.

“In a time when the wind industry needs to be sticking together, I see some splintering going on within the industry,” said Sen. Casey Murdock (R-Felt), a lawmaker with numerous wind farms and further proposed development in his northwest Oklahoma district. “That disappoints me because they need to be sticking together.”

If the Legislature is adamant about drawing dollars from the wind industry, companies with established projects currently receiving state tax credits have said they would prefer a new “gross production tax” on future wind farms’ electricity production.

Conversely, some companies planning future projects say a new production tax would disrupt their business models, but limiting payouts for previously authorized tax credits would not affect future development.

“Wind as an industry in Oklahoma has been getting a lot of spotlight put on it, but in reality it’s still a new industry in Oklahoma,” Murdock said Wednesday. “But probably in the process of the industry growing in Oklahoma, they are having some growing pains as far as the industry as one (group). They’re starting to sprout and have different business interests growing from the main tree of wind.”

Tax credit refundability vs. gross production tax

The House has a bill on its floor agenda this week that would eliminate the refundability of state tax credits for wind companies. Those credits have been sunsetted already, meaning new wind developments do not qualify for them. But hundreds of millions of dollars remain to be paid out over the next decade, and some lawmakers want to eliminate their refundability altogether.

Mark Yates, Oklahoma director of the Wind Coalition, said that would be a bad idea for multiple reasons.

“I have no doubt that there will be lawsuits challenged against the state of Oklahoma (if tax credit refundability is eliminated),” Yates said Tuesday at the Capitol. “These companies have already started assembling teams ready to litigate this particular issue because we will have projects go into default because of this.”

SB 888 by Sen. Josh Brecheen (R-Coalgate) and Rep. Jeff Coody (R-Grandfield) is the bill on the House calendar that concerns Yates. Amended in a House committee to place a hard cap on wind-energy tax credits, SB 888 would eliminate their refundability beginning Jan. 1, 2019. It would only need 51 votes to pass the House.

“We’ve told lawmakers, look, any retroactive treatment is a non-starter with us,” said Yates, whose organization represents some of the world’s largest energy companies, as well as wind developers. “We are willing to continue dialogues about the future tax structure.”

The “future tax structure” Yates referenced involves an alternative proposal that would add a new gross production tax on the electricity generated by new wind energy projects. Such a measure would need 76 votes to pass the House, something Senate Majority Floor Leader Greg Treat (R-OKC) said he believes is unlikely.

“We’ll see if they have the votes over there (in the House) for a GPT,” Treat said. “A soft cap would be much more likely to pass both chambers.”

But Cliff Branan, a former state senator who serves as executive director of the Windfall Coalition, said the state should simply find some way to get the wind industry to have “skin in the game.”

“Those are both good options as lawmakers look for ways to solve Oklahoma’s cash problems,” Branan said of the credits-vs-GPT debate. “It is time for wind producers to contribute to our state’s coffers like other energy sources.”

Murdock, however, said the industry already contributes a lot at local levels. He opposes capping wind tax credits and creating a new GPT.

“I think both are problematic. I want to see the growth of wind in this state. I think the caps are devastating to existing projects,” he said. “I think because they sell the energy where it’s a 20-year contract, these tax credits are figured in with their financing and with their bid price on what they bid electricity into the grid. By capping them, I think it messes with their financing, and I don’t think that’s fair to them when they were counting on this payment.

“Then you switch over to GPT, I think that hurts the developers, and I most definitely want to see more wind developed in this state. So you put GPT on, and I think that hurts future development because we’re in competition with other states.”

‘Different taxes would have different impacts’

While Branan may not care where lawmakers slice in search of a pound of breezy flesh from wind companies, individuals within the industry do.

“Based on the taxes that have been proposed, different taxes would have different impacts,” said Ron Flax-Davidson, chairman and CEO of PNE Wind USA, the American division of PNE Wind Group, a German energy company.

RELATED

Oil, gas, wind: ‘Uncertainty’ hurts industry investments by William W. Savage III

Flax-Davidson said PNE is in the middle of financing discussions on a wind farm project in Kay County, though he declined to provide a specific location for the development. Since Oklahoma ended its tax credit program for new wind development, PNE would not be affected by the proposed caps on existing wind credits. But Flax-Davidson said a new GPT on wind energy would derail his company’s Oklahoma project if it were not grandfathered in with a start date of at least Jan. 1, 2021.

“A new wind tax of gross production would not harm wind farms that are currently operating, but it would affect new projects like ours,” he said. “The question then is, can anybody afford to pay that tax, and will there be any other wind farms that are built? And that I can’t answer.”

Flax-Davidson said PNE is not a member of Yates’ Wind Coalition, which does represent many of the existing wind operators in Oklahoma. While Yates said the Wind Coalition would prefer to see a new GPT instead of a tax-credit cap, he argued that a GPT would also be an impediment.

“Here we go with the generation tax in Oklahoma, when you don’t see it in Kansas, you don’t see it in Texas. In fact, you only see it in Wyoming,” Yates said. “So now we are going to artificially inflate the price of Oklahoma wind. So in the [Southern Power Pool], all that’s going to do is dispatch Kansas and Texas wind first. So really it’s a lose-lose for Oklahoma in the sense that it [would make] our wind generation prices go up, and it’s ultimately, eventually going to be passed onto consumers in electricity cost.”

Branan disagreed.

“Since Oklahoma has established itself as a wind producer, it is time for the industry to pay its share of taxes in our state,” the Windfall Coalition director said. “If future projects can’t sustain themselves without continued subsidies, what is the point of having them here, especially when so much Oklahoma wind power is bound for customers in other states?”

But Yates is quick to note that Oklahoma’s “subsidies” for any new project have been eliminated in recent years. Now, he is trying to protect the refundable payments promised by the state for past projects, which would be eliminated under SB 888 and capped at $35 million per year in HB 3710.

“Our industry has been very unified in its voice that retroactivity is detrimental to our industry and the state of Oklahoma,” Yates said. “I would say that on the cap issue — the retroactivity treatment of the wind industry — all of our companies understand the importance of the state of Oklahoma honoring its word.”

RELATED

Proposals swirling for limiting wind tax credits by William W. Savage III

But Branan questioned Yates’ claim that existing projects would “default” on their loans.

“So far, we only have the word of wind lobbyists that capping tax credits would affect the viability of wind projects in Oklahoma. These projects are still eligible for generous federal subsidies,” Branan said. “Other industries have seen their tax incentives reduced or eliminated over time, including repeated cuts to credits available to oil and natural gas companies.”

Yates noted that the bluster between the two energy industries has been witnessed by lawmakers.

“I think there’s no doubt that we have legislators in this building who have been told (…) if we’re going to increase gross production tax on oil and gas, there’s got to be a hit on wind. And I’ve had many legislators say they’ve been threatened with that,” Yates said. “At the end of the day, yes, there are some oil and gas interests that have been attacking all session long. That hasn’t changed. That’s nothing new.”

Potential amendments to SB 888

Rep. David Perryman (D-Chickasha) has filed two amendments on SB 888: One that would dedicate savings from the bill to the Education Reform Revolving Fund, and a second that gutted the entire bill and replaced it with language creating a production tax on new wind energy developments in 2019 and beyond.

(Editor’s note: Organizations opposing and promoting changes to Oklahoma’s wind industry tax structure are both advertising on NonDoc.)